🚀 Bitcoin Whale Bets $23.7M on BTC Skyrocketing to $200K Before New Year’s Eve

A crypto whale just dropped a $23.7 million gamble that Bitcoin will nearly triple in five months—because Wall Street’s 9-to-5 volatility clearly wasn’t thrilling enough.

The Ultimate Moon Shot

While traditional investors fret over Fed meetings, this whale’s derivatives play screams ‘YOLO’ with a December expiry. The move echoes 2021’s euphoria—back when ‘number go up’ was the entire investment thesis.

Liquidity or Liquidation?

Options desks report surging demand for $200K+ strikes, though skeptics note the same crowd once piled into LUNA at $100. Either BTC’s halving momentum finally breaks the cycle… or someone’s about to fund a very expensive lesson in leverage.

One thing’s certain: when crypto degens and institutional ‘risk managers’ collide, the only guarantee is volatility—and schadenfreude for the rest of us.

Record options activity

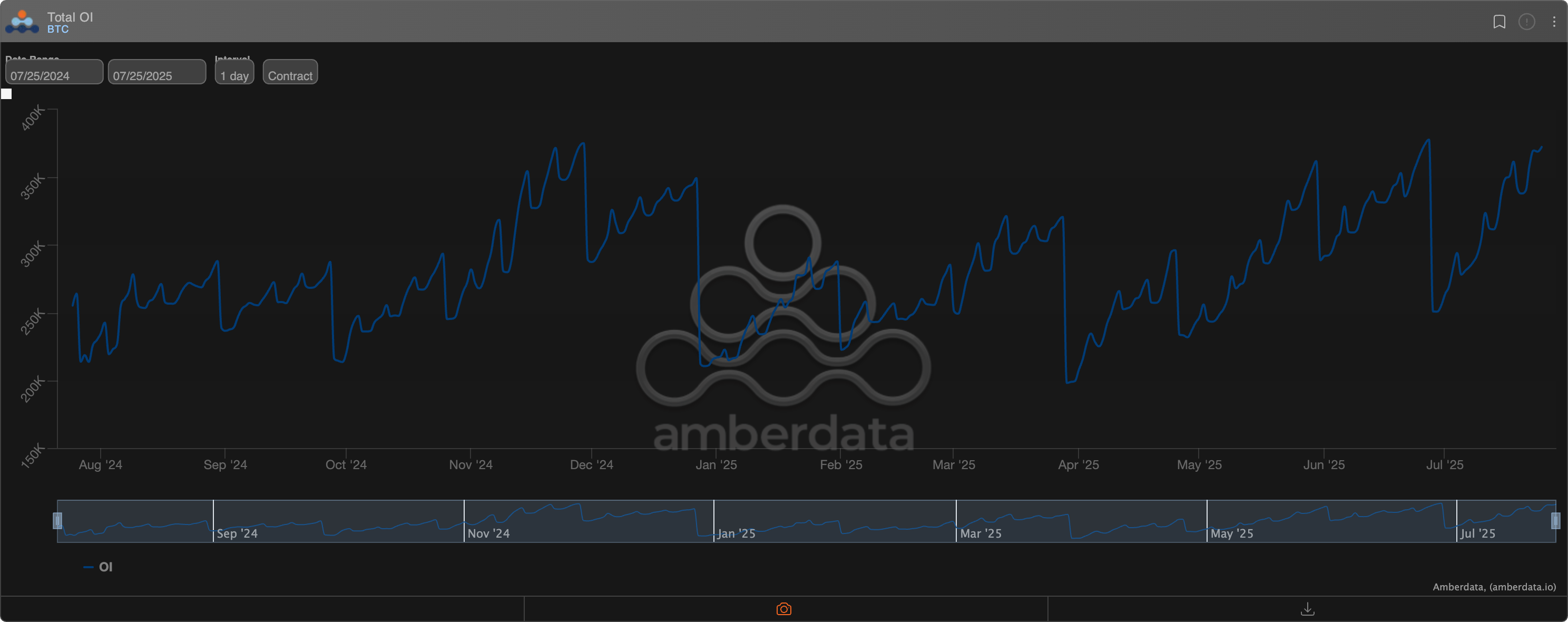

BTC's price rally and growing institutional interest in structured products, which involve volatility selling, have boosted activity in the options market.

On Deribit, which accounts for over 80% of the global options activity, the BTC options open interest, or the number of open options contracts, was 372,490 BTC as of writing – just shy of the record high of 377,892 set in June.

Meanwhile, open interest in ether options has hit a record high of 2,851,577 ETH, according to data source Amberdata. On Deribit, one options contract represents one BTC or ETH.