Trump’s Crypto Wink Sparks Rally as Movement’s Fee Model Implodes

Market pumps on political posturing while ’decentralized’ protocols quietly reenact traditional finance’s rent-seeking behavior—just with more memes and less paperwork.

Trump’s latest pro-crypto comments trigger algo-driven buys, proving digital assets still trade on headlines rather than utility. Meanwhile, Movement’s collapsing fee structure exposes the dirty secret of ’permissionless’ chains: someone always gets paid.

Bonus jab: Wall Street’s watching these fee structures with predatory glee—finally, a pump-and-dump scheme they don’t need SEC approval to copy.

What to Watch

- Crypto:

- May 8: Judge John G. Koeltl will sentence Alex Mashinsky, the founder and former CEO of the now-defunct crypto lending firm Celsius Network, at the U.S. District Court for the Southern District of New York.

- May 12, 1 p.m. to 5:30 p.m.: A U.S. SEC Crypto Task Force Roundtable on "Tokenization: Moving Assets Onchain: Where TradFi and DeFi Meet" will be held at the SEC’s headquarters in Washington.

- Macro

- May 8, 7 a.m.: The Bank of England announces its interest-rate decision. The Monetary Policy Report Press Conference is livestreamed 30 minutes later.

- Bank Rate Est. 4.25% vs. Prev. 4.5%

- May 8, 8:30 a.m.: The U.S. Department of Labor releases unemployment insurance data for the week ended May 3.

- Initial Jobless Claims Est. 230K vs. Prev. 241K

- May 8, 10 a.m.: President Donald Trump will reportedly unveil the framework of a trade deal with the U.K. at a White House press conference.

- May 9-12: Chinese Vice Premier He Lifeng will hold trade talks with U.S. Treasury Secretary Scott Bessent during his visit to Switzerland.

- May 8, 7 a.m.: The Bank of England announces its interest-rate decision. The Monetary Policy Report Press Conference is livestreamed 30 minutes later.

- Earnings (Estimates based on FactSet data)

- May 8: CleanSpark (CLSK), post-market, $-0.11

- May 8: Coinbase Global (COIN), post-market, $1.88

- May 8: Hut 8 (HUT), pre-market, $-0.10

- May 8: MARA Holdings (MARA), post-market, $-0.52

- May 13: Semler Scientific (SMLR), post-market

Token Events

- Governance votes & calls

- Arbitrum DAO is voting on whether to put the last $10.7 million from its 35 million ARB diversification plan into three low‑risk, dollar‑based funds from WisdomTree, Spiko and Franklin Templeton. Voting ends on May 8.

- Compound DAO is voting on which new collateral type to prioritize on Compound V3. Voting ends May 8.

- May 8, 10 a.m.: Balancer and Euler to host an Ask Me Anything (AMA) session.

- May 15, 10 a.m.: Moca Network to host a Discord townhall session discussing network updates.

- Unlocks

- May 9: Movement (MOVE) to unlock 2.04% of its circulating supply worth $8.08 million.

- May 11: Solayer (LAYER) to unlock 12.87% of its circulating supply worth $35.66 million.

- May 12: Aptos (APT) to unlock 1.82% of its circulating supply worth $57.45 million.

- May 13: WhiteBIT Coin (WBT) to unlock 27.41% of its circulating supply worth $1.14 billion.

- May 15: Starknet (STRK) to unlock 4.09% of its circulating supply worth $17.7 million.

- Token Launches

- May 8: AIXBT to be listed on Binance.US.

- May 8: Space and Time (SXT) to be listed on Binance, MEXC, BingX, KuCoin, Bitget and others.

- May 16: Galxe (GAL), Litentry (LIT), Mines of Dalarnia (DAR), Orion Protocol (ORN), and PARSIQ (PRQ) to be delisted from Coinbase.

Conferences

CoinDesk’s Consensus is taking place in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

- Day 3 of 3: Stripe Sessions (San Francisco)

- Day 2 of 3: SALT’s Bermuda Digital Finance Forum 2025 (Hamilton, Bermuda)

- May 9-10: Stanford Blockchain Governance Summit (San Francisco)

- May 11-17: Canada Crypto Week (Toronto)

- May 12-13: Dubai FinTech Summit

- May 12-13: Filecoin (FIL) Developer Summit (Toronto)

- May 12-13: Latest in DeFi Research (TLDR) Conference (New York)

- May 12-14: ACI’s 9th Annual Legal, Regulatory, and Compliance Forum on Fintech & Emerging Payment Systems (New York)

- May 13: Blockchain Futurist Conference (Toronto)

- May 13: ETHWomen (Toronto)

- May 14-16: CoinDesk’s Consensus 2025 (Toronto)

Token Talk

By Shaurya Malwa

- $3, just $3.

