Bitcoin Implied Volatility Hits 2.5-Month Peak as Seasonal Momentum Accelerates

Bitcoin's options market signals growing turbulence ahead as implied volatility surges to levels not seen since late July.

The Volatility Awakening

Traders are positioning for bigger price swings as Bitcoin enters its historically strong seasonal period. The volatility gauge climbing to 2.5-month highs suggests market participants anticipate significant movement—whether up or down.

Seasonal Winds Fill Crypto Sails

Historical patterns show Bitcoin typically gains momentum during this period, creating a self-fulfilling prophecy as traders pile in expecting the trend to continue. The volatility spike indicates both excitement and nervousness about how pronounced this year's seasonal effect will be.

Options Market Heating Up

Derivatives traders are clearly betting on fireworks, with implied volatility reflecting expectations of substantial price action. This comes as institutional players increasingly use sophisticated options strategies to navigate crypto markets—because apparently traditional finance methods weren't complicated enough.

The market's pricing in bigger moves just as seasonal tailwinds arrive. Whether this volatility translates into sustained upward momentum or just gives traders more heartburn remains the billion-dollar question.

Bullish seasonality

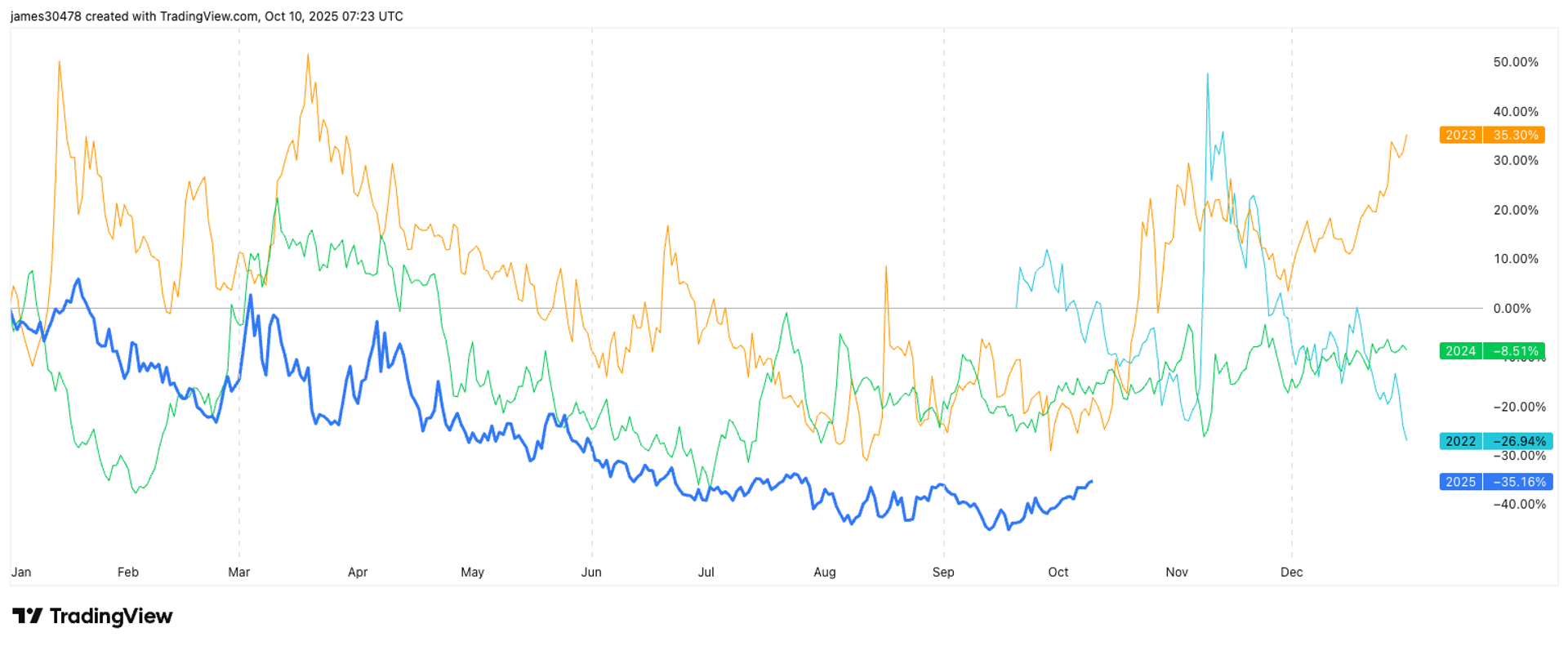

BVIV's historical data shows that the index tends to spike around this time of year. Both 2023 and 2024 saw significant volatility increases in October, highlighting a recurring seasonal pattern.

CoinDesk Research notes that 2025’s volatility setup closely mirrors 2023, when it wasn’t until the second half of October that IV began its next major leg higher, rising from an annualized 40% to over 60%.

It's the same for the spot price. Historically, the second half of October delivers stronger returns than the first.

According to data from Coinglass, bitcoin has averaged roughly 6% gains each week over the next two weeks, which are among the most bullish periods of the year. November is typically the best performing month, historically delivering more than 45% returns on average.

Expectation over the coming weeks is that IV increases from this current range.

Broader inverse relationship

Since late last year, BTC's IV has tended to rise more often than not during price pullbacks in a classic Wall Street like dynamics. The inverse relationship is evident from the persistent downtrend in IV since late last year and the broader uptrend in prices.

As bitcoin matures as an asset, the law of diminishing returns suggests price gains will gradually shrink, and volatility will also decline over time. Zooming out, the BVIV model shows a clear long-term downtrend in implied volatility since the metric was first introduced.