Ethereum’s Bullish Horizon: Why ETH Could Hit $30,000 by 2040 (2025-2040 Price Forecast)

- What's Driving Ethereum's Current Price Action?

- How Significant is the Institutional Demand for Ethereum?

- What Are the Key Technical Levels to Watch?

- How is Ethereum's Ecosystem Evolving?

- What Are the Risks to Ethereum's Growth?

- Ethereum Price Predictions: 2025-2040 Outlook

- Ethereum Price Prediction FAQs

Ethereum is showing all the signs of a cryptocurrency preparing for its next major bull run. With institutional giants like BlackRock accumulating billions in ETH, technical indicators flashing green, and ecosystem developments pointing to long-term utility growth, analysts are increasingly bullish about Ethereum's price trajectory. This deep dive examines the key factors driving ETH's potential growth through 2040, combining technical analysis, institutional demand signals, and ecosystem developments to paint a comprehensive picture of Ethereum's future.

What's Driving Ethereum's Current Price Action?

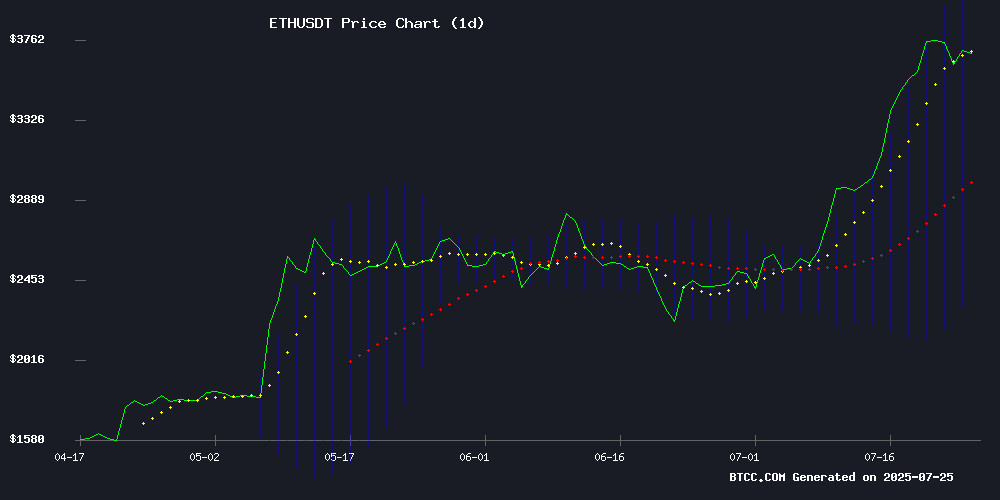

As of July 2025, ETH is trading at $3,640.77, comfortably above its 20-day moving average of $3,235.07 - a classic bullish signal. The MACD, while still negative at -61.19, shows narrowing bearish divergence suggesting weakening downward pressure. "ETH appears poised for a breakout if it can sustain above $3,600 support," notes the BTCC research team.

The price action becomes even more interesting when we look at the Bollinger Bands. ETH is hovering NEAR the upper band at $4,077.49, which typically indicates strong momentum. However, the real story isn't just in the charts - it's in the unprecedented institutional demand that's creating what Bitwise's Matt Hougan calls a "demand shock" scenario.

How Significant is the Institutional Demand for Ethereum?

BlackRock's recent moves tell the story - the asset manager purchased 1,035,653 ETH ($3.76 billion) in just the first three weeks of July 2025, bringing their total holdings to 2.8 million ETH worth $10.22 billion. This isn't isolated behavior either - spot ethereum ETFs have seen $4.4 billion in inflows during the same period, already surpassing 2024's total accumulation.

BitMine Immersion Technologies has emerged as the largest corporate ETH holder with a staggering $2.1 billion treasury position. They've increased their holdings by 700% in just 16 days and plan to raise another $2.5 billion to stake even more, aiming to control 5% of ETH's total supply.

"This mirrors the accumulation patterns we saw before the 2021 bull run," observed analyst Ali Martinez, pointing to similar behavior during previous cycle bottoms. The numbers support this - accumulator wallets have absorbed over 1.13 million ETH ($4.18 billion) in two weeks, the largest sustained inflow on record.

