Bitcoin Stumbles as Trade Policy Whiplash Spooks Crypto Markets

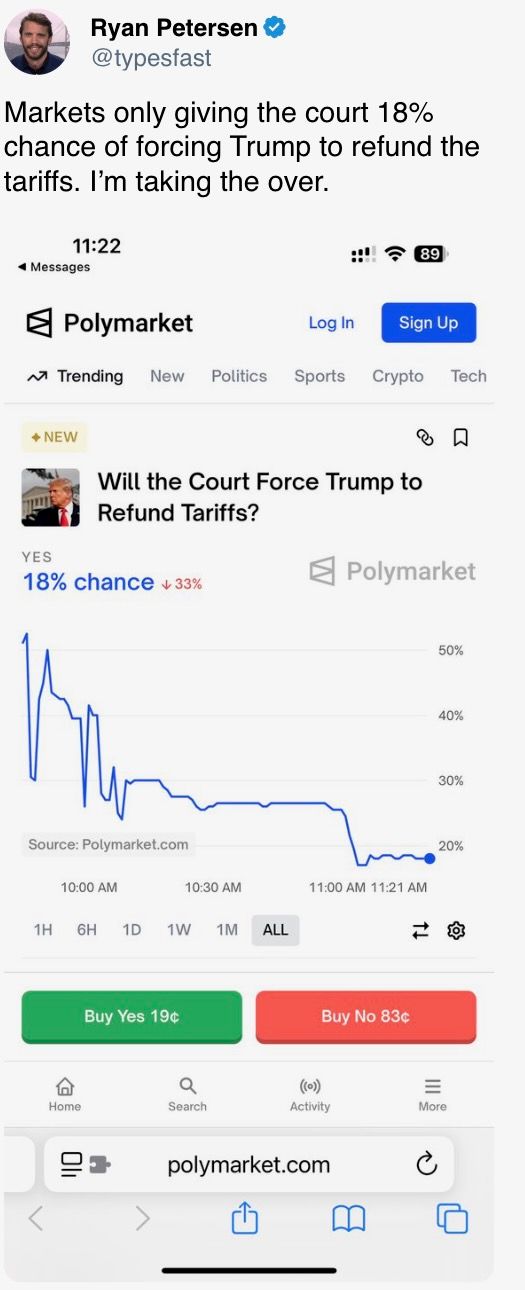

Another day, another knee-jerk reaction—this time courtesy of geopolitical chess moves. Bitcoin dipped sharply after regulators flip-flopped on tariff rulings, proving once again that crypto’s ’decentralized’ narrative still dances to the tune of old-school finance.

Market jitters spread faster than a meme coin pump-and-dump. Traders scrambled as the news hit, with BTC shedding value like a bull shaking off weak hands. Classic risk-off behavior—except this time, the ’safe haven’ playbook got tossed out with the bathwater.

Wall Street’s latest ’hold my latte’ moment? Policy reversals that would make a politician blush. Meanwhile, crypto natives keep building through the noise—because while suits debate tariffs, the blockchain never sleeps.

What to Watch

- Crypto

- May 30: The second round of FTX repayments starts.

- May 31 (TBC): Mezo mainnet launch.

