Bitcoin Smashes $2 Trillion Barrier—Retail FOMO Meets Institutional Cold Feet

Bitcoin’s market cap just punched through the $2 trillion ceiling—triggering a stampede of retail buyers while whales hover cautiously on the sidelines. On-chain analytics reveal a classic bull-market dichotomy: Main Street piles in as Wall Street watches liquidity like hawk-eyed casino bouncers.

The psychology is textbook. Every new all-time high acts like a siren call for latecomers, while OGs check exit routes. Meme-coiners are yolo-ing paychecks, while hedge funds quietly rebalance into stablecoins—because nothing screams ’maturity’ like pretending you weren’t just gambling with client money.

One hedge fund manager (who demanded anonymity before his compliance team could muzzle him) put it best: ’We’ll buy the next dip. Maybe. Unless it dips again.’

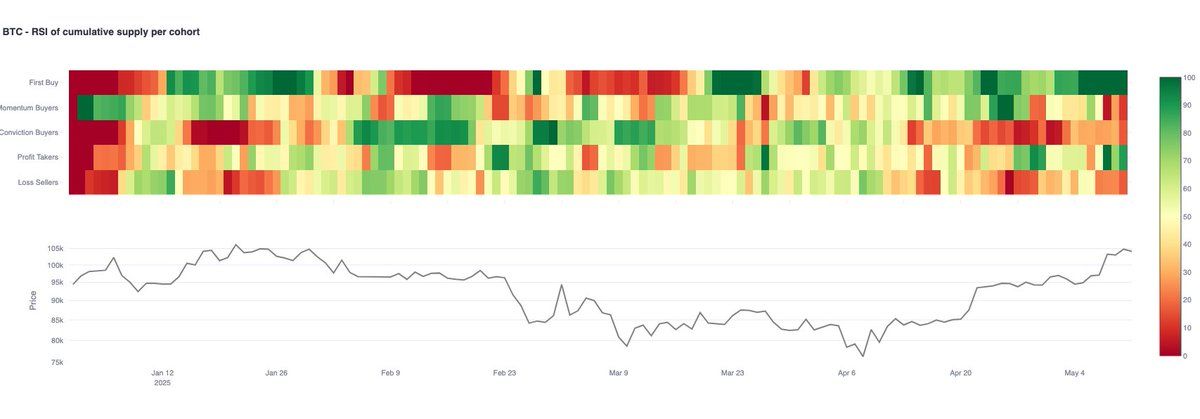

Glassnode’s supply-mapping tool represents granular segmentation of different investor cohorts based on their behavioral patterns.

First timers are defined as wallets engaging with the token for the first time. The 30-day relative strength index of the first-time buyers holding at 100 through the week indicates strong buying interest from these participants.

However, the activity of other investor cohorts isn’t as encouraging, raising the possibility of a BTC price consolidation or pullback.

Per Glassnode, demand from momentum buyers remains weak, with the 30-day RSI at 11. Momentum traders capitalize on an established uptrend or downtrend, betting it will continue.

"Momentum Buyers remain weak (RSI ~11), and Profit Takers are rising. If fresh inflows slow, lack of follow-through could lead to consolidation," Glassnode noted.