Global Banks Are Finally Talking Crypto Regulations—Here’s What’s Actually Happening

Forget the whispers in back rooms—the world's biggest banks are now openly debating how to handle crypto. The conversation has shifted from 'if' to 'how,' and the implications are massive for every trader, builder, and skeptic watching from the sidelines.

The Regulatory Chessboard

Watch the moves, not the speeches. Major financial hubs are scrambling to draft frameworks that don't stifle innovation but still keep the bad actors out. It's a tightrope walk between fostering the next wave of finance and preventing the next meltdown—traditional regulators are learning that crypto moves at light speed, not quarterly report speed.

Why This Matters Now

Clarity breeds confidence. When global banks and their overseers start defining the rules, institutional money follows. We're talking about pension funds, asset managers, and corporate treasuries finally getting the green light to play. This isn't about a short-term pump; it's about laying the plumbing for the next decade of digital finance.

The Bottom Line

The old guard is building the box that the new world will eventually break out of. Today's regulations will shape tomorrow's winners and losers, all while the suits try to tax and track what was designed to be borderless. One cynical finance jab? It's the same institutions that called crypto a scam five years ago now fighting for the right to manage your digital wallet—some things never change.

Summarize the content using AI

![]()

ChatGPT

![]()

Grok

On Thursday, the leaders of the largest banks in the United States will convene to discuss the current state and future of the cryptocurrency market. With cryptocurrencies gaining global traction and continuing to expand, their adoption remains robust despite the volatile graphs. This meeting invites us to delve into both the newly announced meeting of bank CEOs and the present conditions of cryptocurrencies.

ContentsBank CEOs Meet On Cryptocurrency RegulationsCurrent State of CryptocurrenciesBank CEOs Meet On Cryptocurrency Regulations

The CEOs of three major banks will meet with Senators to discuss the regulatory framework of the cryptocurrency market. According to Punchbowl’s announcement, these top executives from the world’s largest financial companies will express their opinions on the rules to be introduced for the crypto market. The list of attendees includes:

- Citigroup CEO Fraser

- Bank of America CEO Moynihan

- Wells Fargo CEO Scharf

Executive orders that TRUMP signed regarding cryptocurrencies and the appointment of crypto-friendly individuals to key positions significantly reduced the pressure on the market. The critical aspect remains the implementation of supportive cryptocurrency laws that would have long-term effects.

Remember, a few days ago, Trump suddenly annulled all executive orders enacted by Biden’s e-signature. This might repeat if Trump loses the elections again in about three years, especially if the incoming president is a Democrat, who could annul all of Trump’s crypto-related orders at once. However, abolishing or tightening laws WOULD require Senate and House of Representatives approval, necessitating the completion of other cryptocurrency laws like GENIUS.

Current State of Cryptocurrencies

The news of the U.S. allowing the export of Nvidia’s H200 chips to China temporarily pushed BTC back over $90,000, yet it consistently dips below this critical threshold. Each day BTC fails to overcome the $94,000 resistance intensifies investors’ fears of hitting a deeper low.

