Bitcoin Holds Firm Above Critical Support—Is the Market Primed for a Surge?

Bitcoin's price action tightens like a coiled spring as it defends a crucial support level. Traders eye the charts, fingers hovering over buy orders—will this consolidation erupt into the next big move?

The calm before the storm? Market volatility has flatlined, but don't let the silence fool you. Every major breakout in crypto history started with this eerie quiet. Meanwhile, Wall Street 'experts' still can't decide if Bitcoin's a currency, an asset, or the reason their 1980s playbook stopped working.

Technical tightrope walk: The $64k support zone becomes the battleground. Bulls need to hold this line to prevent cascading liquidations, while bears salivate at the prospect of another 20% nosedive. Either way—someone's about to get wrecked.

As leverage builds across exchanges, the market's primed for explosive movement. Will institutions finally 'get it' this time, or will we see yet another round of panic-selling followed by FOMO buying at higher prices? Place your bets.

Key technical points

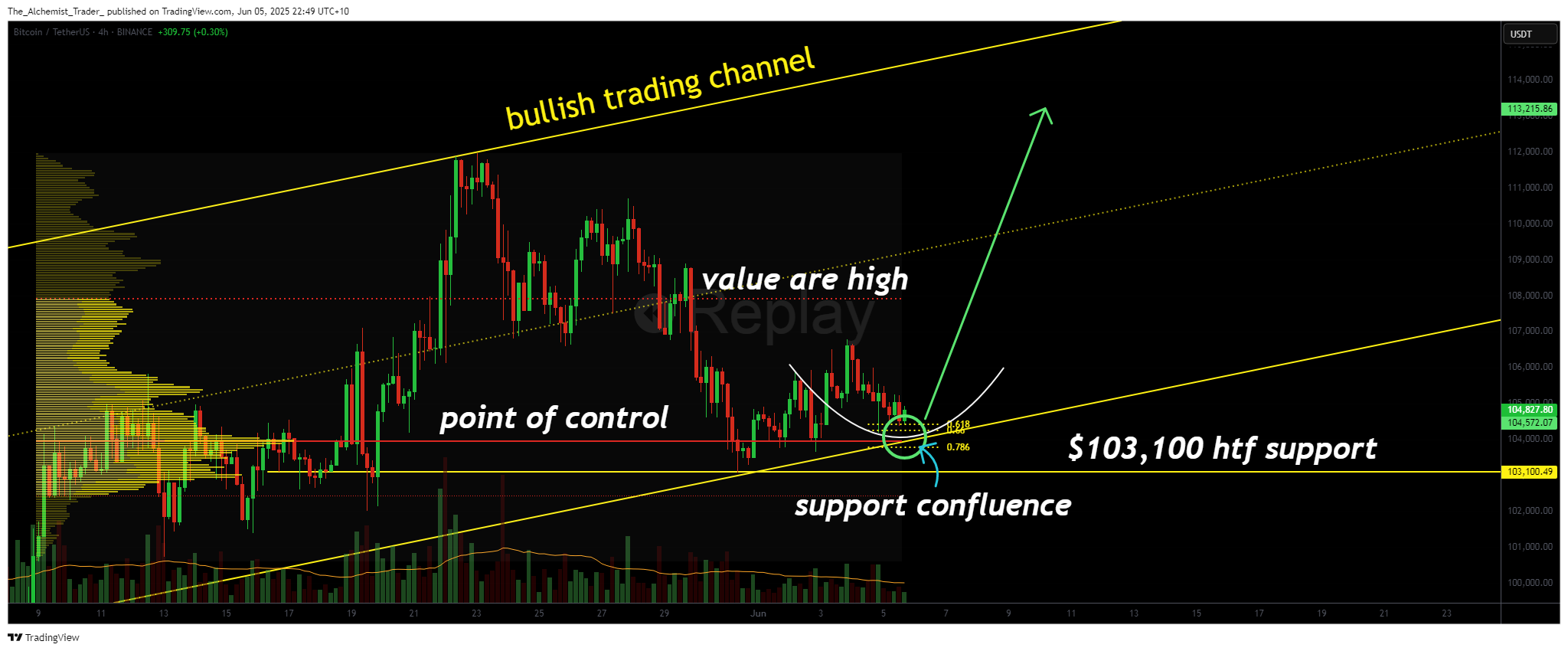

- Point of Control Support: Bitcoin is holding above the POC, which aligns with both the bullish channel low and the 0.618 Fibonacci retracement.

- Rounded Bottom Formation: Price structure on the 4-hour chart is morphing into a rounded bottom pattern, often a precursor to upward momentum.

- Volume Decline Indicates Accumulation: Volume has been declining as price compresses above support — a common signal of accumulation before expansion.

Bitcoin has been consolidating within a narrow range, but the location of this range is what makes it significant. Instead of compressing beneath resistance or within a neutral zone, price is resting on a technically strong support cluster. The Point Of Control, the price level with the highest traded volume, coincides with the channel low support and the 0.618 Fibonacci retracement, creating a robust zone that has held through multiple retests.

On the 4-hour timeframe, candles have been consistently closing above this level, signaling that buyers are defending the zone. The price structure is gradually forming what appears to be a rounded bottom, suggesting a possible reversal pattern and strength building at support.

Volume has been tapering off during this period, a common feature in accumulation phases. Typically, such low-volume compressions resolve in sharp, directional breakouts once volume re-enters the market. In Bitcoin’s case, a reclaim of the value area high will be the first signal of strength. This level has acted as a ceiling in recent weeks and marks the upper boundary of the current volume profile.

What to expect in the coming price action

If Bitcoin continues to hold above the POC and confirms a breakout with volume, a push toward a new all-time high is likely. Until then, traders should monitor volume closely, a spike could signal the end of this accumulation phase and the beginning of a major move.