Crypto Carnage: BTC, XRP, SOL, ETH Get Crushed in Brutal Long Squeeze as Futures Open Interest Collapses

Blood in the crypto streets—major coins are getting hammered in a classic leverage flush-out.

Futures market bleeds out

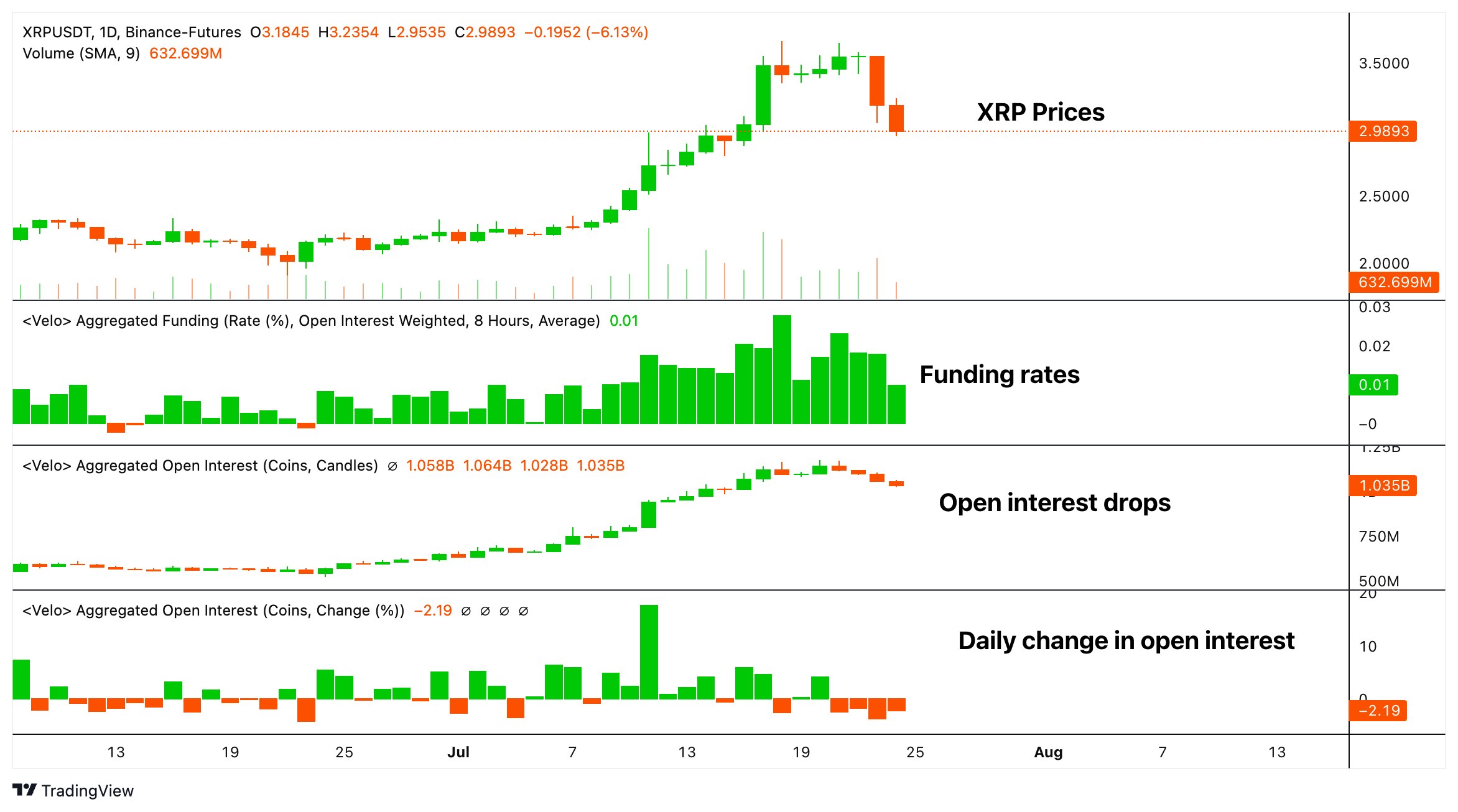

Open interest nosedives alongside prices, signaling mass liquidations. Traders caught with overleveraged long positions are getting wrecked as the market takes no prisoners.

Who's holding the bag?

Retail 'hodlers' watching their portfolios evaporate while institutional sharks circle for discounted entries. Same old story—just with fancier blockchain jargon this time.

The great crypto deleveraging shows no mercy. Will this be the flush that sets up the next rally, or just another reminder that 99% of traders would've made more money flipping burgers?

The combination of falling prices, lower open interest and positive funding rates suggests that bullish bets are being actively removed from the market.

It rules out the likelihood that the price decline is backed by investors taking new short, or bearish, positions because in that case the funding rate WOULD have dropped into negative territory as the short holders would need to pay the longs.

Furthermore, the new shorts would have increased open interest as prices dropped, which is not the case either.

The decline in open interest suggests that traders are closing their positions, a characteristic of leveraged longs being liquidated or voluntarily exiting the market, rather than new shorts entering the market. Put together it signals that while the price is dropping, sentiment remains fairly robust.