Coinbase Smashes Wall Street Barrier: First Crypto Company Joins S&P 500 Elite

Wall Street’s old guard just got a blockchain-powered shakeup. Coinbase—once dismissed as a ’Bitcoin casino’—has bulldozed its way into the S&P 500, marking the first time a pure-play crypto firm cracks the mainstream financial big leagues.

The inclusion signals a tectonic shift: digital assets are no longer the fringe—they’re forcing institutional recognition. TradFi gatekeepers grumble about volatility, but the index committee couldn’t ignore Coinbase’s $80B+ market cap and 110M verified users.

Just don’t ask how they’ll explain the next 20% BTC swing to pension fund managers over golf.

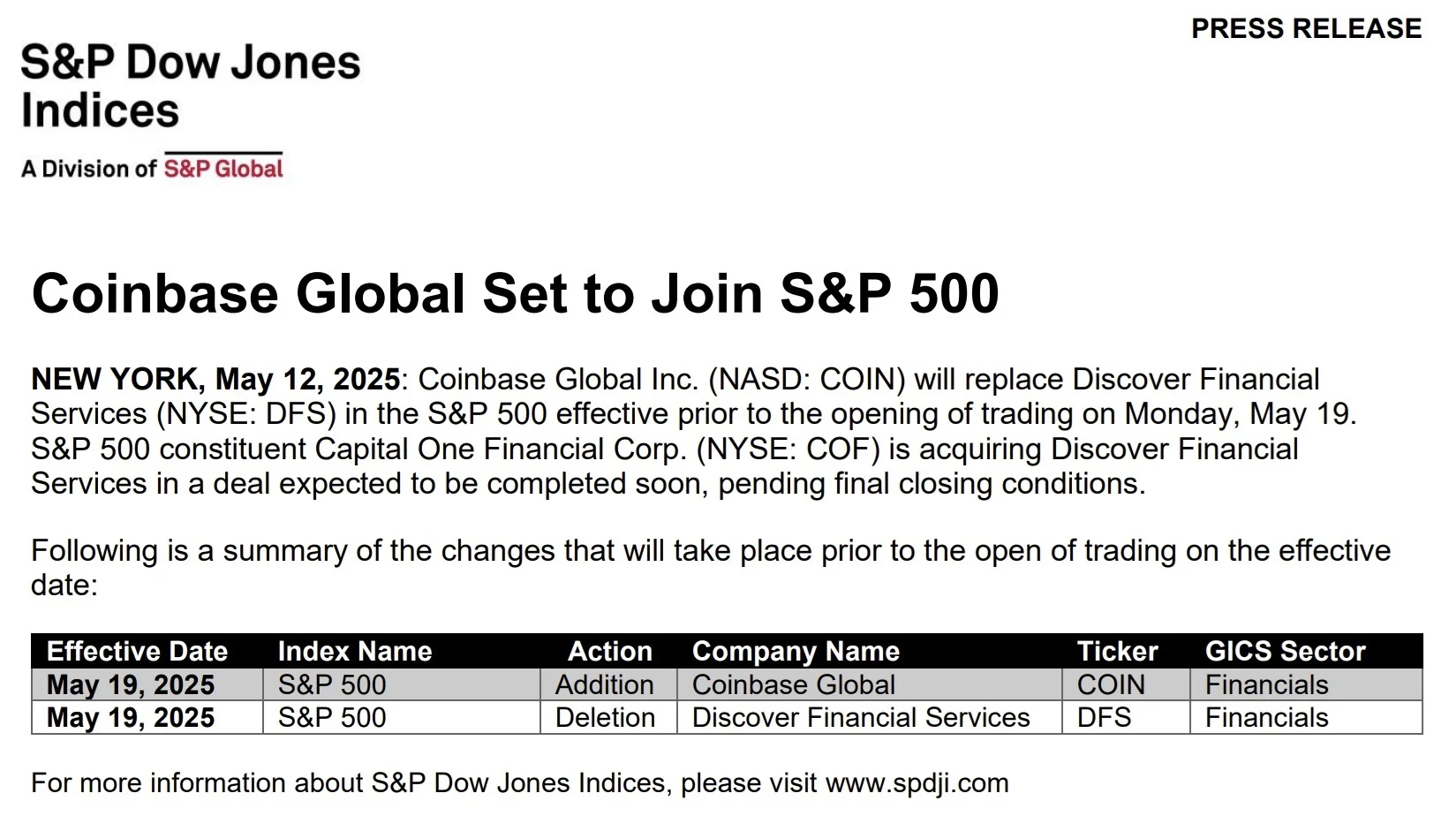

Source: S&P Global

Source: S&P Global

It’s not just a milestone for the company. It’s a clear signal that the financial world is finally starting to take crypto seriously.

Market Reaction

Investors didn’t waste any time reacting. Coinbase stock popped 4 percent during the regular trading day, then tacked on another 9 percent in after-hours action. The stock ended up closing at $207.22. Traders seem to like the idea of crypto moving further into the financial mainstream, and they’re putting their money behind it.

As the saying goes…

“First they ignore you.

Then they laugh at you.

Then they fight you.

Then they add you to the S&P 500.”

…or something like that.

— Coinbase (@coinbase) May 12, 2025

(@coinbase) May 12, 2025

Being included in the S&P 500 is no small thing. The index is tracked by trillions of dollars worth of institutional money. Think pension funds, retirement accounts, and big asset managers. Once a company is added, there’s usually a wave of buying from funds that are required to match the index.

Why It Matters

The S&P 500 is often seen as a snapshot of the U.S. economy. It includes 500 of the largest public companies across all industries. When a company makes the cut, people often view it as entering the corporate big leagues.

DISCOVER: Best New Cryptocurrencies to Invest in 2025For Coinbase, this means more than just status. It brings legitimacy, visibility, and access to a bigger pool of investors. Not bad for a company that started out in a San Francisco apartment a little over a decade ago.