- That’s all Movement network earned in fees over the past 24 hours, DeFiLlama data shows, the lowest in a week for the embattled chain once valued at $1 billion.

- Daily DEX volumes have cratered below $500K, a dramatic fall from earlier exuberance that saw the network process more than $2 million a day.

- The slide comes days after CoinDesk reported irregularities with how the MOVE token was distributed and supplied to trading firms.

- Ironically, the MOVE token launched before the chain existed, raising millions via private sales while the actual blockchain infrastructure lagged far behind.

- The project handed out 66 million MOVE tokens (5% of supply) to a market-making firm called Rentech, which dumped nearly all of it for $38 million.

- Founder Rushi Manche was terminated on May 7, just days after being suspended. He admitted to “zero oversight” and blamed bad-faith advisers for the project’s collapse in X posts following the CoinDesk report.

- MOVE has fallen over 85% from its peak of $1.45 in December 2024 to just 15 cents.

- With no trust, no traction and, now, almost no fees, Movement has turned into the cautionary tale of 2025 — a billion-dollar paper promise with a $3 reality.

Derivatives Positioning

- BTC and ETH perpetual funding rates rose close to an annualized 10%, signaling a strengthening bullish mood in the market.

- BTC, ETH futures premium on the CME still remain under 10%.

- On Deribit, bitcoin and ether options risk reversals show a bullish bias for calls across multiple time frames.

- Notable block trades include a short position in the $85K BTC put expiring in June and a calendar spread involving calls at strikes $140K and $170K, expiring on Sept. 26 and Dec. 26, respectively.

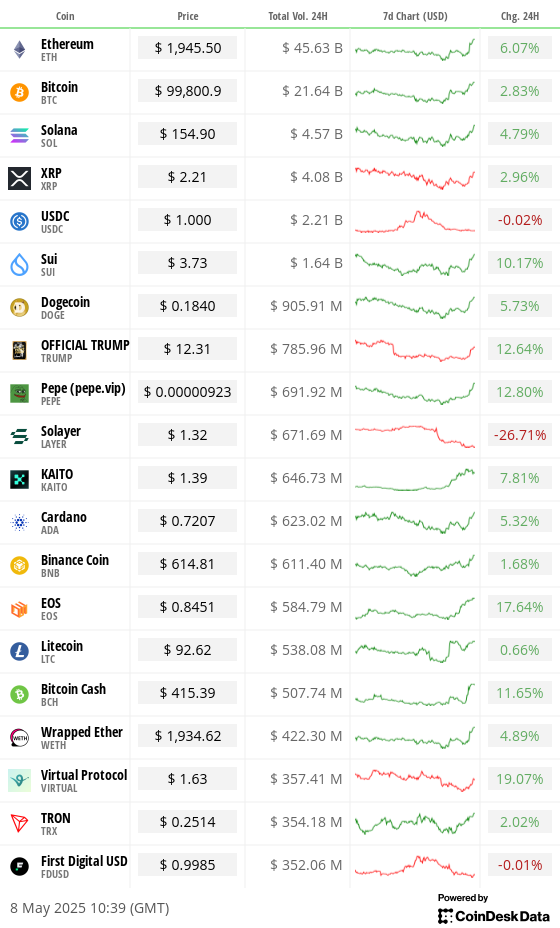

Market Movements:

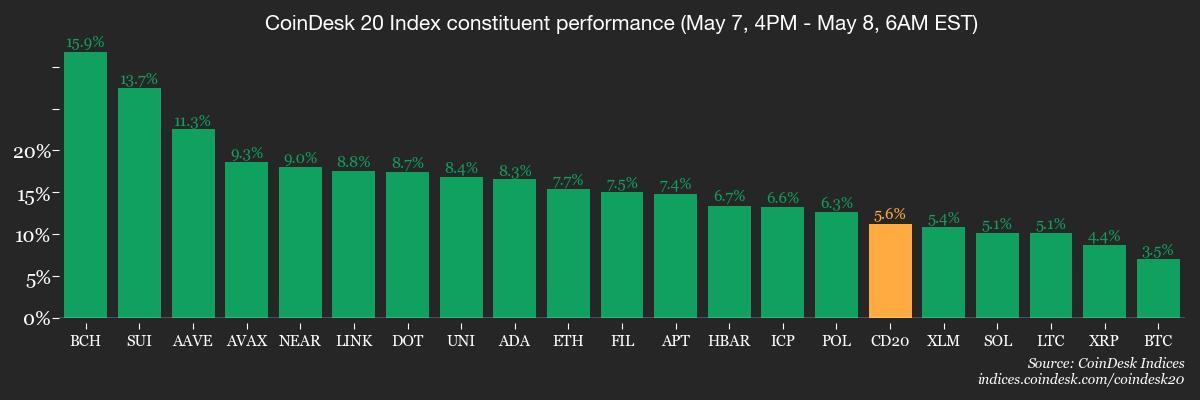

- BTC is up 3.49% from 4 p.m. ET Wednesday at $99,620.26 (24hrs: +2.77%)