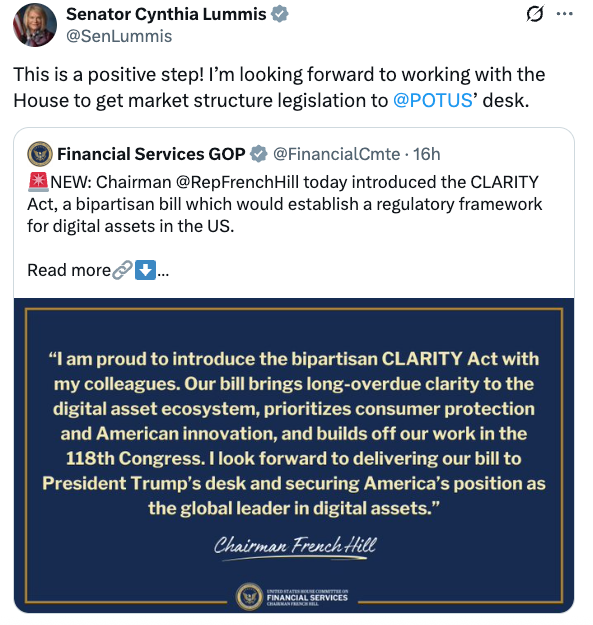

- June 4, 10 a.m.: U.S. House Financial Services Committee will hold a hearing on “American Innovation and the Future of Digital Assets: From Blueprint to a Functional Framework.” Livestream link.

- June 6, 1-5 p.m.: U.S. SEC Crypto Task Force roundtable on "DeFi and the American Spirit"

- Macro

- May 30, 8 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases Q1 GDP data.

- GDP Growth Rate QoQ Est. 1.4% vs. Prev. 0.2%

- GDP Growth Rate YoY Est. 3.2% vs. Prev. 3.6%

- May 30, 8 a.m.: Mexico’s National Institute of Statistics and Geography releases April unemployment rate data.

- Unemployment Rate Est. 2.5% vs. Prev. 2.2%

- May 30, 8:30 a.m.: Statistics Canada releases Q1 GDP data.

- GDP Growth Rate Annualized Est. 1.7% vs. Prev. 2.6%

- GDP Growth Rate QoQ Prev. 0.6%

- May 30, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases April consumer income and expenditure data.

- Core PCE Price Index MoM Est. 0.1% vs. Prev. 0%

- Core PCE Price Index YoY Est. 2.5% vs. Prev. 2.6%

- PCE Price Index MoM Est. 0.1% vs. Prev. 0%

- PCE Price Index YoY Est. 2.2% vs. Prev. 2.3%

- Personal Income MoM Est. 0.3% vs. Prev. 0.5%

- Personal Spending MoM Est. 0.2% vs. Prev. 0.7%

- May 30, 10 a.m.: The University of Michigan releases (final) May U.S. consumer sentiment data.

- Michigan Consumer Sentiment Est. 51 vs. Prev. 52.2

- May 30, 8 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases Q1 GDP data.

- Earnings (Estimates based on FactSet data)

- None in the near future.

Token Events

- Governance votes & calls

- Sui DAO is voting on moving to recover approximately $220 million in funds stolen from the Cetus Protocol hack via a protocol upgrade. Voting ends June 3.

- May 30: Arkham CEO Miguel Morel to participate in an Ask Me Anything (AMA) session.

- June 4, 6:30 p.m.: Synthetic to host a community call.

- June 10, 10 a.m.: Ether.fi to host an analyst call followed by a Q&A session.

- Unlocks

- May 31: Optimism (OP) to unlock 1.89% of its circulating supply worth $21.68 million.

- June 1: Sui (SUI) to unlock 1.32% of its circulating supply worth $150.46 million.

- June 1: ZetaChain (ZETA) to unlock 5.34% of its circulating supply worth $10.14 million.

- June 12: Ethena (ENA) to unlock 0.7% of its circulating supply worth $14.18 million.

- June 12: Aptos (APT) to unlock 1.79% of its circulating supply worth $57.11 million.

- Token Launches

- June 1: Rewards for staking ERC-20 OM on MANTRA Finance end.

- June 16: Advised deadline to unstake stMATIC as part of Lido on Polygon’s sunsetting process ends.

- June 26: Coinbase to delist Helium Mobile (MOBILE), Render (RNDR), Ribbon Finance (RBN), & Synapse (SYN)

Conferences

- Day 4 of 4: Web Summit Vancouver (Vancouver, British Columbia)

- Day 2 of 2: Litecoin Summit 2025 (Las Vegas)

- Day 2 of 4: Balkans Crypto 2025 (Tirana, Albania)

- June 2-7: SXSW London

- June 3: World Computer Summit 2025 (Zurich)

- June 3-5: Money20/20 Europe 2025 (Amsterdam)

- June 4-6: Non Fungible Conference (Lisbon)

- June 5-6: 2025 Crypto Valley Conference (Zug, Switzerland)

- June 19-21: BTC Prague 2025

- June 25-26: Bitcoin Policy Institute’s Bitcoin Policy Summit 2025 (Washington)

- June 26-27: Istanbul Blockchain Week

Token Talk

By Shaurya Malwa

- Starting in June, the Central African Republic will tokenize over 1,700 hectares of land near Bangui using the government’s official CAR token on the Solana blockchain.

