Crypto Markets React to Unique Internal Issues: A 2025 Perspective

Crypto's latest tremor didn't come from a regulator or a hack—it sprouted from within. Forget interest rates and ETF flows for a moment. The digital asset space is now grappling with a new breed of volatility, one born from its own complex, evolving architecture.

The Anatomy of an Internal Shock

These aren't your grandfather's market corrections. We're seeing cascading effects from protocol upgrades gone awry, governance token votes that backfire spectacularly, and liquidity pool mechanics that behave in utterly unpredictable ways under stress. The code is law, until the law of unintended consequences takes over. It's a stark reminder that for all the talk of decentralization, these systems are incredibly sensitive to their own internal logic—and flaws.

A Stress Test for the 'Future of Finance'

This internal friction acts as a brutal stress test. Projects that navigate these unique issues emerge stronger, with more robust code and clearer governance. Others crumble under the weight of their own complexity. It separates the resilient from the fragile. Frankly, it's a more honest gauge of long-term viability than any marketing whitepaper or influencer endorsement. After all, nothing cuts through the hype like a system seizing up because of a rounding error in its own smart contract.

Building Through the Noise

For the seasoned practitioner, this phase isn't a red flag—it's a sign of maturation. Early markets worried about existential threats. Today's markets are sophisticated enough to have sophisticated problems. The focus is shifting from mere survival to optimization and resilience. The solutions being built now, in response to these internal fires, will define the next generation of infrastructure. They're building the shock absorbers for the decentralized economy.

So, while traditional finance wrestles with spreadsheets and committee meetings, crypto is out here conducting real-time, high-stakes experiments in economic design. The volatility isn't just noise; it's the sound of the system debugging itself in public. Just try explaining that to your average fund manager still trying to figure out what a 'wallet' is.

Summarize the content using AI

![]()

ChatGPT

![]()

Grok

As discussions unfold around a $12 billion agricultural aid package, the crypto markets experience notable fluctuations. Bitcoin![]() $91,885 is flirting with the $90,000 mark, while altcoins appear to be declining again. Despite no significant macroeconomic downdrafts today, the market has reversed its previous upward momentum. Could it be that macroeconomic trends are less influential on cryptocurrencies than anticipated?

$91,885 is flirting with the $90,000 mark, while altcoins appear to be declining again. Despite no significant macroeconomic downdrafts today, the market has reversed its previous upward momentum. Could it be that macroeconomic trends are less influential on cryptocurrencies than anticipated?

Understanding the Decline in Cryptocurrencies

Bloomberg’s economic research team has conducted an extensive analysis, with Andre Dragosch highlighting a critical observation. According to the company’s internal model, Bitcoin and other cryptocurrencies are primarily declining due to inherent factors unique to this sector. As a result, numerous developments throughout 2025 have not produced the expected outcomes in the crypto space.

While significant negative macroeconomic developments undeniably affect cryptocurrencies negatively, Andre argues that short-term investor behaviors are the main drivers of the overall performance. Indeed, the report confirms this notion, indicating that sales by long-term holders (LTH) are the primary reason for the dip in cryptocurrencies.

The current report categorizes developments from January 2025 to December 2025 in four key colors. Gray represents crypto-specific developments like regulations, exchange news, hack cases, and adoption rates. Blue reflects investor appetite and “fear of missing out” (FOMO). Purple follows reactions during periods of uncertainty. Yellow encompasses macro developments like Fed interest rate decisions and global liquidity. Bitcoin’s weak performance stems more from its internal challenges than global economics or the dollar’s condition.

