Bitcoin Defies European Sell-Off: The Rally That’s Rewriting the Rules

Bitcoin just staged a classic 'climb the wall of worry' move—soaring while traditional European markets hit the sell button. It's the kind of divergence that makes portfolio managers reach for the antacids.

The Decoupling Is Real

Forget correlation. While European equities and bonds faced a classic risk-off wave, Bitcoin charted its own course north. The digital asset didn't just ignore the macro gloom—it treated it as a springboard. This isn't a hedge; it's a declaration of independence from legacy finance's mood swings.

Liquidity Finds a New Home

Capital is smart. When one door closes—or in this case, when traditional markets look shaky—it kicks down another. The flow into Bitcoin wasn't a trickle; it was a deliberate pivot. Money isn't just sitting on the sidelines anymore—it's actively seeking the asymmetric upside only crypto volatility can offer. Who needs stable dividends when you can have rocket fuel?

The Institutional Whisper

Don't call it retail FOMO. The rally's backbone feels different—more structural, less frenzied. It's the quiet accumulation of players who've finally built the infrastructure to play, turning volatility from a bug into a feature. They're not trading the news; they're building a position for the next cycle.

A Cynical Footnote from Finance

Meanwhile, in a boardroom somewhere, a CFO is probably still explaining how their 'strategic pivot' and 'optimized balance sheet' led to a 2% annual return—before fees. Bitcoin just did that before lunch.

The message is clear: the old playbook is fraying. When fear hits the traditional system, digital assets aren't just surviving—they're learning to thrive. This rally isn't an anomaly; it's a preview.

Summarize the content using AI

ChatGPT

Grok

The cryptocurrency markets are showing signs of recovery after a steep correction in November, with Bitcoin (BTC) $90,755 trading around the $90,400 level. However, a significant selling pressure emanating from Europe continues to influence market direction. Recent data indicates that Europe’s impact was a major contributor to the November market downturn.

$90,755 trading around the $90,400 level. However, a significant selling pressure emanating from Europe continues to influence market direction. Recent data indicates that Europe’s impact was a major contributor to the November market downturn.

European Pressure Shakes the Market

According to CoinGecko data, BTC fell by 1% over the past 24 hours, while Ethereum $3,139 experienced a limited decline of 0.2%. Altcoins displayed a mixed performance: BNB dropped nearly 1.5%, SOL decreased by 2%, and XRP also witnessed a minor pullback. Weak liquidity suggests that the market is waiting for the Fed’s decision, which will be announced on Wednesday.

$3,139 experienced a limited decline of 0.2%. Altcoins displayed a mixed performance: BNB dropped nearly 1.5%, SOL decreased by 2%, and XRP also witnessed a minor pullback. Weak liquidity suggests that the market is waiting for the Fed’s decision, which will be announced on Wednesday.