- A presidential decree references the nation’s mining code and recent tokenization laws, suggesting the land could be allocated for gold or diamond extraction.

- The CAR token is up 10% in the past 24 hours and has gained 127% this week, with prices starting to climb even before the official announcement.

- President Touadéra announced the plan on X, framing it as a step toward transparency and easier access to national resources.

- The land — about the size of 2,500 football fields— lies west of Bossongo village, 45 km from the capital.

- CAR, which has a market capitalization of $56.63 million and over 18,400 holders, remains down nearly 93% from its all-time high.

Derivatives Positioning

- Premium in ether ETH futures on the CME remains elevated relative to BTC in a sign of persistent bias for the Ethereum blockchain’s token. Perpetual funding rates on offshore exchanges paint a similar picture.

- XLM and AVAX see negative funding rates in a sign of bias for bearish, short positions.

- The one-year put-call skew on IBIT flipped positive Thursday, indicating renewed bias for put options, offering downside protection.

- BTC call skews have weakened across the board on Deribit.

- Block flows on Paradigm featured risk reversals and a large short strangle, involving $100K and $170K strike options, both expiring in December.

Market Movements

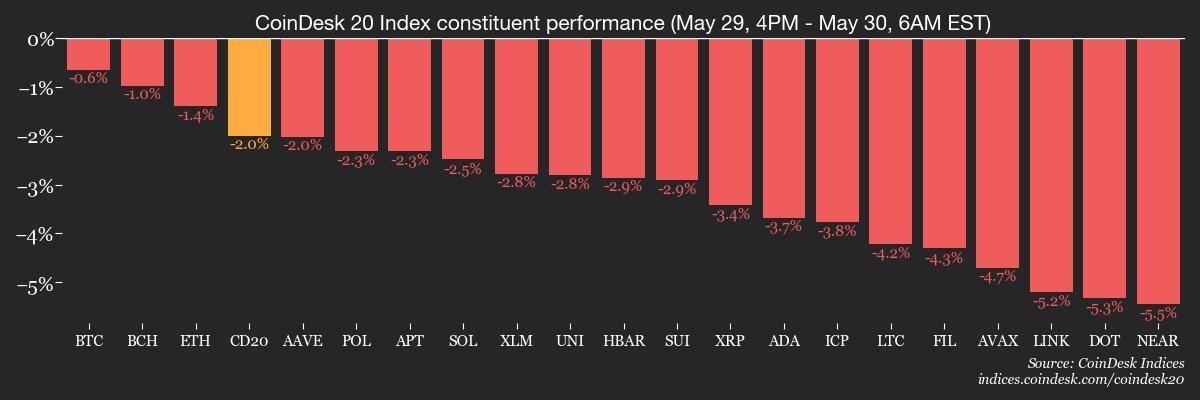

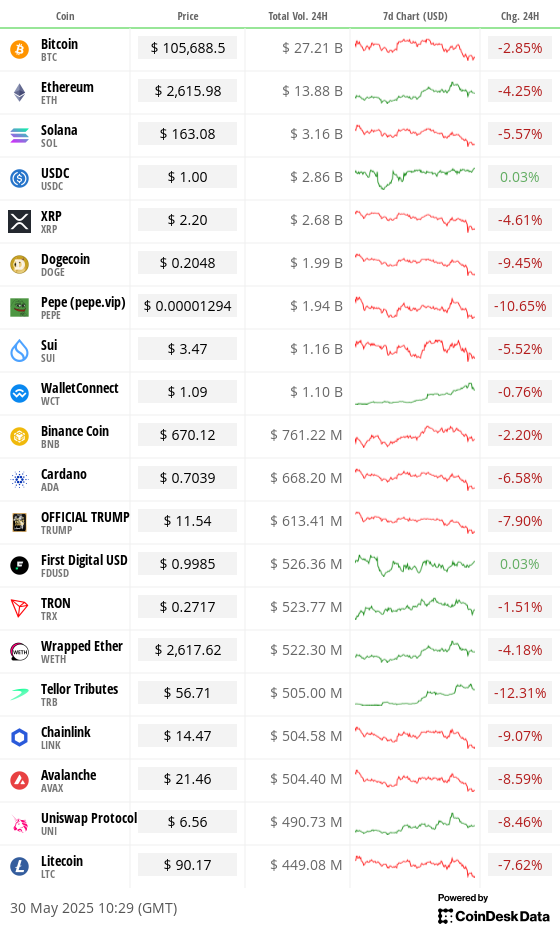

- BTC is down 0.47% from 4 p.m. ET Thursday at $105,705.74 (24hrs: -3.08%)

- ETH is down 1.01% at $2,618.44 (24hrs: -4.43%)

- CoinDesk 20 is down 1.85% at 3,133.82 (24hrs: -4.59%)

- Ether CESR Composite Staking Rate is down 2 bps at 3.08%

- BTC funding rate is at 0.0077% (8.388% annualized) on Binance

- DXY is up 0.31% at 99.58

- Gold is down 0.74% at $3,296.9 /oz

- Silver is down 0.55% at $33.13/oz

