Bitcoin and XRP Hold Steady at $110K and $2.3 While Ether Braces for Wild Swings—Here’s Why

The crypto markets are playing a game of tug-of-war—and the ropes are fraying. Bitcoin and XRP cling to $110K and $2.3 like anchors in a storm, while Ether wobbles on a tightrope. Traders are either sweating or salivating. Maybe both.

### The Stability Illusion

Don’t let those flatlining charts fool you. Beneath the surface, liquidity pools are churning like a Wall Street happy hour. Bitcoin’s $110K floor isn’t just technical—it’s psychological warfare. Meanwhile, XRP’s $2.3 peg has more layers than a regulatory filing.

### Ether’s Rollercoaster Protocol

Volatility isn’t a bug for ETH—it’s a feature. Gas fees spike, DeFi degens leverage up, and suddenly everyone’s a mathematician. The only certainty? The next 24 hours will be a masterclass in chaos theory (with lower fees, hopefully).

### The Cynic’s Corner

Let’s be real—these ‘key market dynamics’ are just hedge funds front-running retail… again. But hey, at least the charts are pretty.

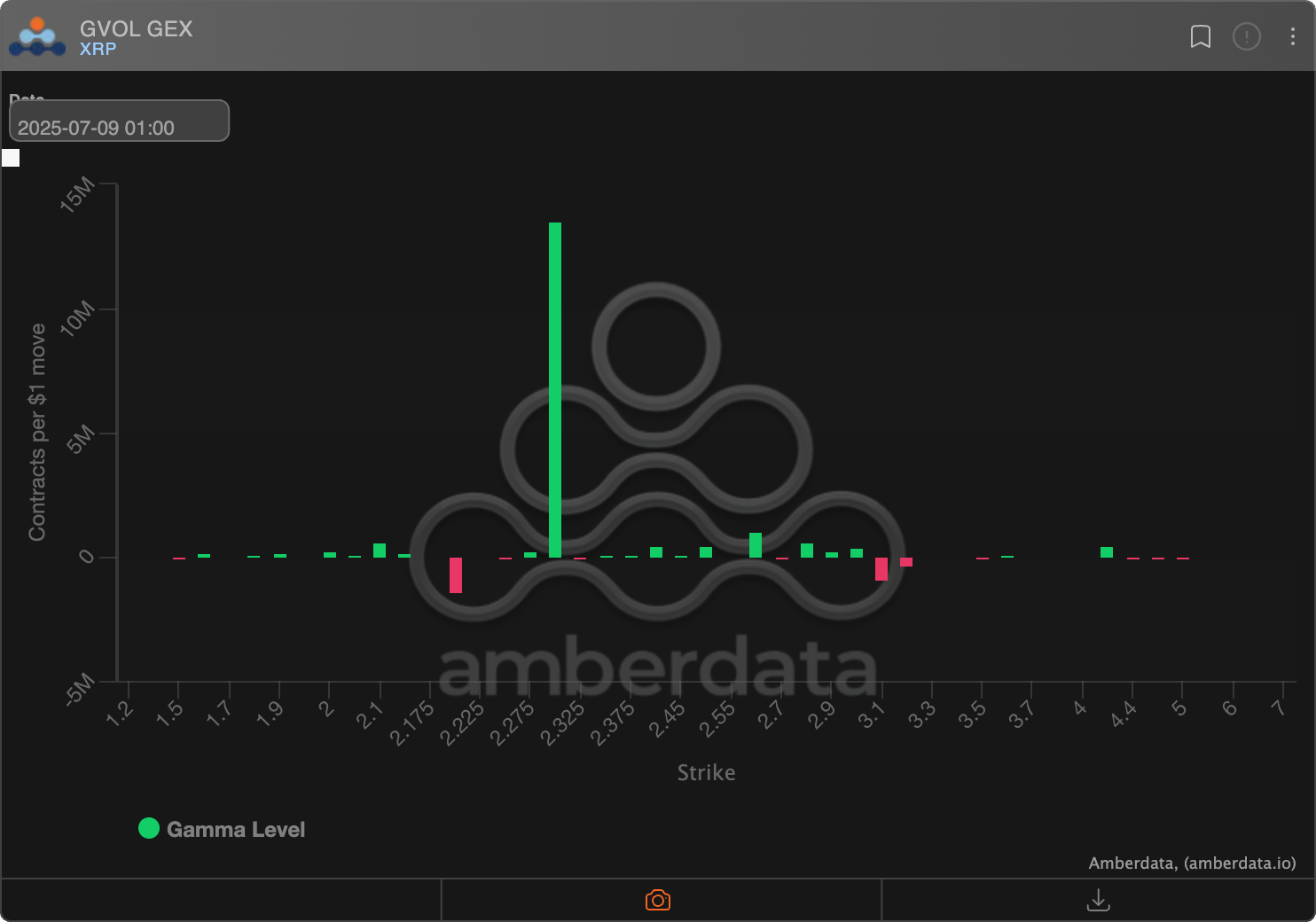

A similar dynamic seems to be playing out in the XRP market, where a large positive market Maker gamma build up is observed at the $2.30 strike price. That calls for maker makers to buy low and sell high around that level capping volatility.

Ether prone to volatility

Ethereum's native token ether, the second-largest cryptocurrency by market value, hit a high of $2,647 early today, the level last seen on June 16.

The MOVE has pushed ether into a "negative market maker gamma" zone of $2,650-$3,500. When dealers hold negative gamma, they tend to trade in the direction of the market, exacerbating bullish/bearish moves.

In other words, their hedging activities could add to ether's bullish momentum, exacerbating volatility, assuming other things being equal.