Stablecoin Retail Transfers Shatter Records in 2025, Surpass $5.8B in August

Digital dollars hit escape velocity as mainstream adoption goes parabolic.

The Tipping Point

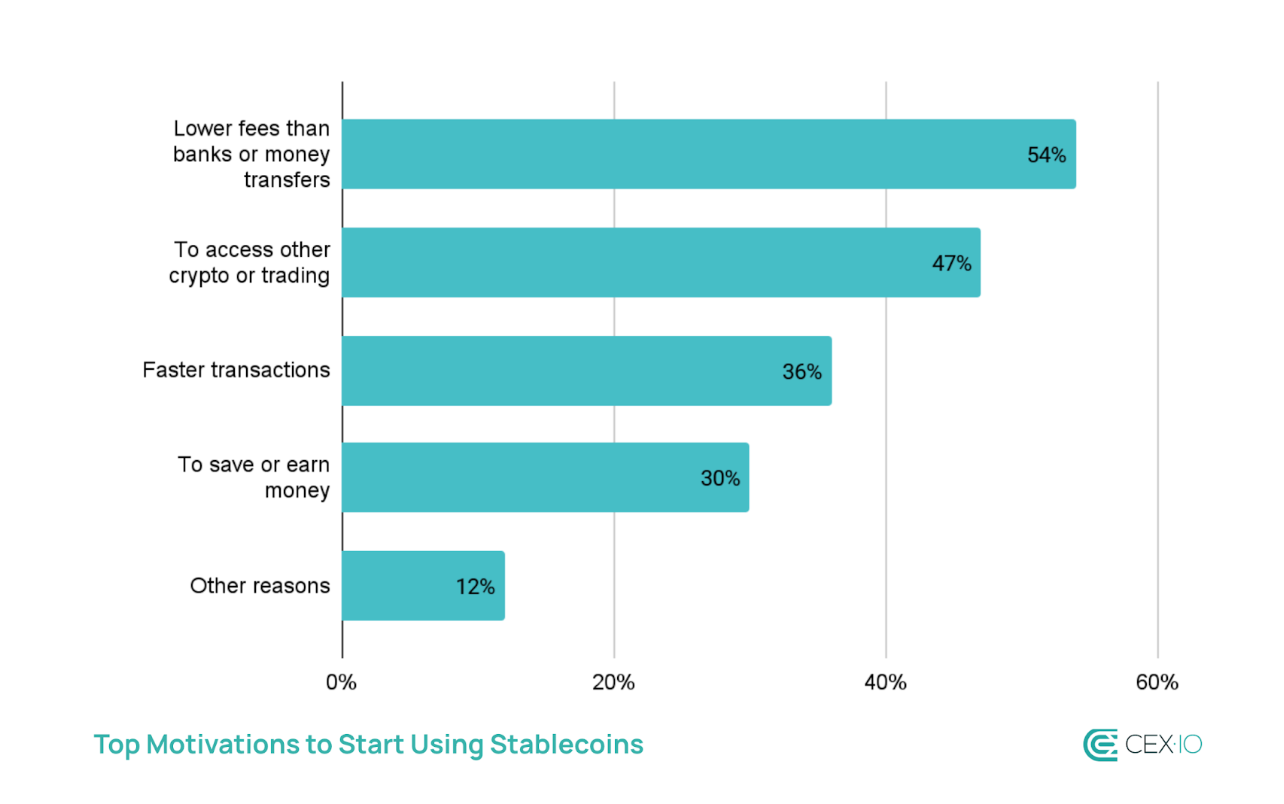

Retail users moved a staggering $5.8 billion through stablecoin networks last month—smashing previous records and signaling that digital currency isn't just for crypto degens anymore. This isn't speculative gambling; it's actual people moving actual value across borders without begging permission from legacy banks.

Inflection Moment

The numbers don't lie: traditional payment rails are getting bypassed at unprecedented scale. While Wall Street still debates 'blockchain adoption,' consumers are voting with their wallets—transferring value faster and cheaper than traditional systems ever managed. Guess what? They're choosing efficiency over nostalgia.

Finance's Ironic Twist

Here's the kicker: the very stability that bankers mocked now fuels their disruption. Stablecoins achieved what decades of fintech innovation couldn't—actually making cross-border payments work without taking a 3% vig and a five-day vacation. But don't worry—your bank will probably launch a 'digital asset task force' to study this trend until 2030.

Ethereum gains, TRON falls back

Ethereum gains, TRON falls back

The distribution of activity among blockchains have shifted, the report noted. The Tron (TRX) blockchain, traditionally popular for retail transfers due to its low fees and wide support for Tether's USDT (USDT), has given up market share. Monthly transaction counts fell by 1.3 million, or 6%, and its growth in volume lagged behind its closest competitors.

In its place, Binance Smart Chain (BSC) emerged as the top choice for retail users, capturing nearly 40% of retail stablecoin activity, the report said. The network’s transaction count jumped 75% this year with transfer volume rising 67%. Much of the momentum came after Binance delisted USDT in March for European users and a resurgence of memecoin trading on PancakeSwap on BSC.

The ethereum complex, with the base chain and layer-2 networks combined, made up over 20% of transfer volume and 31% of transaction counts, the report noted. While small transfers largely took place on L2s, the mainnet enjoyed a significant rise in the retail segment. Sub-$250 transfers on the mainnet rose 81% in volume and 184% in count.

Ethereum has been mostly used for large-value transactions due to its high fees, but transaction costs have dropped more than 70% over the past year, making mainnet transactions more competitive even in the sub-$250 range, the authors said.