- Nikkei 225 closed -1.22% at 37,965.1

- Hang Seng closed -1.2% at 23,289.77

- FTSE is up 0.79% at 8,785.29

- Euro Stoxx 50 is up 0.44% at 5,401.87

- DJIA closed on Thursday +0.28% at 42,215.73

- S&P 500 closed +0.4% at 5,912.17

- Nasdaq closed +0.39% at 19,175.87

- S&P/TSX Composite Index closed -0.28% at 26,210.6

- S&P 40 Latin America closed unchanged at 2,600,63

- U.S. 10-year Treasury rate is down 5 bps at 4.42%

- E-mini S&P 500 futures are down 0.15% at 5,913.75

- E-mini Nasdaq-100 futures are down 0.17% at 21,372.75

- E-mini Dow Jones Industrial Average Index futures are down 0.1% at 42,235

Bitcoin Stats

- BTC Dominance: 63.99 (0.42%)

- Ethereum to bitcoin ratio: 0.02486 (-0.28%)

- Hashrate (seven-day moving average): 917 EH/s

- Hashprice (spot): $54.94

- Total Fees: 5.27 BTC / $566,744

- CME Futures Open Interest: 153,800

- BTC priced in gold: 31.7 oz

- BTC vs gold market cap: 8.97%

Technical Analysis

- The chart shows BTC has dropped below a trendline that represents the sharp recovery from early-April lows near $75,000.

- The breakdown coincides with the bearish crossover of the 50- and 200-hour simple moving averages.

- The bearish shift points to test of supports at $102K and $100K.

Crypto Equities

- Strategy (MSTR): closed on Thursday at $370.63 (1.75%), down 0.48% at $368.86 in pre-market

- Coinbase Global (COIN): closed at $248.84 (-2.14%), down 0.42% at $247.8

- Galaxy Digital Holdings (GLXY): closed at C$27.05 (-3.39%)

- MARA Holdings (MARA): closed at $14.61 (-1.68%), down 0.82% at $14.49

- Riot Platforms (RIOT): closed at $8.18 (-2.39%), down 0.86% at $8.11

- Core Scientific (CORZ): closed at $10.69 (-0.83%), unchanged

- CleanSpark (CLSK): closed at $8.78 (-3.62%), down 1.14% at $8.68

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $16.9 (-2.14%)

