Bulls Triumph as Anti-MSTR Leveraged ETF Crashes—Bears Forced to Capitulate

MicroStrategy's crypto bet leaves short-sellers bloodied—again.

Another leveraged ETF bites the dust as Bitcoin's relentless rally proves too hot to handle.

Wall Street's 'clever' anti-crypto trade now looks like a $1.4B lesson in confirmation bias.

Meanwhile, hodlers keep stacking—because fundamentals always win in the end.

Bears capitulate as BTC surges

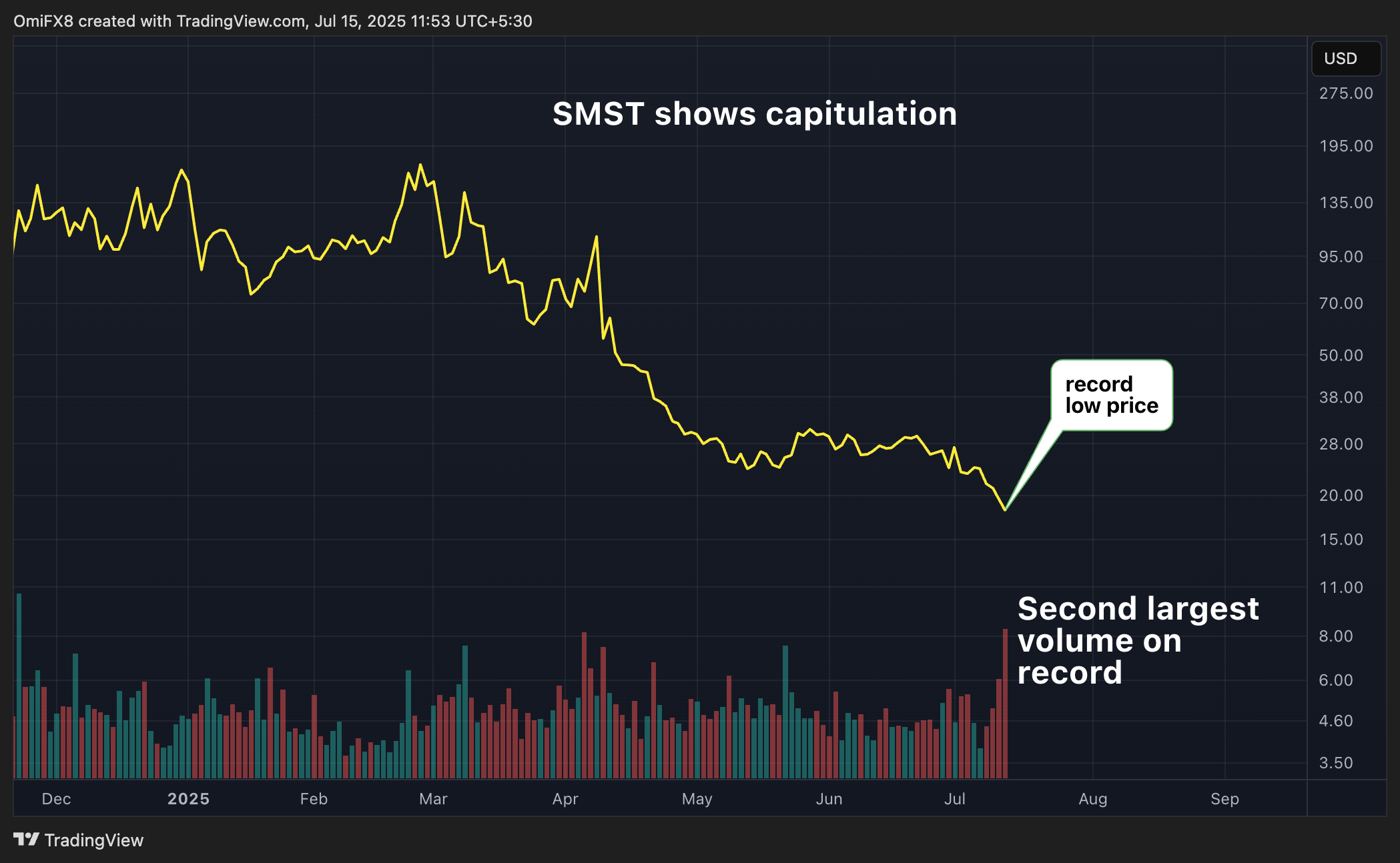

SMST's high-volume collapse points to capitulation of bears – those betting against MSTR have likely given up and are exiting the market.

A high-volume record low typically indicates capitulation – market participants surrendering to the relentless bearish trend and exiting all their positions, giving up all hope of a recovery. This type of price action often marks peak bearishness in the market or bottoms.

Bitcoin's price tapped record highs above $122,000 during Monday's Asian trading hours, providing bullish cues to all things tied to crypto. Later in the day, shares in MSTR ROSE over 3% to $456, the highest since November.

Leveraged bearish bet

The 2x short ETF seeks to deliver daily investment results that are -200%, or minus 2x, the daily percentage change in the MSTR share price. In other words, it's a leveraged bearish bet.

The ETF's price, however, has collapsed from over $2,000 on the inception day in August last year, and has been primarily in a downtrend, barring the brief uptrend from $1,600 to $2,368 in late August last year. As of Friday, the fund had a net inflow of $8.2 million in six months, according to VettaFi.

MSTR's share price has increased multi-fold from $100 to over $440 during the same time. MicroStrategy is the largest publicly-listed bitcoin holder in the world, boasting a coin stash of 601,550 BTC ($70.56 million) as of writing.

2x long MSTR ETF rises

The Defiance daily target 2x long MSTR ETF rose to nearly $50 on Monday, the highest since January 24, with trading volumes rising for the fourth straight day to tally 9.2 million.

As of Friday, MSTX had a net six-month outflow of over $175 million, per VettaFi.