Bitcoin Illiquid Supply Shatters Records at 14.3M as Long-Term Holders Ramp Up Accumulation

Bitcoin's bedrock just got stronger—illiquid supply hits unprecedented levels while diamond hands keep stacking.

The Hodl Wave Intensifies

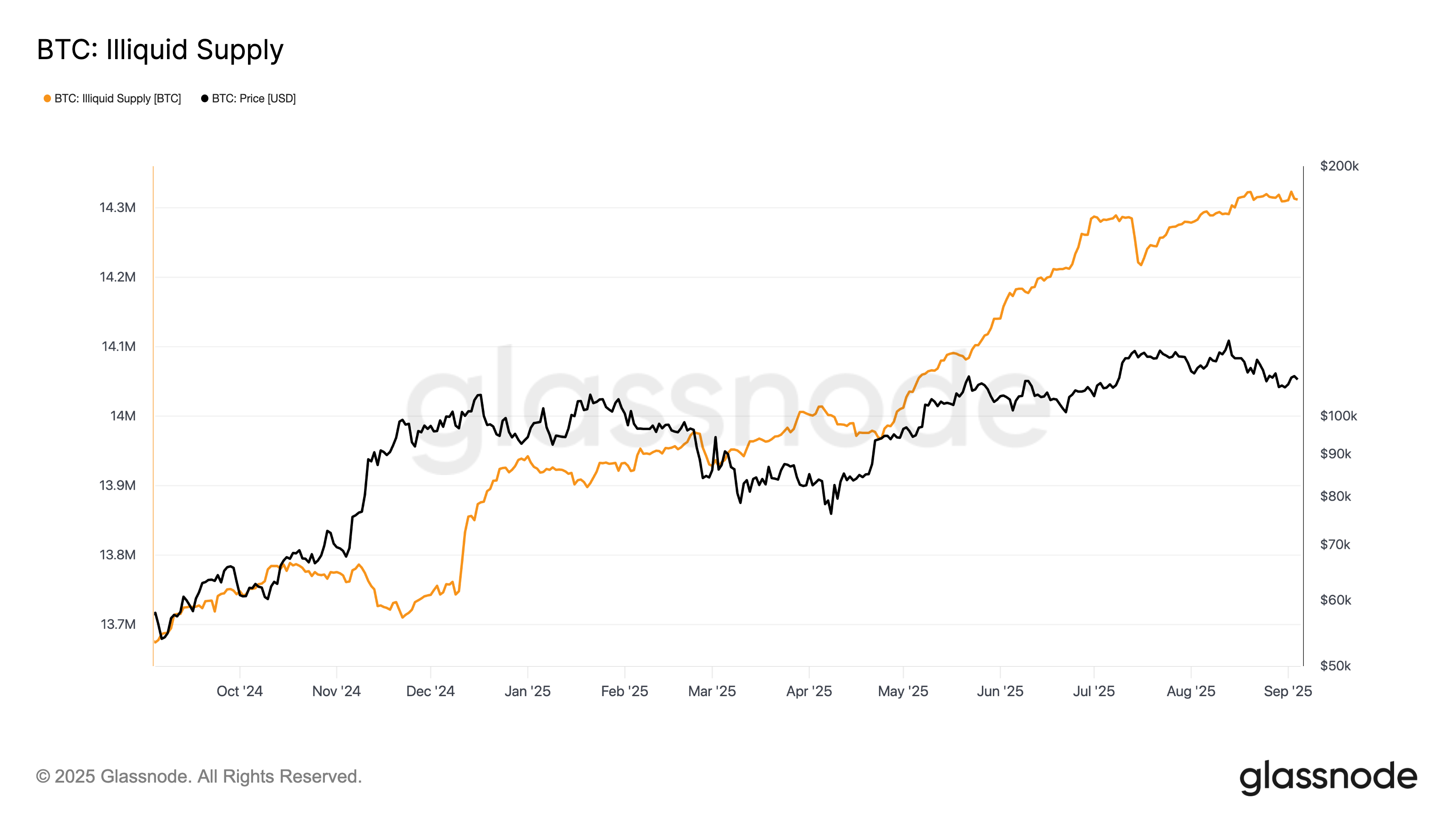

Long-term believers aren't just holding—they're aggressively accumulating, pushing illiquid supply to a staggering 14.3 million BTC. That's coins effectively locked away in cold storage, off exchanges, and out of weak hands' reach.

Market Dynamics Shift

This isn't just numbers on a screen—it's a fundamental supply squeeze in motion. Fewer coins available for trading means less selling pressure and more potential for explosive moves when demand spikes. Traditional finance still can't wrap its head around an asset that gets stronger when people refuse to sell it.

The Institutional Silence

While Wall Street debates entry points, the real accumulation happens in silence—private wallets growing heavier by the day. They'll probably start buying right after the next ATH, as usual.

Bottom line: When supply disappears during price discovery, you're not watching a market—you're witnessing a paradigm shift. The old financial playbook just got another page torn out.

In mid-August, Bitcoin hit an all-time high of $124,000 before retreating roughly 15%. Despite the price pullback, the illiquid supply continued to rise, showing that holders remain undeterred by short-term corrections.

Over the past 30 days alone, the net change in illiquid supply has increased by 20,000 BTC, underscoring persistent investor conviction.

The ongoing increase in this category suggests tightening supply dynamics that could set the stage for renewed momentum once sentiment recovers. For now, the trend reflects growing confidence in bitcoin as a long-term store of value.