Bitcoin & Gold Thrive as Bond Market Chaos Exposes U.S. Fiscal Theater

When the bond market throws a tantrum, hard assets win. Bitcoin and gold are capitalizing on the latest Treasury turmoil—while Washington’s budget gimmicks look more like pro wrestling theatrics than actual policy.

The ’smackdown’ in bonds isn’t just volatility—it’s a flashing neon sign pointing to the dollar’s slow bleed. Meanwhile, BTC keeps minting new millionaires while gold bugs nod smugly. Same playbook, different eras.

Funny how ’safe’ government debt now needs its own warning label—while decentralized assets quietly eat its lunch. Maybe the real inflation was the friends we made in the Fed’s balance sheet all along.

As of May 19, the U.S. national debt, also known as the total public debt, stood at $36.22 trillion. It is projected to rise by $22 trillion over the next 10 years, with , according to practice. The QUEST report also said the burgeoning debt will weigh heavily on economic growth.

Robin Brooks, senior fellow in the Global Economy and Development program at the Brookings Institution, pointed to the five-year forward real interest rate as evidence of bond players questioning the fiscal sustainability.

"The 5y5y forward real interest rate now stands at 2.5%, which is the highest level going all the way back to 2010. Most importantly, it far exceeds levels seen during hawkish Fed episodes, like the 2013 "taper tantrum" or the 2022/23 hiking cycle after the COVID inflation scare," Brooks said in a Substack post, while noting the stability in the 5y5y forward inflation breakevens.

"That makes it all the more likely that many years of irresponsible fiscal policy are catching up with the U.S, adding urgency to the need to get our fiscal house in order," Brooks added.

FX-bond correlations are deadAnother sign that the market is waking up to the fact that the emperor has no clothes is the breakdown in the traditional correlation between the foreign exchange (forex) and bond markets.

Typically, rising bond yields boost the appeal of the home currency, causing it to appreciate against other fiat currencies. For example, the EUR/USD has historically closely tracked the spread between yields on German and U.S. two-year government bonds.

But not anymore. The EUR/USD has risen sharply since early April despite the narrowing of the two-year yield differential, led by a sharp rise in the U.S. two-year yield. The breakdown in correlations indicates that concerns over fiscal stability have likely prompted investors to MOVE away from U.S. assets.

The degree of dollar bearishness is evident from the options market, which is now most bullish on EUR/USD since COVID. It’s unusual for the options market to put a greater premium on the upside in euro than the downside, according to Brooks.