Coinbase’s Backstory

Brian Armstrong and Fred Ehrsam founded Coinbase in 2012. It grew quickly by making crypto easier to buy, sell, and hold for everyday users. In 2021, it made headlines with its public debut via direct listing on the Nasdaq.

Since then, it’s faced everything from wild market swings to intense regulatory scrutiny. But it’s also grown into a global platform with more than 100 million users across over 100 countries.

Bigger Moves in Play

The timing of Coinbase’s S&P 500 inclusion is interesting. Just days earlier, the company announced a $2.9 billion deal to acquire Deribit, a Dubai-based crypto derivatives platform. That MOVE expands Coinbase’s reach into options and futures, a space that appeals heavily to institutional traders.

So now, between this acquisition and its new role in the S&P 500, Coinbase is shaping up to be a heavyweight in both crypto and traditional finance.

Coinbase Joining S&P 500: Looking Forward

Coinbase landing in the S&P 500 isn’t just a corporate win, it’s a cultural moment. It shows that crypto is no longer an outsider in finance. The industry still has plenty of hurdles to clear, especially on the regulatory front, but this moment feels like another big step toward normalization.

Whether you’re a crypto diehard or just watching from the sidelines, one thing’s clear: the line between Wall Street and crypto just got a whole lot thinner.

Key Takeaways

- Coinbase will officially join the S&P 500 on May 19, becoming the first crypto-native company to enter the iconic stock index.

- The news sent Coinbase stock up 4% during the day and another 9% in after-hours trading, closing at $207.22.

- Inclusion in the S&P 500 boosts Coinbase’s legitimacy, bringing exposure to institutional investors managing trillions of dollars.

- Founded in 2012, Coinbase has grown from a startup into a global crypto platform serving over 100 million users in 100+ countries.

- The milestone comes just days after Coinbase announced its $2.9 billion acquisition of Deribit, further expanding into crypto derivatives.