XRP Surges 4% as Fed Rate Cut Probability Hits 99% - Crypto Rally Ignites

XRP rockets upward as traders bet big on Federal Reserve easing—because nothing says 'stable monetary policy' like near-certainty speculation.

The Rate Cut Catalyst

Markets pivot on the Fed's next move, with a 99% probability priced in for lower rates. XRP captures the momentum, climbing 4% as liquidity expectations shift.

Crypto's Fed Fantasy

Digital assets feast on dovish signals—never mind that traditional finance still views crypto as its rebellious nephew. XRP's jump mirrors broader optimism, proving once again that crypto traders love betting on central bank whims.

Forward Momentum

Watch for sustained moves if the Fed follows through. Or don’t—because in crypto, today’s certainty is tomorrow’s forgotten narrative.

News Background

- Federal Reserve futures now imply a 99% chance of a 25-bps cut on September 17, boosting crypto as a dollar-weakening trade.

- Exchange reserves rose to a 12-month peak, signaling more supply on exchanges even as whales accumulated an estimated 10M XRP in 15 minutes during the breakout.

- Six spot XRP ETF applications are pending SEC review in October, a structural catalyst traders are monitoring.

Price Action Summary

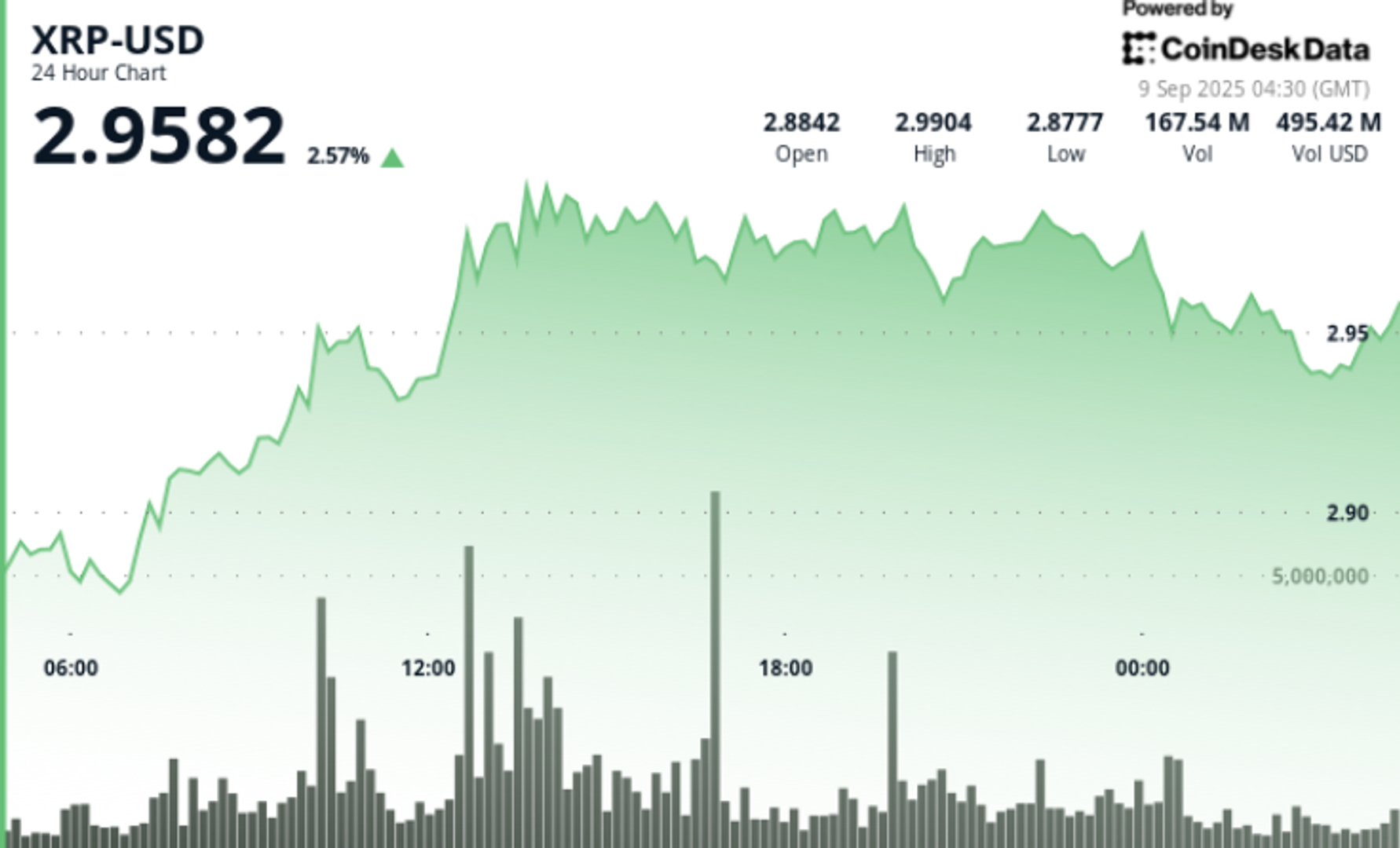

- Session ran from September 8 04:00 to September 9 03:00.

- XRP advanced from $2.89 to $2.995 intraday (+4%) before closing at $2.95.

- Volume spiked to 159.63M at 13:00—nearly 3x daily norms—confirming institutional participation.

- Support held multiple times at $2.88–$2.89, while $2.995–$3.00 was repeatedly rejected.

- Final hour saw a grind higher: $2.94 → $2.95 (+0.34%) on 1.6M volume, with higher lows showing controlled accumulation.

Technical Analysis

- Support: $2.88–$2.89 zone continues to attract buyers.

- Resistance: $2.995–$3.00 ceiling remains intact after multiple high-volume rejections.

- Momentum: RSI steady in mid-50s = neutral-to-bullish bias.

- MACD: Histogram converging toward bullish crossover, consistent with accumulation.

- Pattern: Price compressing within a consolidation channel under $3.00. A confirmed close above $3.00–$3.05 could target $3.30–$3.50.

What Traders Are Watching

- Ability to close above $2.99–$3.00. Bulls want a clean daily settlement above the zone to flip resistance into support.

- Fed meeting on Sept. 17. A 25-bps cut is fully priced; anything larger or delayed could alter crypto liquidity expectations sharply.

- Whale inflows. Roughly 340M tokens reportedly accumulated in recent weeks. Traders are gauging whether this continues into ETF decision season.

- SEC’s October ETF rulings. Six applications, including from Grayscale and Bitwise, could transform institutional access and reprice XRP’s structural demand.