PEPE Crashes 5% Amid Surging Volume—Yet Whale Wallets Are Gobbling Up the Dip

PEPE takes a nosedive as trading activity spikes—but the big players aren't panicking. They're buying.

Whales vs. Retail: The Eternal Crypto Dance

While retail traders scramble, deep-pocketed investors see opportunity in PEPE's plunge. Volume surges 5% as the meme coin stumbles, but blockchain sleuths spot accumulation patterns in whale wallets. Same old story—just with frog-themed tokens this time.

Smart Money Moves or Greater Fool Theory?

The accumulation trend mirrors classic buy-the-dip strategies, though skeptics note meme coins have more exits than a hedge fund manager's offshore accounts. Either way, PEPE's volatility proves crypto's casino economy is alive and kicking—complete with high rollers playing a different game entirely.

Technical Analysis Overview

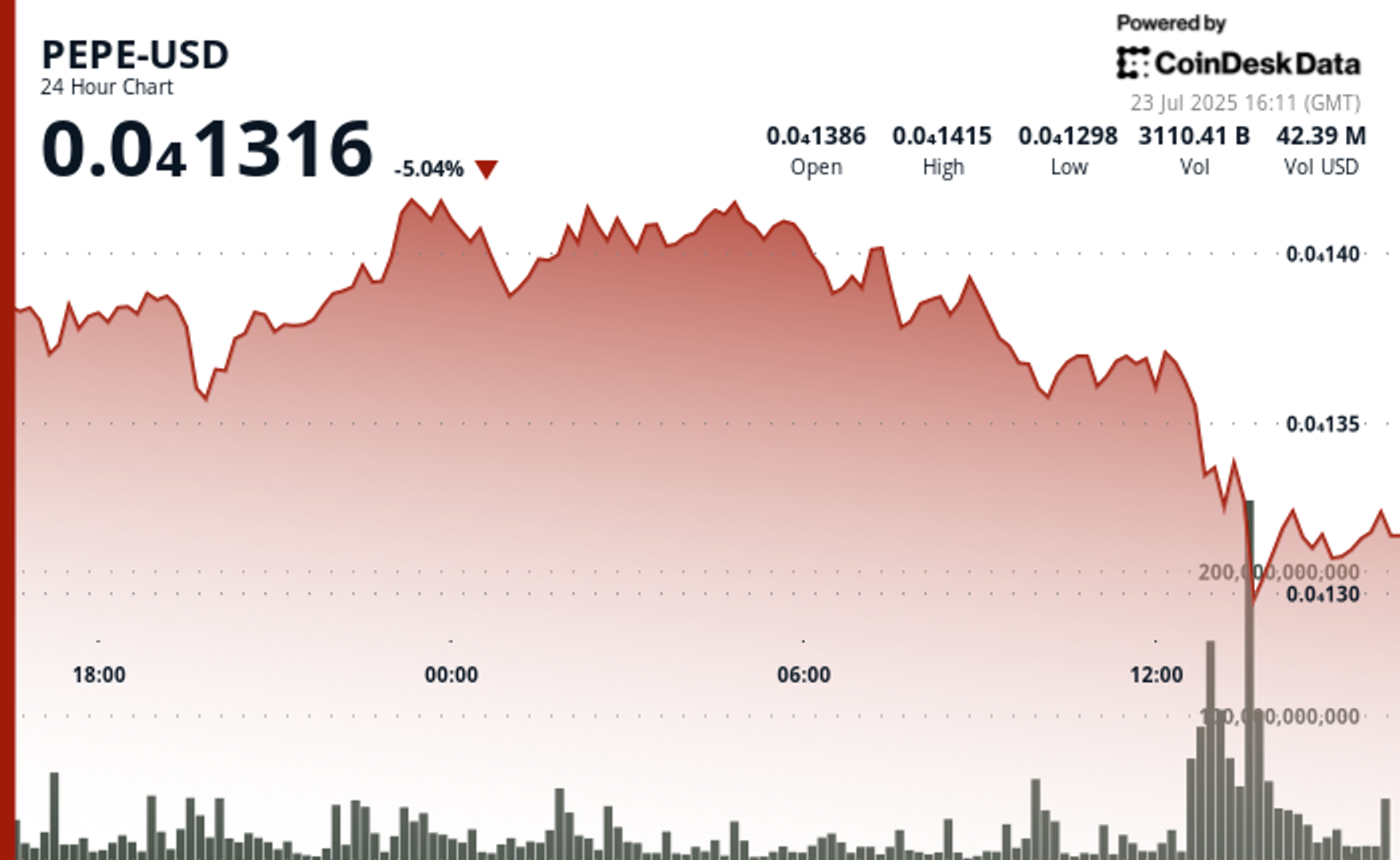

Price action during the session was defined by sharp swings and clear levels of resistance and support. PEPE consistently failed to break through the $0.000014150 range, forming a ceiling that turned buyers away multiple times.

On the downside, the $0.000013 mark acted as a floor where prices repeatedly bounced back.

The most intense selling came as hourly volume spiked, suggesting forced exits and large-scale profit-taking. But by session close, steady buy-side activity, averaging 300 to 400 billion tokens per hour, hinted at a potential rebound.

While the rally lost steam, the underlying trading behavior reflects a pattern familiar in memecoin markets: hype-driven surges followed by sharp corrections, with long-term holders seizing volatility as an entry point.

Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI Policy.