Bitcoin’s Wild Ride: Surging Then Plunging – What Top Analysts See Coming Next

Bitcoin just gave traders whiplash. A blistering rally met an equally sharp correction, leaving everyone asking one question: where's it headed now?

The Bull Case: Fuel in the Tank

Proponents point to the surge's velocity as a sign of underlying strength. They argue the dip is a healthy consolidation, shaking out weak hands before the next leg up. The narrative hasn't changed—institutional adoption, a hedge against monetary debasement, digital gold. One fund manager quipped, 'It's the only asset that can make you question your life choices and retirement plan in the same 15-minute candle.'

The Bear Trap: Warning Flashes

Skeptics see a classic pump-and-dump pattern, amplified by leveraged speculation. They highlight how quickly gains evaporated, suggesting a lack of real buy-side depth. The rapid fall exposes the market's continued fragility, where sentiment shifts faster than a trader can hit the sell button.

The Analyst Consensus: Volatility is the New Normal

Most agree on one thing: buckle up. Predictions range from a swift reclaim of lost ground to a deeper pullback, but nearly all forecasts are stamped with a high volatility warning. The next major move will likely hinge on macroeconomic cues and flows into spot ETFs—the same old dance, just with faster music.

So, is this a buying opportunity or the start of a larger correction? The charts are conflicted, the pundits are loud, and your portfolio is sweating. In crypto, certainty is the most overpriced asset of all.

Summarize the content using AI

ChatGPT

Grok

ContentsBitcoin VolatilityAnalyst Forecasts

Following the opening of the US markets, Bitcoin $90,357.50 experienced a dramatic surge to $90,000 before wiping out the gains within about an hour. This rapid rise and subsequent fall led to $237 million in liquidations over the past four hours, accounting for approximately 70% of the day’s total liquidations. So, what are analysts currently forecasting?

$90,357.50 experienced a dramatic surge to $90,000 before wiping out the gains within about an hour. This rapid rise and subsequent fall led to $237 million in liquidations over the past four hours, accounting for approximately 70% of the day’s total liquidations. So, what are analysts currently forecasting?

Bitcoin Volatility

Without any supportive news flow, we noted the price’s liquidity-targeted sudden increase an hour earlier. Given tomorrow’s inflation report and the interest rate decision on Friday, it was clear that this was a risky rise. Bitcoin’s return to its starting point within an hour proved that the MOVE was a trap, not a rally.