Current State of the Cryptocurrency Market

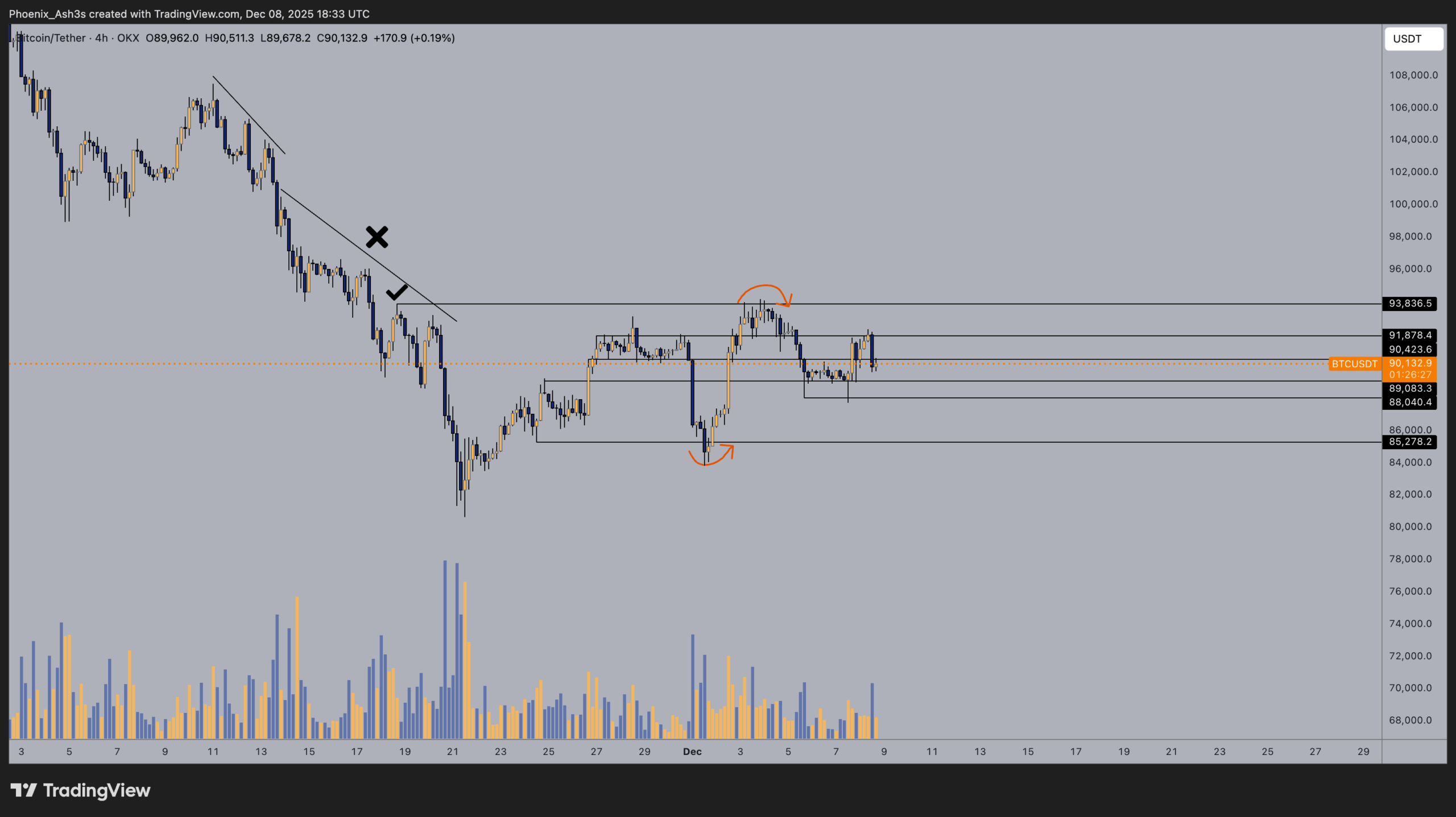

Phoenix identifies two critical levels, indicating that action should only be expected if one of them breaks permanently: $92,000 above and $88,000 below. Should we witness convincing weekly closures above or below these points, Bitcoin’s direction will become apparent.

Today, the macro backdrop appeared supportive. The sale of Semafor H200 chips to China is expected to be approved, potentially propelling advancements in artificial intelligence. As the AI competition intensifies, if cryptocurrencies, which often behave like tech stocks, respond similarly, they may witness an upward trend.

DaanCrypto shared recent evaluations for ETH stating:

“ETH is showing a bullish trend in the lower time frame, rising above the $3,000 level.

Next, the daily 200MA/EMA hovers around $3,400-3,500. To achieve this, the bullish trend in the lower timeframe must persist.”

You can follow our news on Telegram, Facebook, Twitter & Coinmarketcap Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.