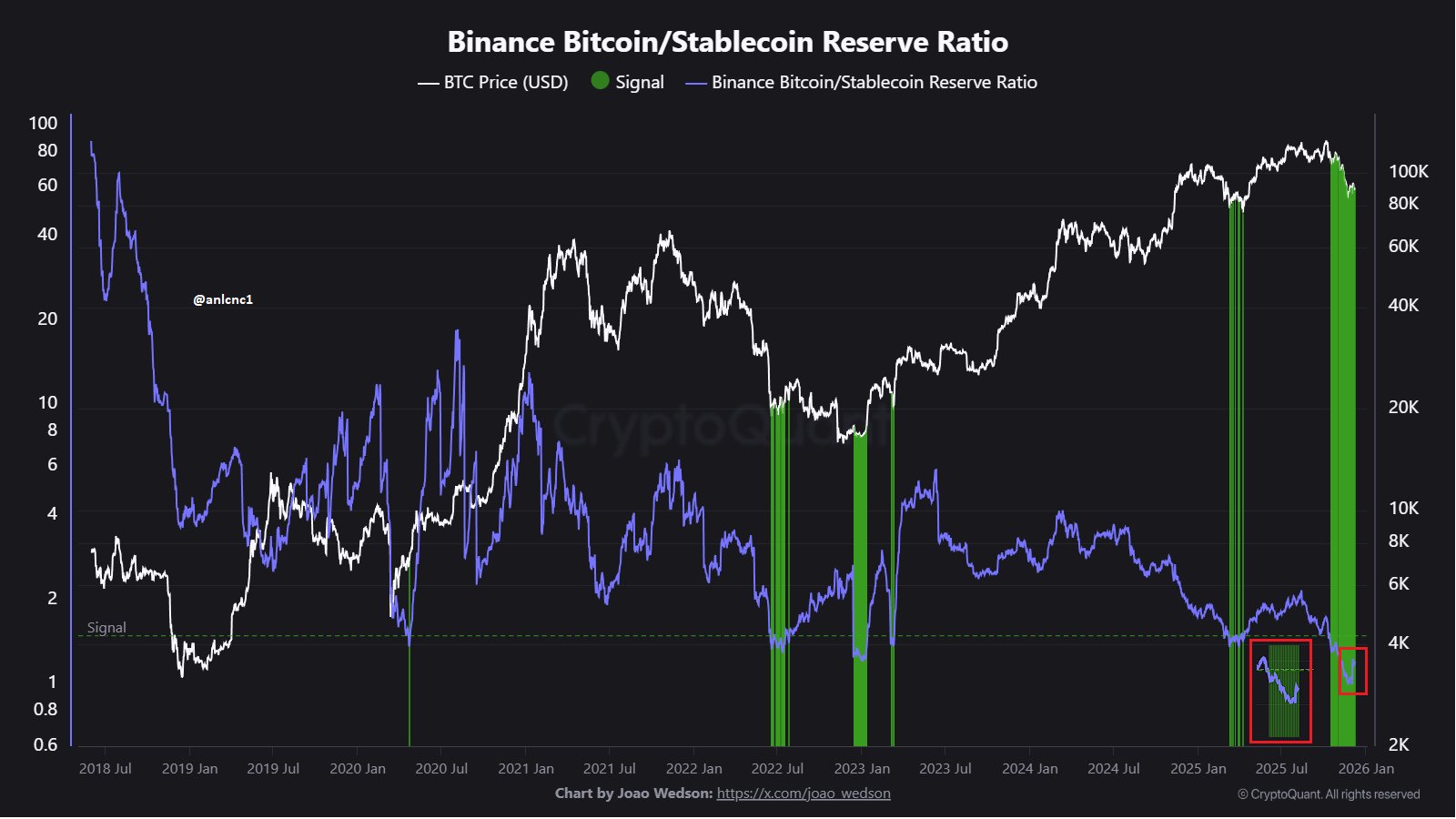

Turkish on-chain analyst anlcnc1 points to the Binance BTC/Stablecoin Reserve Ratio chart, signaling the potential formation of a bottom. However, it’s still early to be certain.

The Binance BTC/Stablecoin Reserve Ratio began to curve upwards after forming a bottom in the $86-$88K range. Transitioning from Bitcoin![]() $91,885 > Stablecoin to Stablecoin > Bitcoin around December 1, this may indicate a dip formation. Continuity is crucial, like in all data, and we need time and patience for these metrics as they show direct trends. If the Reserve Ratio keeps rising despite price retreats, showing Bitcoin > Stablecoin transitions, we may be witnessing classic dip-buying behavior. Currently, the upward diversion hints at a positive start. We must continue monitoring further developments.

$91,885 > Stablecoin to Stablecoin > Bitcoin around December 1, this may indicate a dip formation. Continuity is crucial, like in all data, and we need time and patience for these metrics as they show direct trends. If the Reserve Ratio keeps rising despite price retreats, showing Bitcoin > Stablecoin transitions, we may be witnessing classic dip-buying behavior. Currently, the upward diversion hints at a positive start. We must continue monitoring further developments.