XRP Whiplash: $105M Longs Vaporized as ETF Uncertainty Sparks Market Chaos

XRP just got caught in a crypto meat grinder—volatility spiked so fast it left traders' heads spinning. Here's how the ETF rumor mill triggered a cascade of liquidations.

The domino effect: When speculation around an XRP ETF hit fever pitch, the market reacted like a caffeinated bull—then promptly face-planted. Over $105 million in long positions got obliterated in the frenzy.

Why it matters: This isn't just another 'crypto being crypto' moment. The sheer scale of liquidations exposes how jittery institutional money gets when regulatory clarity remains stuck in purgatory.

The irony? Wall Street still thinks it can slap an ETF sticker on this rollercoaster and call it 'investing.' Meanwhile, degens keep printing money off the volatility—some things never change.

What to Know

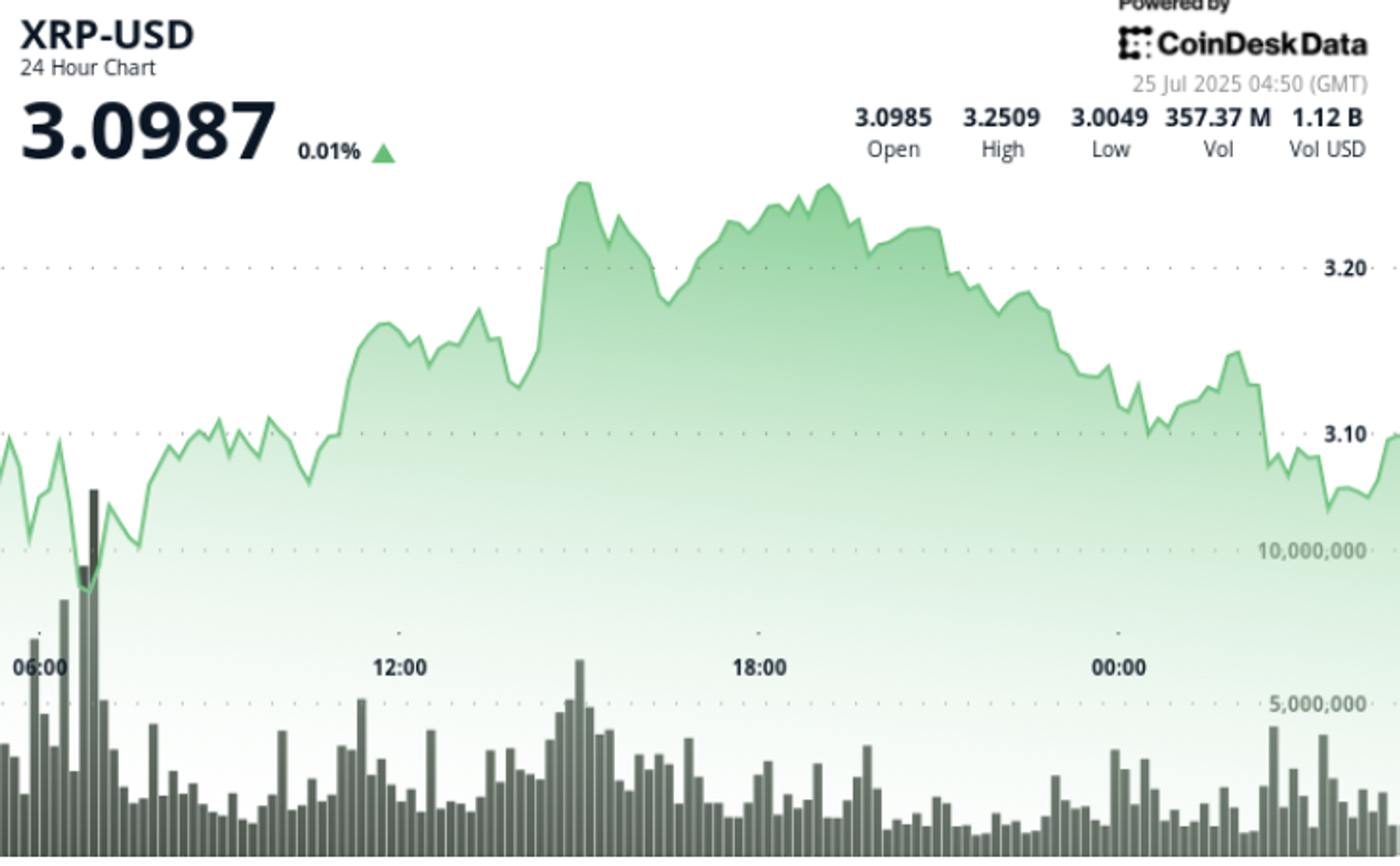

XRP posted sharp losses during the July 24–25 session, dropping 8% as the token traded in a $0.30 range from $2.96 to $3.26.

An early session rally fizzled after profit-taking intensified NEAR the resistance level, while a sudden liquidation wave wiped out more than $100 million in long positions.

Despite the selloff, key support at $3.06–$3.10 held through repeated tests, with late-session price action showing signs of potential stabilization.

Nature’s Miracle and Brazil’s VERT made headlines with new XRP-based strategies, but institutional sellers dominated the tape amid fears that ETF approvals may face delays.

News Background

• XRP traded in a 7.85% range between $2.96 and $3.26 over 24 hours starting July 24 at 05:00.

• Coinglass data showed over $18 billion in total crypto liquidations during the session.

• XRP long liquidations topped $105 million, contributing to rapid declines.

• Nature’s Miracle announced a $20 million XRP treasury plan.

• Brazil-based VERT deployed a $130 million blockchain solution built on the XRP Ledger.

Price Action Summary

The session opened at $3.13 and saw a sharp drop to $2.96, followed by a bounce to a $3.26 high at 15:00 on 175.94 million volume — more than double the average. However, resistance at $3.24–$3.26 capped gains. Price collapsed again late in the session, dropping to $3.05 during the 03:00–04:00 window on a 6.2 million volume spike, likely due to forced selling or liquidation flows. XRP recovered modestly to close at $3.08.

Technical Analysis

• Trading range of $0.30 between $2.96 low and $3.26 high.

• Heavy resistance confirmed at $3.24–$3.26 after rejection post 15:00 rally.

• Critical support at $3.06–$3.10 tested repeatedly with volume-backed bounces.

• Final hour shows breakdown to $3.05 before reclaiming $3.08 — a possible bullish reversal signal.

• Liquidation-driven volatility suggests increased risk, but firm bid zones offer short-term structure.

What Traders Are Watching

• Whether XRP can hold the $3.06–$3.10 zone into the next session.

• Impact of further ETF-related developments from U.S. regulators.

• Signs of institutional reentry or renewed retail participation above $3.15.

• Broader crypto market stability following multi-billion-dollar liquidations.