What Are the Key Technical Levels to Watch?

Ethereum currently faces its biggest test at the psychological $4,000 barrier, which aligns with December 2021's $4,100 all-time high. The daily charts show robust structure with ETH holding above ascending 100/200-day moving averages since their golden cross at $2,500.

While the 78 RSI suggests overbought conditions, the absence of distribution signals underscores persistent demand. Market depth data reveals minimal sell walls until $4,200, suggesting room for continuation if Bitcoin's rally persists.

However, not all signals are bullish. The 4-hour chart shows a descending triangle formation below $3,800 resistance, creating some short-term uncertainty. The validator exodus also raises questions - with 688,356 ETH (worth $2.6 billion) awaiting withdrawal as of July 25, creating operational hurdles for institutional participants due to unpredictable unstaking mechanics.

How is Ethereum's Ecosystem Evolving?

The NFT market has staged a dramatic recovery in July 2025, with total capitalization soaring 94% to $6.6 billion - the first significant rebound after three quarterly declines. Weekly trading volumes jumped 51% to $136 million, the highest since Q1 2025.

CryptoPunks reclaimed dominance with a 53% floor price increase and a single specimen selling for $5 million. Moonbirds saw a 600% volume comeback, while Art Blocks recorded 156% higher average prices after platform upgrades.

On the infrastructure side, ContributionDAO launched an institutional-grade staking platform using SSV Network's Distributed Validator Technology (DVT). The solution, compliant with SOC 2 Type 2 and ISO 27001:2022, addresses enterprise needs for security and fault tolerance.

What Are the Risks to Ethereum's Growth?

Ethereum's recent surge above $3,700 triggered over $160 million in short liquidations on Binance, following a similar $195 million squeeze near $3,500. These violent moves highlight the high-leverage environment where rallies fueled by forced buybacks often lack organic demand.

Whale activity shows contradictions - 7-day netflows up 171.75% but 90-day netflows down 2512.17%. This suggests institutions may be trading volatility rather than committing to sustained upside. Without robust spot buying or supportive macro conditions, ETH's advance risks reversal - a pattern seen repeatedly in crypto's leverage-heavy ecosystems.

The validator exodus also introduces uncertainty. While network security remains robust with over 2 million active validators, the outflow mirrors whale-scale selling pressure, with freed ETH likely earmarked for treasury deployments or OTC deals.

Ethereum Price Predictions: 2025-2040 Outlook

| Year | Price Range (USD) | Key Catalysts |

|---|---|---|

| 2025 | $3,200-$4,800 | ETF approvals, Shanghai upgrade |

| 2030 | $8,000-$12,000 | Enterprise adoption, scaling solutions |

| 2035 | $15,000-$25,000 | Web3 infrastructure dominance |

| 2040 | $30,000+ | Tokenized economy maturity |

Ethereum Price Prediction FAQs

What is Ethereum's price prediction for 2025?

Based on current technicals and institutional flows, ETH is projected to trade between $3,200-$4,800 in 2025. Key factors include ETF approvals, the Shanghai upgrade, and institutional adoption trends.

Could Ethereum really reach $30,000 by 2040?

While ambitious, the $30,000 target by 2040 assumes continued ecosystem growth, Web3 dominance, and maturation of the tokenized economy. Current institutional accumulation patterns suggest this trajectory is plausible if adoption continues at its current pace.

Is now a good time to buy Ethereum?

With ETH testing key resistance at $4,000 after a 49% surge from February lows, short-term volatility is likely. However, long-term indicators like institutional accumulation and ecosystem growth remain strongly bullish.

What are the biggest risks to Ethereum's price growth?

Key risks include validator exodus creating selling pressure, high leverage in derivatives markets leading to violent corrections, and potential regulatory challenges as institutional adoption increases.

How does BlackRock's ETH accumulation affect price?

BlackRock's $10.22 billion position creates significant demand shock. Their continued accumulation could drive prices higher as available supply decreases, especially when combined with ETF inflows.