- Semler Scientific (SMLR): closed at $40.08 (-3%), down 0.2% at $40

- Exodus Movement (EXOD): closed at $30.31 (16.85%), up 2.18% at $30.97

ETF Flows

- Daily net flow: -$346.8 million

- Cumulative net flows: $44.97 billion

- Total BTC holdings ~ 1.21 million

- Daily net flow: $91.9 million

- Cumulative net flows: $2.99 billion

- Total ETH holdings ~ 3.60 million

Source: Farside Investors

Overnight Flows

Chart of the Day

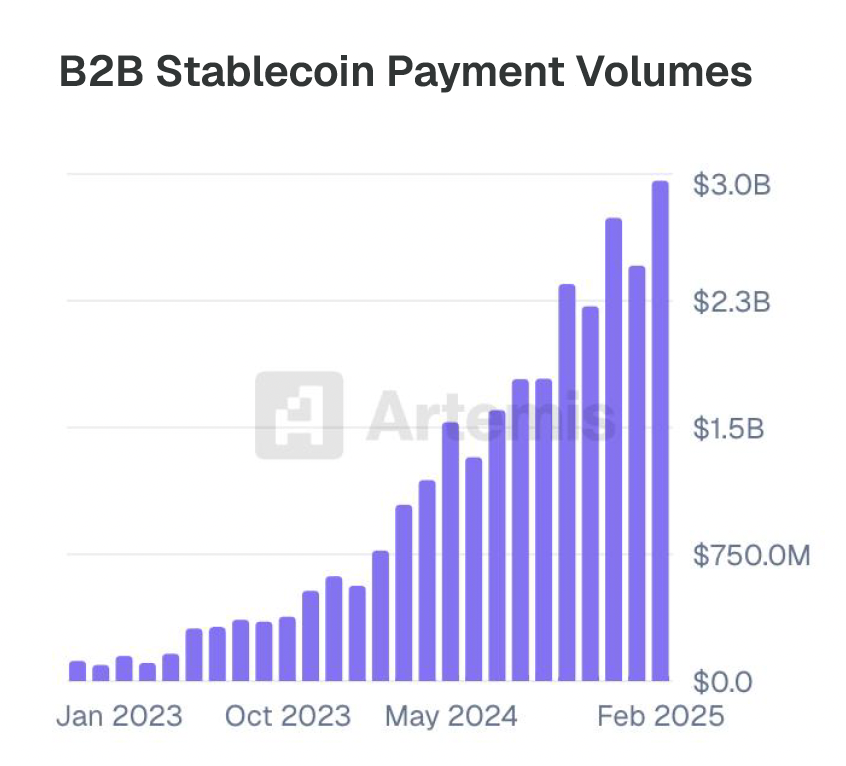

- The chart shows stablecoin usage in business-to-business payments has exploded from near zero two years ago to nearly $3 billion.

- The data is evidence of stablecoins’ growing adoption in the real economy.

While You Were Sleeping

- Crypto Staking Doesn’t Violate U.S. Securities Law, SEC Says (CoinDesk): A new SEC staff statement clarifies that certain staking-related activities won’t trigger securities violations, aligning them with mining and potentially accelerating regulatory approval for staking components in spot ether ETFs.

- Two Ways This Bitcoin Bull Market Is Sturdier Than 2020-21 and 2017 (CoinDesk): Realized volatility in the current bull market, which started in early 2023, has averaged under 50%, as reduced exchange leverage helps limit the frequency and depth of price pullbacks.

- Thailand to Block OKX, Bybit and Others, Citing Lack of License (CoinDesk): Thailand’s securities regulator filed a complaint against five unlicensed crypto platforms and asked the Ministry of Digital Economy and Society to block access starting June 28.

- Israel Fears Being Boxed In by Trump’s Iran Talks (The Wall Street Journal): Israel fears Trump’s push for a deal will leave Iran’s uranium enrichment intact, yet acting alone risks losing the U.S. backing essential for managing Iranian retaliation after a potential strike.

- Trump Aims to Exceed First Term’s Weapons Sales to Taiwan, Officials Say (Reuters): U.S. officials are pressing Taiwan’s opposition parties to support a special defense budget raising spending to 3% of GDP as Washington prepares new arms sales to counter Chinese military pressure.

