Corporate Bitcoin Treasuries Rocket Past $85B—A 100% Surge in 12 Months

Wall Street's digital gold rush hits hyperdrive as blue-chip balance sheets now hoard enough Bitcoin to buy a small country—or at least a few Manhattan skyscrapers.

From fringe to fundamental

What started as Tesla's side bet has morphed into a corporate treasury arms race, with CFOs scrambling to hedge against money printers running 24/7. The $85B milestone exposes how fast 'risky speculation' became 'risk management' in boardrooms worldwide.

The institutional FOMO is real

While goldbugs grumble and central bankers sweat, the doubling of corporate Bitcoin holdings screams one thing: smart money's building exits from fiat before the musical chairs stop. Just don't ask about the tax implications.

Closing thought: Nothing boosts adoption like watching your competitor's balance sheet moon while yours holds depreciating cash—the ultimate FOMO trigger for C-suites still on the sidelines.

Adding to that, new fair-value accounting rules introduced by the Financial Account Standards Board (FASB) this year allow companies to recognize gains on BTC holdings, removing a longstanding deterrent.

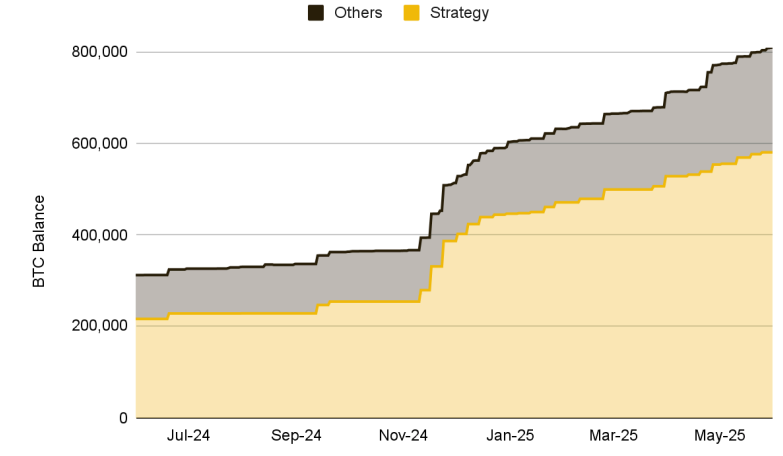

Newer entrants including GameStop (GME) and PSG have recently started accumulating BTC as a well, yet Strategy still holds the lion’s share of BTC in corporate treasuries, with over 70% of holdings.

Some companies are also tiptoeing into other assets. SharpLink holds $425 million in ETH, while DeFi Development and Classover are betting on solana SOL. China-based firm Webus recently filed for a $300 million XRP strategic reserve.

Still, these altcoin holdings remain relatively small and are often tied to firms trying to rebrand as token-forward entities, Binance noted.

Binance’s report also flagged the rapid rise of tokenized real-world assets (RWAs), which have climbed more than 260% from $8.6 billion to $23 billion this year.