Dogecoin (DOGE) Roars Back: Daily Active Addresses Explode as Price Finds Its Floor

Dogecoin just bounced hard off a critical support level—and the on-chain data shows retail isn't just watching. Daily active addresses spiked, signaling a wave of renewed interest as the meme token's price action turns bullish.

The On-Chain Surge

Forget the quiet periods. The network just saw a sharp, undeniable spike in daily active addresses. That metric cuts through the noise, pointing directly to real user engagement and transaction volume flooding back in. It's the kind of fundamental shift that often precedes—or accompanies—a significant price move.

Support Holds, Narrative Flips

The price found its footing at a well-defined support zone and rebounded. This isn't random volatility; it's a classic technical playbook. Holding support transforms sentiment, turning fear of a drop into fuel for a rally. The bounce bypasses skeptical headlines, driven instead by pure market mechanics and, apparently, a growing crowd of active users.

What The Metrics Don't Show (But Traders Feel)

Spiking addresses suggest accumulation or preparation for movement. It's capital flowing in, not out. While traditional analysts might scoff at a 'meme coin' fundamentals, on-chain activity doesn't lie. This is the market voting with its wallet—a far more reliable signal than another talking head's price prediction on financial television, that sacred temple of hindsight analysis.

Dogecoin's latest move blends a technical rebound with a tangible on-chain resurgence. The support held. The users returned. The only thing left to do is see if the momentum lasts.

TLDR

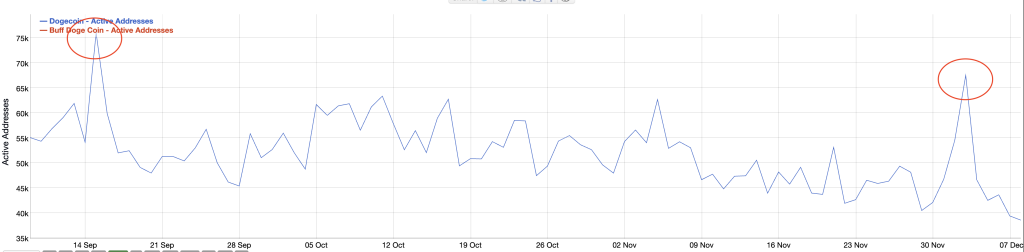

- Dogecoin’s daily active addresses hit 67,511 on December 3, the second highest level in three months

- DOGE is currently trading at $0.14, bouncing from a key support level it has tested three times

- Trading volumes have more than doubled in the past 24 hours as buying pressure increases

- The token needs to break above $0.16 to confirm a trend reversal and exit its bearish structure

- The Federal Reserve will meet Wednesday to decide on interest rates, which could impact crypto markets

Dogecoin is showing signs of increased network activity as on-chain data reveals a jump in wallet usage. The meme coin is currently holding above a key price level that has served as support multiple times in recent weeks.

Data from BitInfoCharts shows that daily active addresses on the Dogecoin blockchain reached 67,511 on December 3. This marks the second highest reading in three months.

The highest number of active addresses during this period occurred on September 15. At that time, Doge reached a local top of $0.30 before declining to current levels.

The spike in active addresses suggests increased wallet activity for both buying and selling. This typically happens when a price level attracts interest from both bulls and bears.

DOGE has gained 3.5% in the past 24 hours and is currently trading at $0.14. This price point has proven to be an important support level for the token.

The $0.14 level has already served as a bounce point three times. Each time the price has dropped to this area, buyers have stepped in to push it higher.

Trading volumes have increased by more than double in recent hours. This surge in volume confirms that buying pressure is growing at the current price level.

Key Price Levels for DOGE

The critical level for dogecoin now sits at $0.16. A move above this price would break the token’s current bearish structure and signal a potential trend reversal.

$Doge/monthly#Dogecoin![]() pic.twitter.com/nmRFvVfPo2

pic.twitter.com/nmRFvVfPo2

— Trader Tardigrade (@TATrader_Alan) December 8, 2025

If DOGE breaks above $0.16, the first target WOULD be the 200-day exponential moving average. This technical indicator typically represents a high-volume trading zone.

A break above the 200-day EMA would suggest a positive mid-term outlook for Dogecoin. In this scenario, the token could potentially climb back toward its September 2025 levels.

On the downside, DOGE faces immediate support NEAR the $0.140 level and a bullish trend line at $0.1405. The price is currently trading above the 100-hourly simple moving average.

If the token fails to climb above $0.1450, it could face continued downward pressure. Initial support sits at $0.140, with the next major support level at $0.1380.

Federal Reserve Decision Looms

The Federal Reserve is scheduled to meet Wednesday to make a decision on interest rates. A rate cut could provide support for cryptocurrency prices across the market.

The main support level sits at $0.1350. A break below this level could push DOGE down to $0.1265 or even $0.1250 in the near term.

If DOGE manages to recover and break resistance levels, the next targets would be $0.1490, followed by $0.1530. A close above $0.1530 might push the price toward $0.1620.

The spike in daily active addresses to three-month highs comes as DOGE holds the $0.14 support level with increased trading volume.