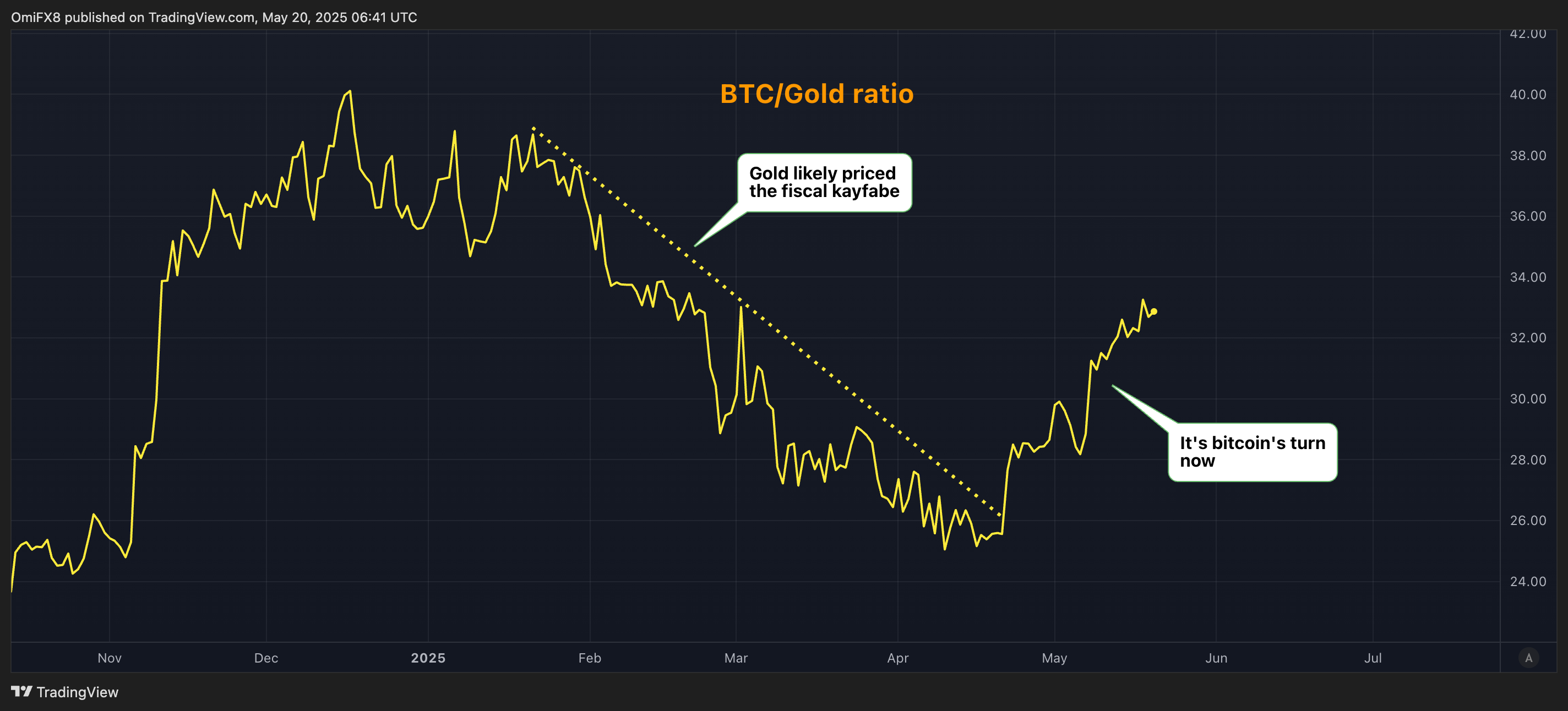

Bullish bitcoin and goldHistorically, governments facing fiscal concerns have resorted to inflation and repaying debt by printing more money. They will likely retake the same road, incentivizing demand for hard assets like Gold and bitcoin.

"All roads lead to inflation. That’s historically the way every civilization has gotten out is that they inflated away their debts," Tudor Jones said last year, while naming BTC, gold, and commodities as preferred holdings over longer duration bonds.

Two years ago, Economist Russell Napier voiced a similar opinion, saying, "We need to prepare for an era of increasing financial repression and persistently high inflation."

Financial repression refers to government policies that direct funds from the private sector to the public sector to help reduce national debt. The scenario is characterized by the inflation rate exceeding the return on savings, capital controls and interest rate caps, all of which could bode well for bitcoin and gold.

Interest rate caps are usually implemented through policies like yield curve control, which has the central bank targeting a specific level for the long bond yields, let’s say 5%. Every time, the yield looks to rise above the said level, the central bank steps up bond purchases, injecting liquidity into the system.

Arthur Hayes, CIO and founder of Maelstrom, has said that yield curve control will eventually be implemented in the U.S., torching a record rally in bitcoin.

Hayes recently said that President Donald Trump’s decision to water down trade tariffs after early April panic in financial markets is evidence that the financial system is too levered for tough reforms and warrants additional money creation.

“They can call it whatever they want—just don’t call it QE—but it has the same effect: liquidity rises and Bitcoin benefits," Hayes said.

The bullish case for BTC does not necessarily mean there won’t be hiccups.

The U.S. Treasury market serves as a bedrock of global finance and increased volatility in these bonds could cause financial tightening, potentially triggering a global dash for cash that sees investors sell every asset, including bitcoin.

As of now, however, the MOVE index, which represents the 30-day implied or expected volatility in the U.S. Treasury notes, remains in a downtrend.