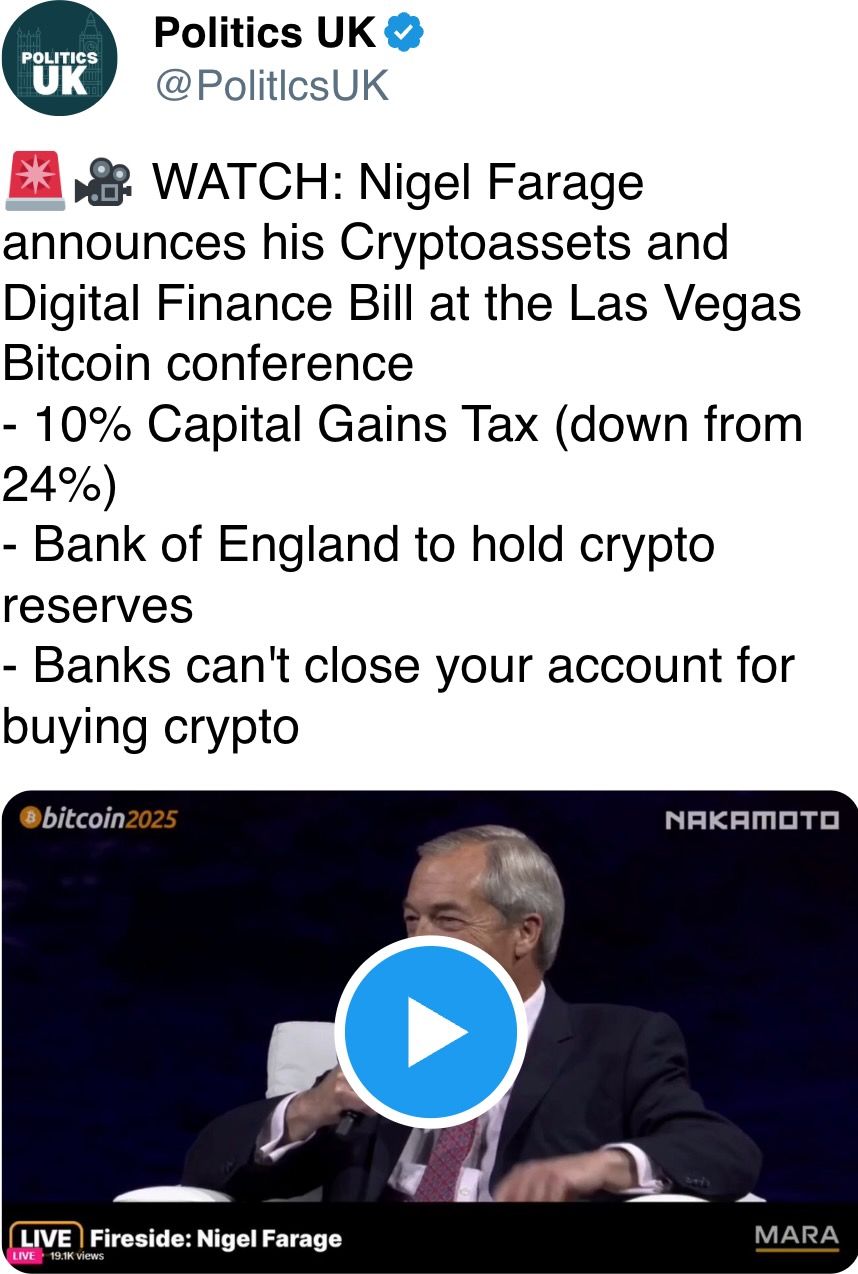

- Bank of England Policymaker Plays Down Inflation Risk in Call for Rate Cuts (Financial Times): BoE’s Alan Taylor argued April’s inflation surge was driven by temporary price hikes, not demand, and warned Trump’s trade war continues to weigh heavily on the U.K. growth outlook.

In the Ether