Fidelity Quietly Launches Tokenized Treasury Fund on Ethereum - Wall Street’s Crypto Awakening

Fidelity just dropped a blockchain bomb—and traditional finance didn't even see it coming.

The $4.2 trillion asset manager stealth-deployed its tokenized treasury fund directly on Ethereum, bypassing the usual Wall Street gatekeepers. No press releases, no fanfare—just pure institutional adoption happening in real-time.

Why This Shakes the System

Treasury bonds meet DeFi rails. Fidelity's move effectively bridges the world's safest assets with crypto's most efficient settlement layer. Suddenly, yield generation isn't confined to banking hours or geographic borders.

The Quiet Revolution

While traditional finance was debating ETF approvals, Fidelity built the next infrastructure. Tokenization doesn't just digitize assets—it rearchitects entire market structures. Lower friction, instant settlement, 24/7 accessibility.

Wall Street's worst nightmare? They're becoming their own disruptors. Because nothing says 'adapt or die' like a 77-year-old financial giant outmaneuvering fintech startups at their own game—while somehow making blockchain look boringly professional.

What is Fidelity Digital Interest Token (FDIT)?

According to RWA.xyz, the fund began operating in August with a portfolio that consists entirely of US Treasury securities and cash. Fidelity applies a 0.20% management fee, and Bank of New York Mellon is responsible for custody.

As of press time, its assets have already climbed to more than $200 million, though participation remains limited. Current records show the fund has just two holders—one with roughly $1 million in tokens and another managing the balance.

Fidelity has yet to comment on the fund publicly.

However, the fund’s launch builds on Fidelity’s earlier filing with the Securities and Exchange Commission (SEC), where it sought approval to add an on-chain share class to its digital Treasury fund.

That step signaled its commitment to real-world asset (RWA) tokenization, a trend gaining momentum across traditional finance.

Over the past year, global asset managers have been experimenting with blockchain rails to make markets more efficient, cut settlement times, and reduce costs.

This has drawn interest from traditional financial giants like BlackRock, the largest asset management firm in the world, already making significant progress in this market.

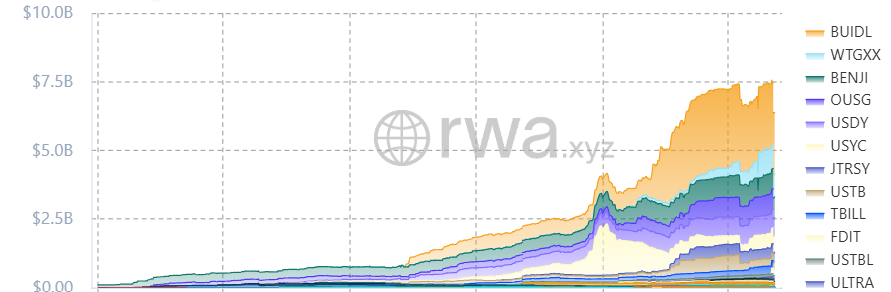

Over the past year, BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) has become the largest tokenized Treasury product, with a value of over $2 billion.

Notably, similar offerings from Franklin Templeton and WisdomTree have helped the broader market for tokenized Treasuries above $7 billion, according to RWA.xyz.

Considering the pace of this growth, analysts at McKinsey have estimated that tokenized securities could reach a market value of $2 trillion before the end of the decade.