Crucial Crypto Developments Ignite Market Frenzy as 2025 Winds Down

The digital asset landscape is crackling with energy. Forget the quiet holiday season—this December is shaping up to be a fireworks display of protocol upgrades, regulatory breakthroughs, and eye-popping capital flows. The momentum isn't just speculative chatter; it's built on tangible, network-level evolution.

The Infrastructure Leap

Major Layer 1 networks are executing surgical upgrades. Transaction finality times are getting slashed, sometimes by orders of magnitude, while fee markets are being overhauled to bypass congestion. This isn't about promises on a roadmap; it's about code hitting mainnets and changing the user experience overnight. Developers are shipping at a breakneck pace, treating 'impossible' scaling hurdles like yesterday's news.

Institutional On-Ramps Widen

Watch the traditional finance gates. Regulatory clarity in key jurisdictions—think definitive rulings, not just guidance—is paving direct highways for institutional capital. We're seeing approved, regulated products that don't just dip a toe but plunge into digital asset exposure. It's a quiet revolution in portfolio management, moving billions with the sterile efficiency of a spreadsheet (and all the soul of one, too).

The DeFi Reboot

Decentralized finance isn't just back; it's retooled. Next-gen lending protocols are going live with risk models that would make a legacy bank's software weep. Automated strategies are capturing yield across chains without asking permission. The narrative has shifted from 'wild west' to 'mission-critical financial plumbing,' attracting a different caliber of builder and capital.

This convergence of tech maturity and financial acceptance is creating a potent mix. The market isn't just excited; it's recalibrating its entire valuation model based on utility and cash flow, not memes. The closer? While Wall Street debates basis points, crypto's building the next basis of finance—one immutable block at a time.

Summarize the content using AI

ChatGPT

Grok

After a tough start to the week, cryptocurrencies are rebounding as Bitcoin $90,610 touches $94,000 again. Despite this optimistic surge, Bitcoin is yet to close above $94,000 in the short term, making it difficult to assert a definitive upward trend. Today, we explore the 8 major developments from the last 24 hours and examine 3 significant charts influencing the crypto market.

$90,610 touches $94,000 again. Despite this optimistic surge, Bitcoin is yet to close above $94,000 in the short term, making it difficult to assert a definitive upward trend. Today, we explore the 8 major developments from the last 24 hours and examine 3 significant charts influencing the crypto market.

Major Crypto Developments

Recently, PNC Bank announced permission for eligible customers to trade bitcoin via Coinbase. The day was eventful in the news sphere; despite disappointing JOLTS data, Bitcoin rose, leading many investors to worry this might be a false breakout. Their concerns are justified, considering the market’s similar behavior repeatedly over the past two months.

To summarize the 8 major developments:

- Trump approved the sale of Nvidia’s H200 chips to China, with similar concessions expected for AMD and Intel. In exchange, the US will claim 25% of the revenue. Meanwhile, China plans to impose an embargo to encourage domestic production, as Blackwell remains excluded from the deal.

- BlackRock filed for a Staked ETH ETF. This is their second ETH ETF following ETHA, offering investors yield from staking in addition to potential ETH price appreciation.

- Circle received the ADGM Money Services Provider license.

- Executives from Bank of America, Wells Fargo, and Citi are meeting US senators on Thursday to discuss crypto regulation.

- Standard Chartered expects the Fed to cut interest rates by 25 basis points on Wednesday, echoing BofA’s similar predictions. However, future rate cut expectations are downgraded for 2026.

- US gas prices fell to $2.95, the lowest in four years, with Trump praising the benefit on inflation and creating room for rate cuts in a recent Politico interview.

- The SEC announced a Financial Oversight and Privacy roundtable on December 15, featuring participants like Zcash, StarkWare, Aleo, and ACLU. Regulation respecting privacy needs could significantly boost privacy altcoins.

- Hyperliquid Strategies Inc. announced a $30 million buyback program.

