CoinSwitch Proves Solvency Again—Reserves Balloon 10% in Latest Audit

Another quarter, another proof-of-reserves report—but this time with actual growth. CoinSwitch’s fifth transparency dump shows user funds climbed 10%, defying the ’crypto winter’ narrative (and maybe making traditional banks sweat).

Behind the numbers: While exchanges like FTX turned proof-of-reserves into a punchline, India’s crypto giant keeps stacking sats. The 10% reserve bump likely reflects new deposits rather than price appreciation—Bitcoin’s been flatlining since January.

The cynical take: Of course they’re growing. When banks pay 0.5% on savings and inflation eats 6%, even ’risky’ crypto starts looking rational. Welcome to financial decay.

Source: CoinSwitch

Source: CoinSwitch

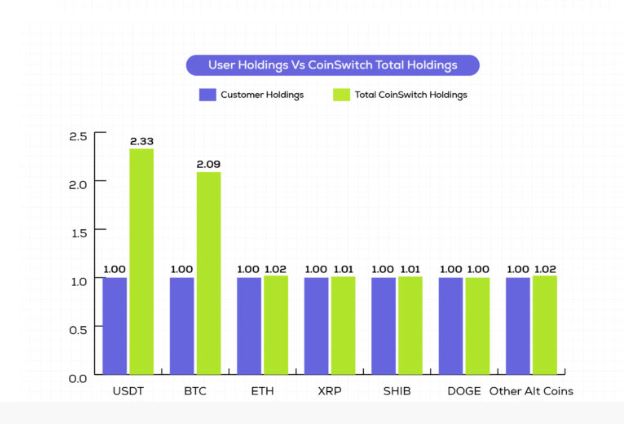

The extra holdings come from CoinSwitch’s own assets, which are separate from user funds.

The report also reveals a growth of about 10% in customer holdings compared to the previous report, mostly due to market conditions and rising prices.

The report also shows a roughly 10% increase in customer holdings compared to the last edition, driven by favorable market conditions and rising crypto prices. For example, Bitcoin (BTC), which was priced at ₹57 lakh on October 22, 2024, has risen to ₹80 lakh, reflecting a solid price uptick.

In terms of crypto specifically:

- Customer Crypto Holdings: ₹2,043.15 crore

- CoinSwitch Crypto Holdings: ₹2,576.54 crore

Why This Matters

In an industry where trust is everything, CoinSwitch is continuing to push for transparency. To allow users to verify the findings themselves, the platform has made an updated list of its major crypto wallet addresses available, with the latest information as of May 6, 2025.

On top of that, CoinSwitch makes sure over 95% of its crypto is held in its own custodial wallets and on CoinSwitchX, the platform’s exchange. The remaining less than 5% is kept on partner exchanges, just to help with the trading experience for users.

With this fifth edition of its Proof of Reserves, CoinSwitch is strengthening its promise of keeping users’ funds SAFE while maintaining the trust of its growing community.

Also Read: Binance Leads with 38% Market Share – Coingecko CEX Report