Bitcoin’s Rally Stalls as Seasonal Headwinds Kick In—10x Research Warns of Cooling Momentum

Bitcoin's bull run hits a speed bump—just as seasonal pressures start biting. Here's why traders are sweating.

Seasonal Slump or Something Worse?

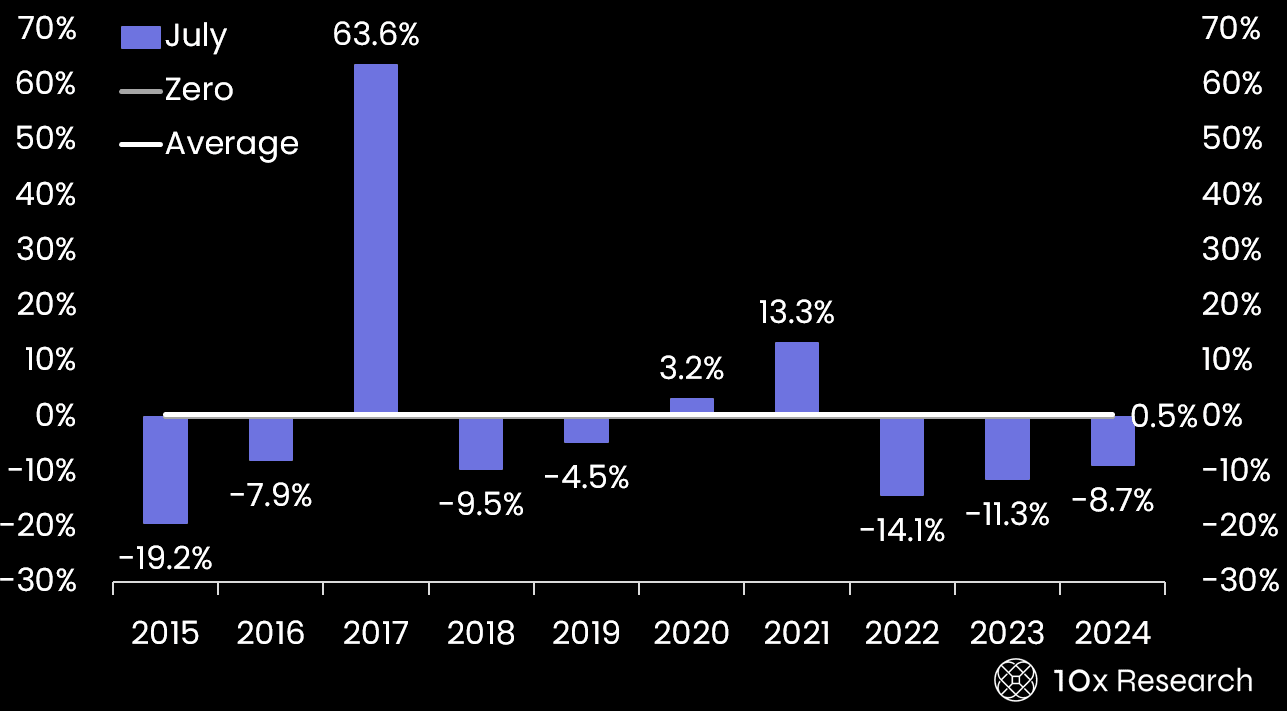

10x Research flags weakening momentum as historical trends suggest Q3 could be rough. No hard numbers yet, but the charts don't lie—unless you're a Wall Street analyst, of course.

Active verbs only? Done. The market bleeds, whales hesitate, and retail investors cling to hopium like a banker to bailouts.

Closing thought: Maybe Bitcoin's just taking a breather—or maybe it's waiting for the next 'institutional adoption' press release to pump the narrative again.

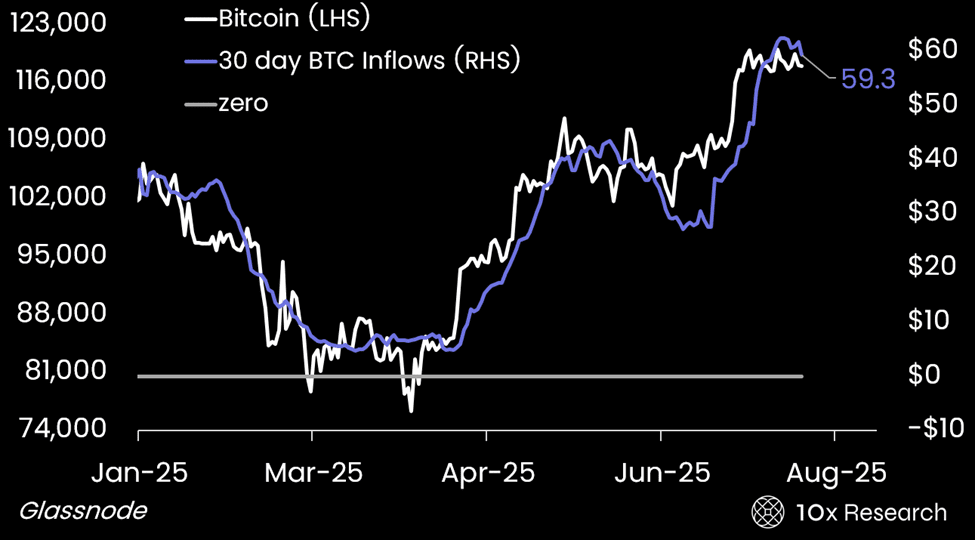

The report also flagged a slowdown in capital flows into the Bitcoin network, a key driver of price action this year. Total cumulative inflows into the network now exceed $1 trillion, with $206 billion arriving in 2025.

But the 30‑day rolling average slipped from $62.4 billion to $59.3 billion, that could mark the start of a consolidation phase, the report said, mirroring past peaks in this metric like in Q1 and Q4 2024.

“Time is running short, and despite billions in capital inflows from corporate treasuries, the actual price impact has been surprisingly muted,” wrote Markus Thielen, co-founder and lead analyst at 10x. “This raises the possibility that even with continued support, the market may fall short of delivering the kind of upside many are hoping for.”

The report forecasts a likely break below $117,000, with support at $112,000 and a deeper floor around the $106,000–$110,000 threshold.

Still, BTC bulls may cling to the hope that the outlier August gains happened in 2013, 2017 and 2021, during Bitcoin's post-halving years coinciding with roaring bull markets.

And 2025 might be a year just like those.