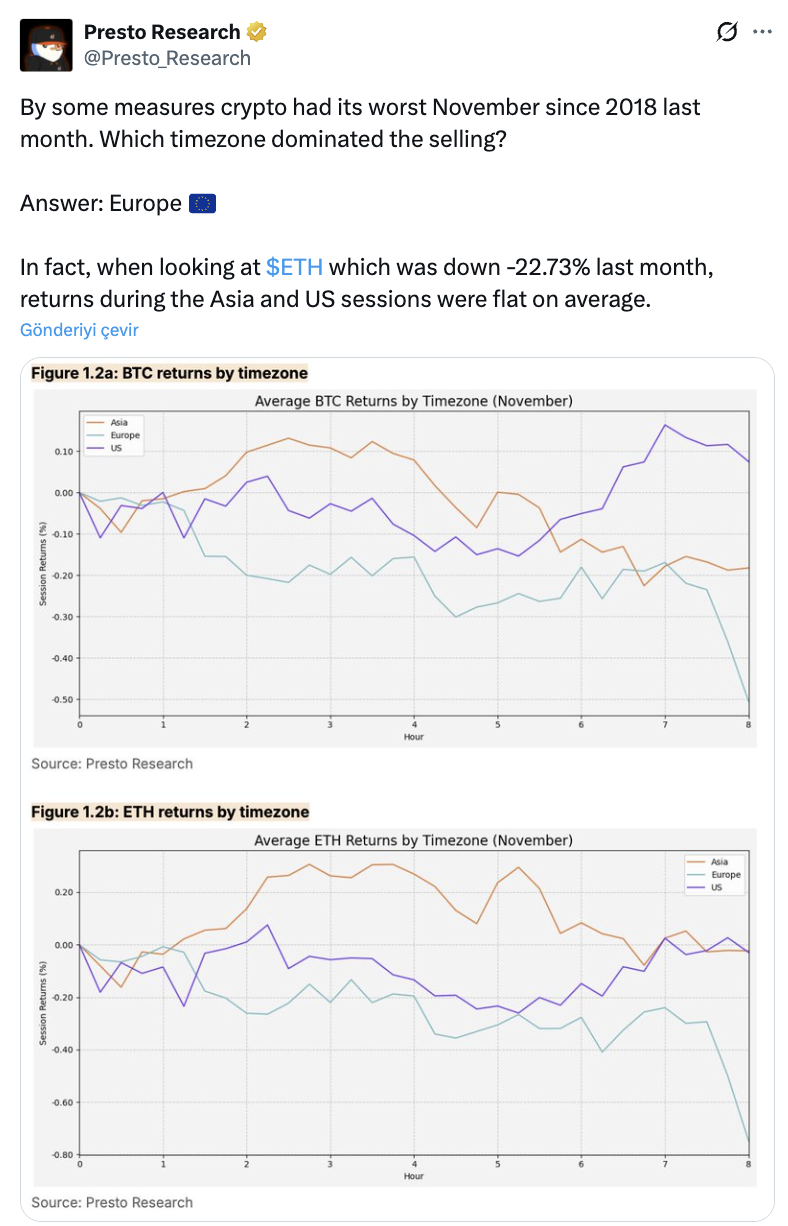

A dataset released by Presto Research shows that the 20–25% losses in BTC and ETH in November were largely driven by European trading sessions. During these sessions, average returns turned significantly negative, while Asian and US sessions remained mostly flat. This highlights how regional investor behaviors have diverged sharply during crypto’s deleveraging process.

The November sell-off also triggered repositioning movements in crypto-linked stocks. One leading company announced its largest Bitcoin purchase in three months on Monday, acquiring 10,624 BTC with an investment of $963 million. This purchase elevated the company’s total holdings to approximately 660,600 BTC, valued at about $60 billion at current prices.

Although the company’s shares are trading around $180, investors are concerned about its nearly 50% value decline over the past six months.

Anticipation Builds Over Fed Decisions and Global Bonds

The macroeconomic landscape remains the most significant directional influencer in the crypto market. Asian stocks have slightly fallen while awaiting the Fed’s messages regarding rate cuts and an easing process extending into 2026. Despite the previous day’s decline, global bond yields remain high, continuing to exert pressure on risky assets.

Market sentiment remains fragile. CryptoQuant’s Bull Score index fell to zero for the first time since January 2022, signaling dominance by bearish indicators across BTC’s on-chain data. However, some medium-term developments offer hope, such as anticipated changes in the U.S. 401(k) retirement plan regulations at the beginning of 2026, which may allow access to bitcoin for trillions in savings.

Simultaneously, a significant development came from South Korea last week: the country’s financial regulation agency completed a draft law introducing new compliance requirements for crypto exchanges. This step is expected to increase transparency and attract institutional interest in the Asian region. Experts believe that clearer regional regulations could bring stability to the global crypto markets over the medium term.

Currently, Bitcoin is trading at about $90,300, with investors closely monitoring whether it can MOVE toward the $94,000–$98,000 range or if European trading hours will continue to amplify selling pressure during year-end position adjustments.

You can follow our news on Telegram, Facebook, Twitter & Coinmarketcap Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.