Significant Cryptocurrency Charts

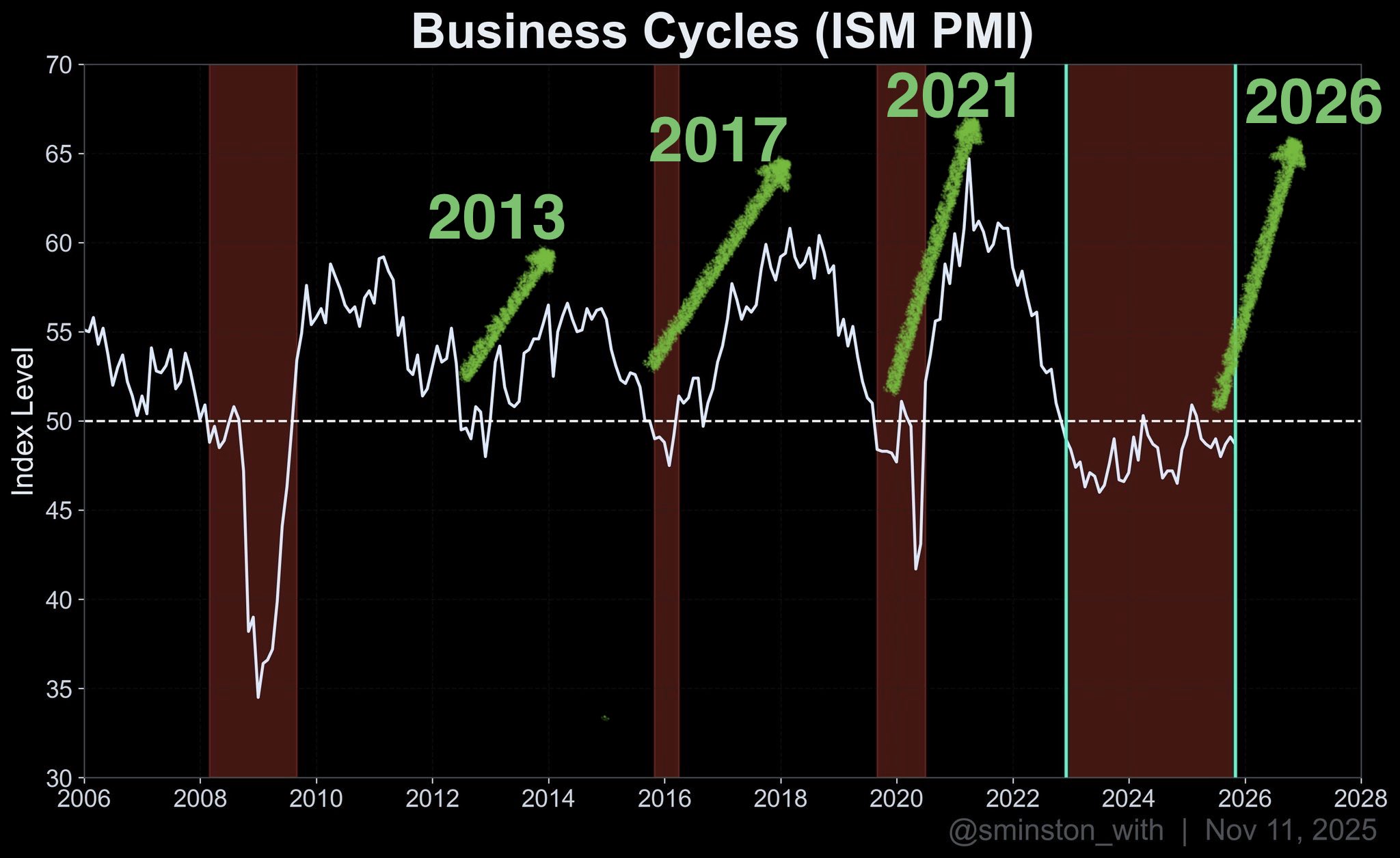

Some claim the four-year cycle narrative is obsolete. However, Quinten argues otherwise, emphasizing its continued alignment with business and liquidity cycles. Supported by a chart, he suggests we’re not nearing the peak. A crypto bear market amidst rate cuts seems unlikely, with even CZ discussing a super cycle by 2026.

Poppe shared a chart indicating increased risk appetite as Bitcoin closes above $92,000. If $92,000 holds as support on Fed’s decision evening, his scenario points towards $100,000.

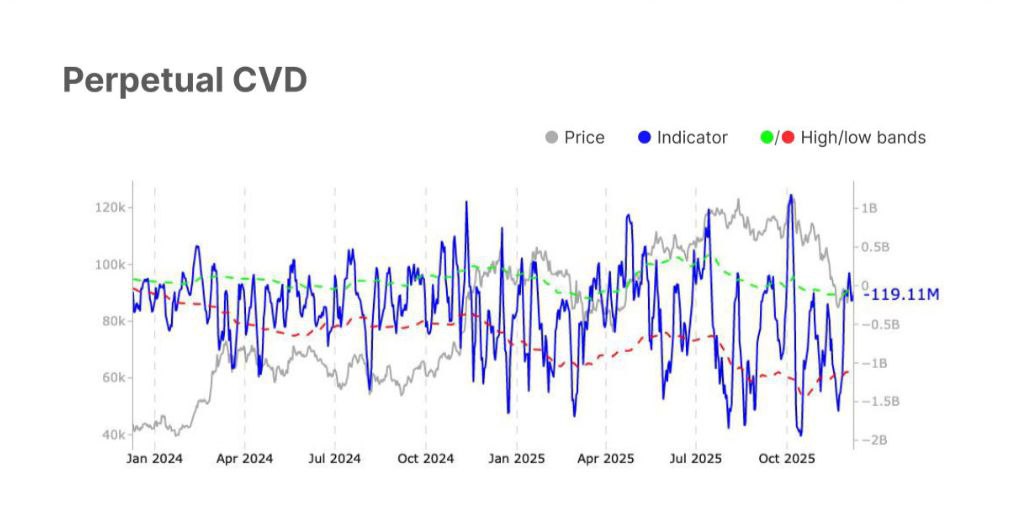

Kyle focuses on the Perpetual CVD change, indicating buyers’ resurgence. If sustained, this could signify an ongoing uptrend.

“-After dropping to -$139.3 million, it rebounded to +$119.1 million, indicating reduced selling pressure and buyers re-engaging. This suggests more of a balanced futures environment than a trend reversal. Constructive…but not yet a breakout signal.”

You can follow our news on Telegram, Facebook, Twitter & Coinmarketcap Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.