- ETH is up 7.76% at $1,939.15 (24hrs: +5.11%)

- CoinDesk 20 is up 5.75% at 2,854.54 (24hrs: +3.81%)

- Ether CESR Composite Staking Rate is down 6 bps at 2.894%

- BTC funding rate is at 0.0048% (5.2242% annualized) on Binance

- DXY is up 0.48% at 100.09

- Gold is down 1.25% at $3,343.61/oz

- Silver is down 0.25% at $32.40/oz

- Nikkei 225 closed +0.41% at 36,928.63

- Hang Seng closed +0.37% at 22,775.92

- FTSE is up 0.39% at 8,592.98

- Euro Stoxx 50 is up 1.21% at 5,293.07

- DJIA closed on Wednesday +0.7% at 41,113.97

- S&P 500 closed +0.43% at 5,631.28

- Nasdaq closed +0.27% at 17,738.16

- S&P/TSX Composite Index closed +0.75% at 25,161.18

- S&P 40 Latin America closed -0.2% at 2,512.07

- U.S. 10-year Treasury rate is up 5 bps at 4.315%

- E-mini S&P 500 futures are up 1.03% at 5,170.00

- E-mini Nasdaq-100 futures are up 1.4% at 20,240.00

- E-mini Dow Jones Industrial Average Index futures are up 0.82% at 41,552.00

Bitcoin Stats:

- BTC Dominance: 65.08 (-0.44%)

- Ethereum to bitcoin ratio: 0.01942 (4.02%)

- Hashrate (seven-day moving average): 909 EH/s

- Hashprice (spot): $53.34

- Total Fees: 6.64 BTC / $661,908.40

- CME Futures Open Interest: 142,255 BTC

- BTC priced in gold: 29.5 oz

- BTC vs gold market cap: 8.37%

Technical Analysis

- The XRP-ETH ratio has dived out of the year-to-date ascending trendline.

- The breakdown suggests ether outperformance relative to XRP in the days ahead.

Crypto Equities

- Strategy (MSTR): closed on Monday at $392.48 (+1.78%), up 5.35% at $413.49 in pre-market

- Coinbase Global (COIN): closed at $196.56 (-0.17%), up 4.77% at $205.94

- Galaxy Digital Holdings (GLXY): closed at C$26.49 (+2.28%)

- MARA Holdings (MARA): closed at $13.33 (+1.37%), up 5.55% at $14.07

- Riot Platforms (RIOT): closed at $7.84 (-0.25%), up 5.1% at $8.24

- Core Scientific (CORZ): closed at $8.90 (-1%), up 5.28% at $9.37

- CleanSpark (CLSK): closed at $8.03 (-0.74%), up 5.23% at $8.45

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $14.59 (+0.34%), up 5.89% at $15.45

