Bitcoin’s $90,000 Plunge: The Critical Insights and Backlash Every Investor Must See

Bitcoin just sliced through a key psychological barrier. The market's reaction? A mix of cold analysis and heated criticism.

The Anatomy of a Dip

When the world's premier cryptocurrency tumbles below a major round-number threshold, it's never just about the price. It triggers a cascade of margin calls, liquidates over-leveraged positions, and sends shockwaves through the altcoin ecosystem. This isn't a blip—it's a stress test for the entire digital asset class.

Why the Critics Are Louder Than Ever

Skeptics have seized the moment. They're pointing to the volatility as proof of an immature asset, a speculative casino unfit for serious capital. One cynical finance veteran quipped that Bitcoin's chart looks less like a store of value and more like a EKG reading during a panic attack.

Looking Beyond the Headline Number

The real story isn't the dip itself, but the underlying network health, hash rate resilience, and institutional accumulation that often occurs during these fear-driven sell-offs. Smart money watches the fundamentals, not just the ticker.

So, is this a buying opportunity or the start of a deeper correction? The market never offers a clear answer—it only presents the next volatile, unforgiving, and utterly fascinating data point.

Summarize the content using AI

![]()

ChatGPT

![]()

Grok

Bitcoin![]() $91,885 has once again turned downward after U.S. market opening, sliding below $90,000. Although the recovery observed in the last 24 hours is significant for cryptocurrencies, every attempt to move upwards ends in failure, which is a concerning trend. While this is unfolding, crypto detective ZachXBT is focusing on a different issue.

$91,885 has once again turned downward after U.S. market opening, sliding below $90,000. Although the recovery observed in the last 24 hours is significant for cryptocurrencies, every attempt to move upwards ends in failure, which is a concerning trend. While this is unfolding, crypto detective ZachXBT is focusing on a different issue.

ZachXBT Targets Specific Projects

Zach, one of the renowned figures in the crypto world, addressed a general problem involving five crypto initiatives. He criticized InfoFi projects like Kaito Yaps, Galxe, Layer3, Cookie, and Wallchain, accusing them of encouraging AI bots to fill platforms with low-quality interactions, effectively turning the ecosystem into a dumping ground.

To combat this issue, ZachXBT advocates for enforcing content account restrictions based on individual countries. This approach aims to mitigate the spread of spam and irrelevant content proliferated by AI bots. His commentary also humorously notes the frequent presence of nonsensical replies under posts, reflecting the impact of these projects on the digital landscape.

AI Content and Cryptocurrencies

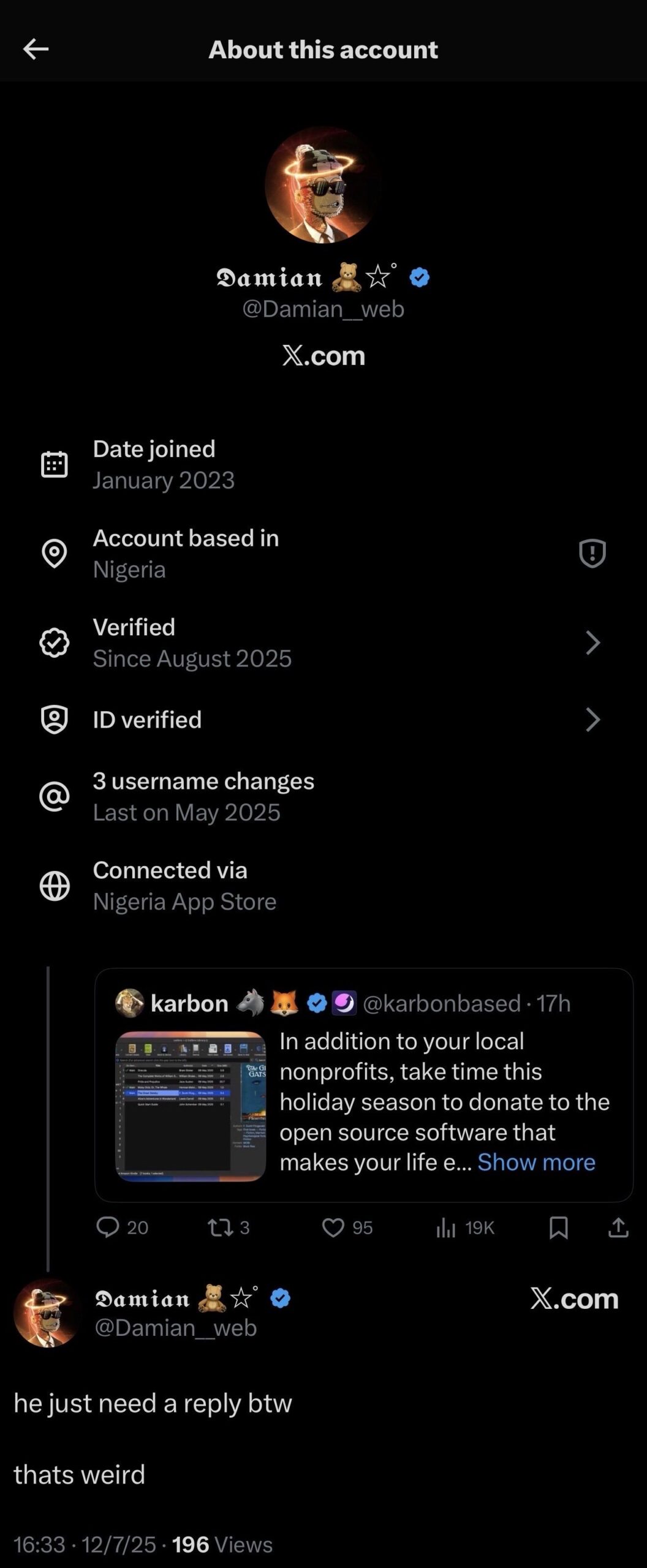

ZachXBT argues even donation threads for open-source projects have been inundated with AI-generated junk content, deeming it unproductive and lacking benefit. He provides an example of an account and post, illustrating the problem with AI bot networks exacerbating the situation.

AI certainly simplifies many tasks, making adjustments beneficial in several areas. However, in fields like journalism and authentic commentary, AI falls short compared to human capability. With a decent grasp of your native language (reading minimally one or two books a year), spotting the artificiality in AI-produced content is relatively straightforward. AI-generated material often lacks the organic quality of human-authored work.

In social media, especially in the past year, AI bots have been visibly ‘spitting content’ under various posts. This trend is mirrored in newsletters and numerous websites. The AI technology of today revels in presenting users with error-laden information confidently, embellished beyond recognition, often resulting in consumer discomfort. ZachXBT is APT in highlighting the ‘AI junkyard’ issue, underscoring the necessity for developing solutions to address it.

You can follow our news on Telegram, Facebook, Twitter & Coinmarketcap Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.