Chainlink (LINK) Surges 4% After Launching Real-Time U.S. Equities & ETF Data Streams

Chainlink jolts crypto markets with a bullish 4% rebound—just as it flips the switch on institutional-grade data feeds for traditional finance.

Wall Street's New Data Pipe

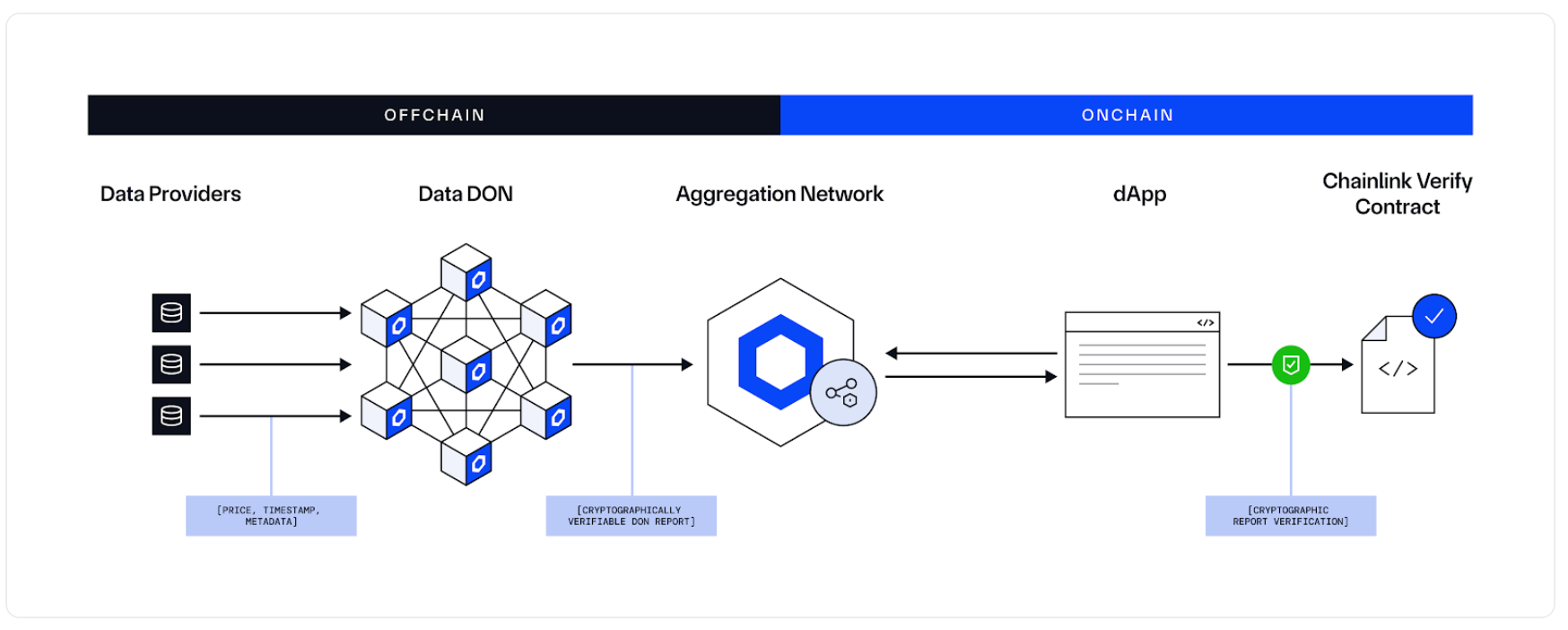

No more batch updates or stale pricing. Chainlink's Data Streams now pump real-time equities and ETF data directly into DeFi—while hedge funds still pay six figures for Bloomberg terminals.

The LINK reaction proves crypto's appetite for real-world assets remains ravenous. Even after a 90% drop from its ATH, Chainlink keeps building while 'disruptors' pivot to AI narratives.

Another brick in the defi fortress—or just feeding the beast before the next rug pull? Either way, the oracle wars just got hotter.

Technical Analysis Shows Strong Momentum

Technical Analysis Shows Strong Momentum

LINK exhibited remarkable bullish performance throughout the 24-hour trading session, climbing from $16.16 to $16.87 and delivering a substantial 4.39% gain, according to CoinDesk Research's technical analysis model.

The persistent upward momentum, distinguished by progressively higher lows and consistently above-average volume during rally phases, indicates sustained bullish market sentiment with strong potential for additional gains targeting the $17.00 psychological threshold, the model said.

Technical Indicators- Normal support established at $16.11 representing the initial session low during the 24-hour period.

- High-volume support confirmed at $16.29 during the midnight UTC surge with significant trading activity.

- Key resistance formed at $16.87 with strong volume confirmation and multiple test attempts.

- Volume spike to 1,533,754 units during the 4 August 13:00 hour, nearly triple the average volume.

- Breakout pattern confirmed from $16.65 to $16.83 establishing critical resistance turned support level.

- Higher lows pattern maintained throughout the rally indicating sustained bullish momentum.

- Volume confirmation above 30,000 units during key rally phases supporting upward price action.

Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI Policy.