- Semler Scientific (SMLR): closed at $33.05 (-0.12%), up 4.99% at $34.70

- Exodus Movement (EXOD): closed at $40.01 (+1.34%), up 0.25% at $40.11

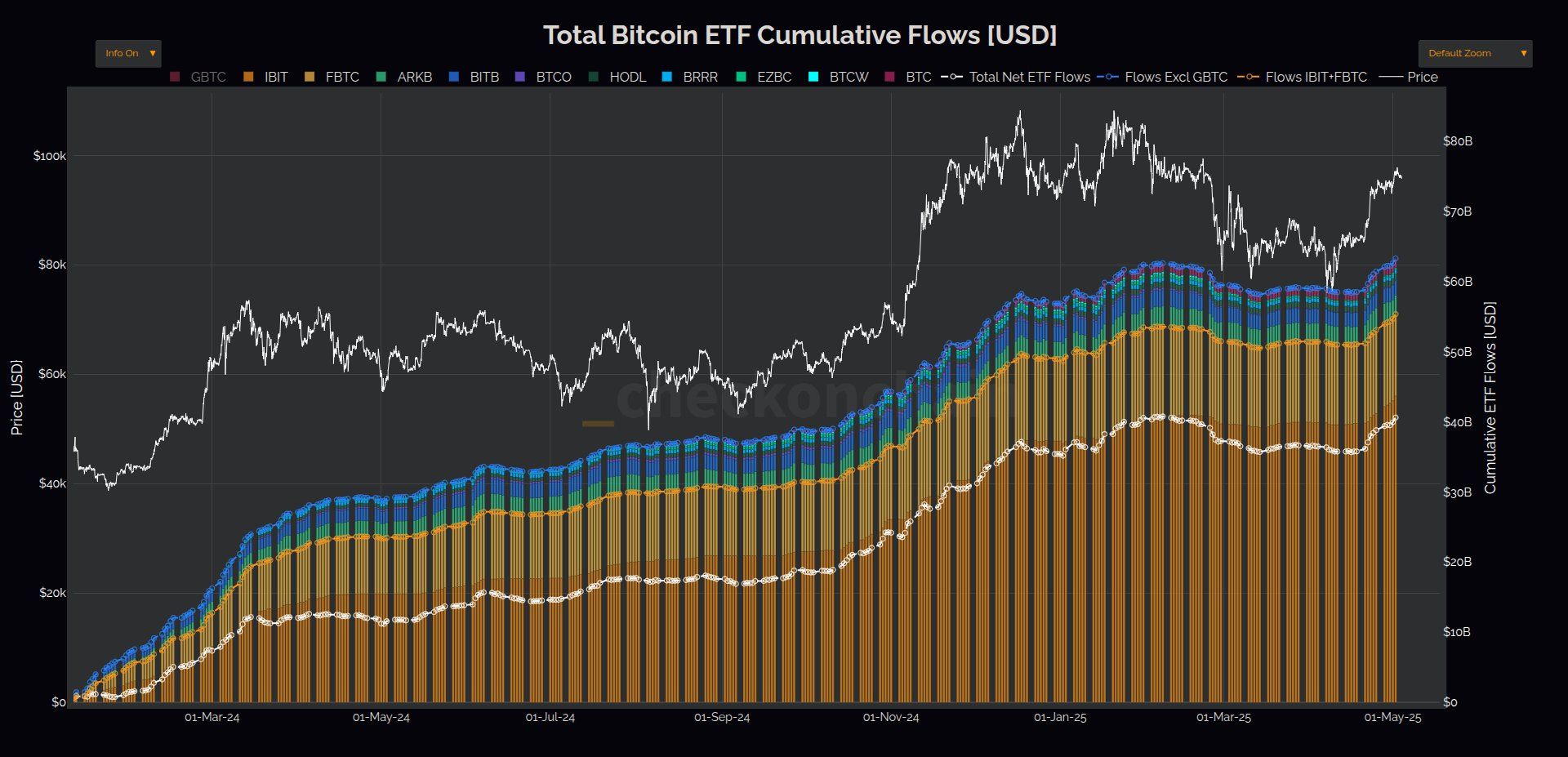

ETF Flows

- Daily net flow: $142.3 million

- Cumulative net flows: $40.68 billion

- Total BTC holdings ~ 1.17 million

- Daily net flow: -$21.8 million

- Cumulative net flows: $2.48 billion

- Total ETH holdings ~ 3.45 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- The chart shared by pseudonymous analyst Checkmate shows the cumulative inflows into the U.S.-listed spot bitcoin ETFs have hit a record high above $40 billion.

- Early this week, BlackRock’s IBIT surpassed the SPDR gold ETF in year-to-date inflows.

While You Were Sleeping

- Trump to Announce Trade-Deal Framework With Britain (The Wall Street Journal): The U.K. is seeking relief from steep U.S. tariffs on steel and autos in exchange for curbing a tax on digital services, according to people familiar with the talks.

- India and Pakistan May Have an Off-Ramp After Their Clash. Will They Take It? (New York Times): India and Pakistan signaled room for de-escalation after Indian strikes killed over 20 in Pakistan, with both sides portraying their responses as limited and back-channel talks reportedly underway.

- Binance Founder CZ Confirms He Has Applied for Trump Pardon After Prison Term (CoinDesk): CZ said his lawyers had applied for a presidential pardon after media reports in March wrongly claimed he had already done so.

- Arthur Hayes Says Bitcoin Will Hit $1M by 2028 as U.S.-China Craft Hollow Trade Deal (CoinDesk): The former BitMEX CEO predicted bitcoin will hit $1 million by 2028, citing Treasury-driven liquidity and geopolitical shifts while dismissing U.S.-China trade deals as largely symbolic.

- The EU Wants to End All Russian Gas Imports. Moscow’s Friends in the Bloc Say It’s a ‘Serious Mistake’ (CNBC): The European Commission’s plan to end all energy imports from Russia by 2027 was condemned by Hungary and Slovakia.

- Bankers Are Bouncing Back to Life as Hunger for Junk Debt Soars (Bloomberg): Some U.S. investors are moving into European junk bonds to diversify amid tariff-related uncertainty, drawn by expectations of faster rate cuts and demand for companies insulated from trade risks.

In the Ether