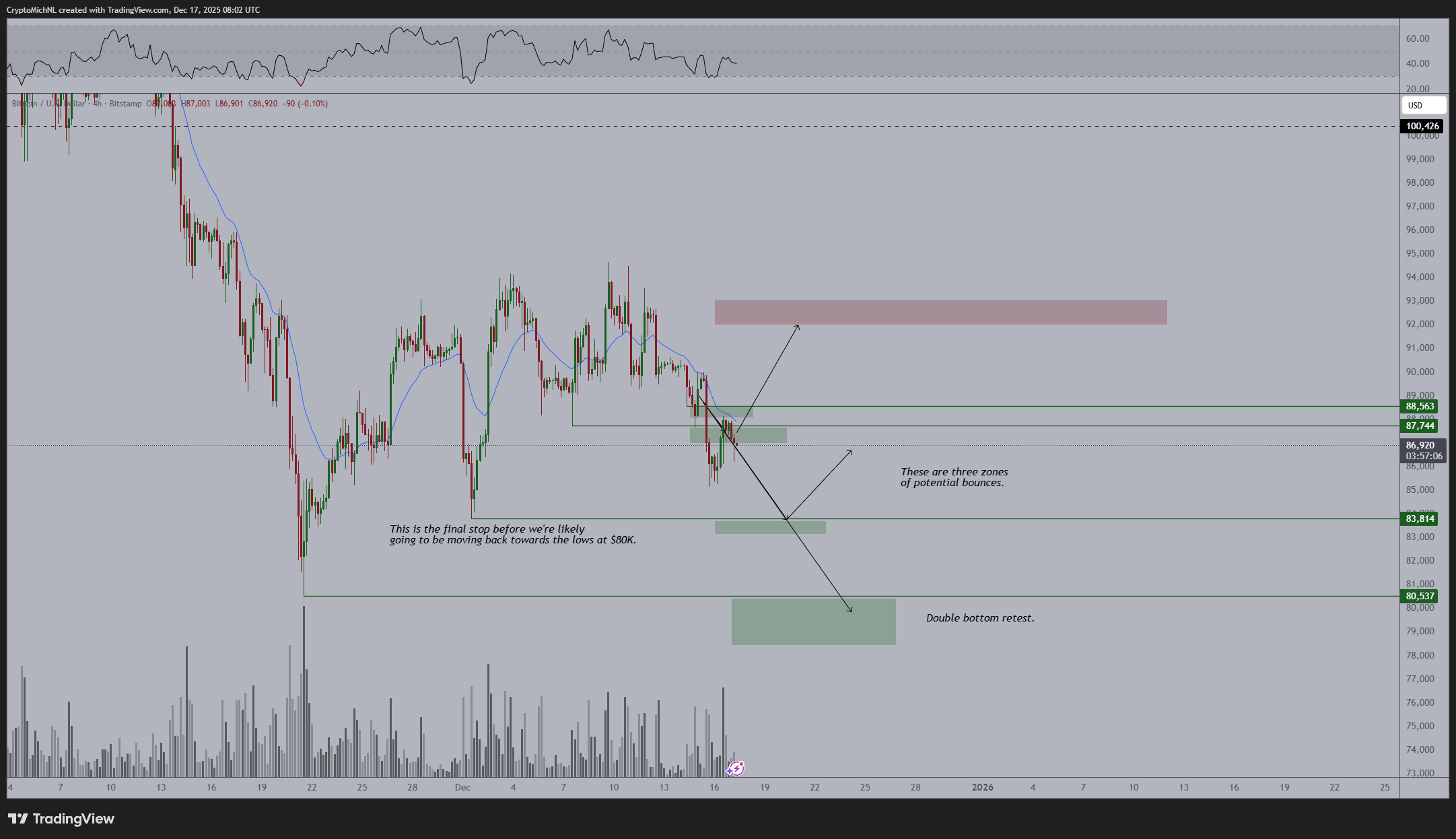

Prior to this trap, Poppe had written about Bitcoin’s downward trend, which was concerning coming from someone who constantly expects an uptrend. The analyst stated they wouldn’t be convinced of upward momentum without a clear break above $88,000 and anticipated testing the $83,000 and $80,000 levels. Echoing the risks mentioned since last week, the analyst is now embracing the bottom tests.

Analyst Forecasts

When the weekly RSI and MACD signaled a downturn, Bitcoin was above $120,000, and Roman Trading’s warnings of decline proved accurate today. However, Lark Davis warned that the opposite might now occur at this stage.

“Bitcoin’s weekly RSI recently reached the most oversold levels:

– End of the 2018-2019 bear market

– March’s COVID crash

– End of the 2022 bear market

I’m not saying the bottom is near. Definitely not.

We could always drop another 40%; you never know. In 2018, when bitcoin was this oversold, it dropped another 49%. In 2022, it fell another 58%. The formation of these bottom levels can take much longer and bring much more pain than you anticipate.”

According to The Graph shared by CryptoBullet, with continuous closures above $85,000, we might experience a new upward attempt reaching $108,000. Afterward, we could witness the true cycle bottom.

Efloud anticipated a short-term fake rise, viewing it as a selling opportunity and adjusted his stop price to the entry level. Possible short-term rebounds around $85,390 could be considered. However, given the adverse news FLOW for cryptocurrencies in the coming two days, these attempts may also end in failure.

You can follow our news on Telegram, Facebook, Twitter & Coinmarketcap Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.