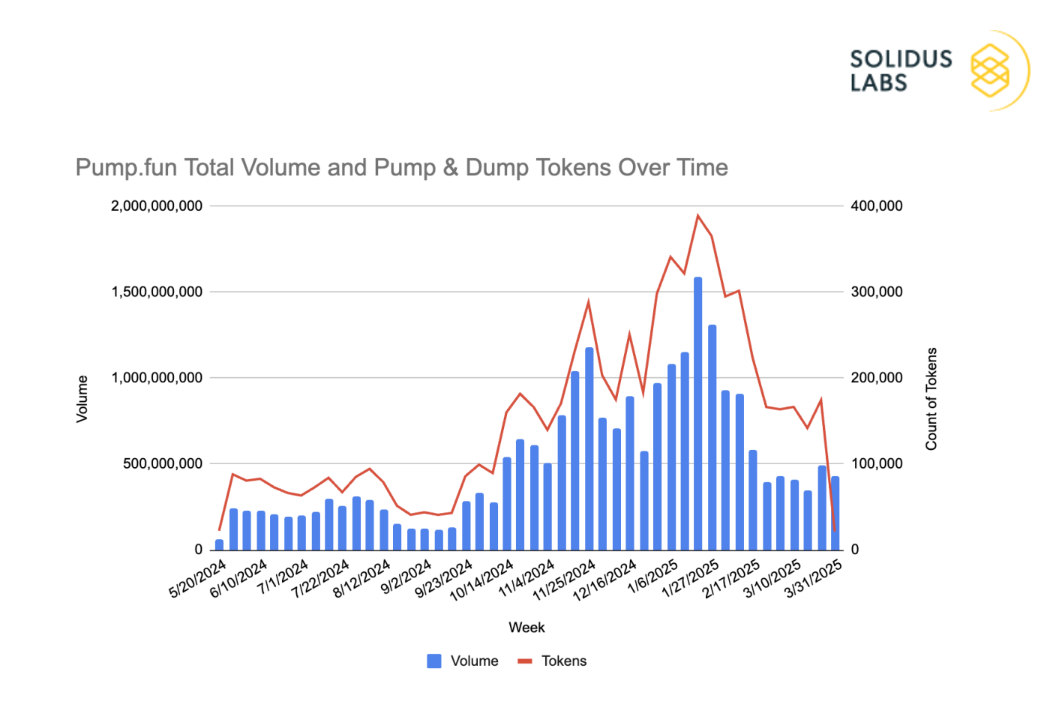

Pump.Fun’s Dirty Secret: 98% of Tokens Were Rug Pulls or Scams, Report Reveals

Another day, another crypto bloodbath—only this time, the numbers are jaw-dropping even for jaded degens. A new report exposes Pump.Fun as a rug-pull factory where 98% of tokens were either outright frauds or exit scams. Remember when ’DYOR’ was advice and not a suicide note?

Platforms like these give decentralized finance a bad name—which, let’s face it, takes some doing in 2025. The irony? Most victims probably thought they were ’early’ while watching their bags turn to vapor. Some things never change—except your portfolio balance, downward.

The largest rug pull Solidus Labs identified over the time period was worth $1.9 million and was related to MToken.

Whilst the crypto industry has progressed and moved on following the spectacular implosion of FTX, hacks and scams are still rife with bad actors embezzling millions of dollars worth of assets by capitalizing on retail greed.

The memecoin sector is the greatest example of that, with 10s of thousands of bogus tokens being created every day. The hype around memecoin reached a crescendo in January when U.S. President Donal TRUMP touted his own TRUMP memecoin on social media. Shortly after the U.S. First Lady Melania Trump promoted MELANIA, both tokens are now down by 87% and 97% respectively, with a cabal of insiders reportedly profiting more than $100 million by buying the token before it was publicly available.

Meanwhile, on decentralized exchange Raydium, Solidus Labs found that 93% of liquidity pools (361,000 pools) exhibited soft rug pull characteristics, with the median rug pulls worth $2.8K.

In February, a Merkle Science report revealed that $500 million had been lost to rug pulls and scams in 2024.

Solana has emerged as a popular blockchain among criminals and scammers. Its near-zero fees and instant execution make it easy to deploy tokens and extract value.

Regulators are keeping a watchful eye over the sector. In March, the SEC set up a Cyber and Emerging Technologies unit designed to “root out those seeking to misuse innovation to harm investors and diminish confidence in new technologies.”

The regulator filed a class action lawsuit against Meteora in April, naming individuals associated with the M3M3 meme coin, alleging that they were responsible for a $69 million rug pull.