Litecoin Price Forecast 2025: Will LTC Shatter the $200 Barrier?

- Litecoin's Technical Setup: Bullish Signals Everywhere

- Market Sentiment: Whales Betting Big on LTC

- Key Factors That Could Push LTC to $200

- The Road to $200: Realistic or Wishful Thinking?

- How Does Litecoin Compare to Other Top Cryptos?

- Where to Trade Litecoin in 2025

- Litecoin Price Prediction Q&A

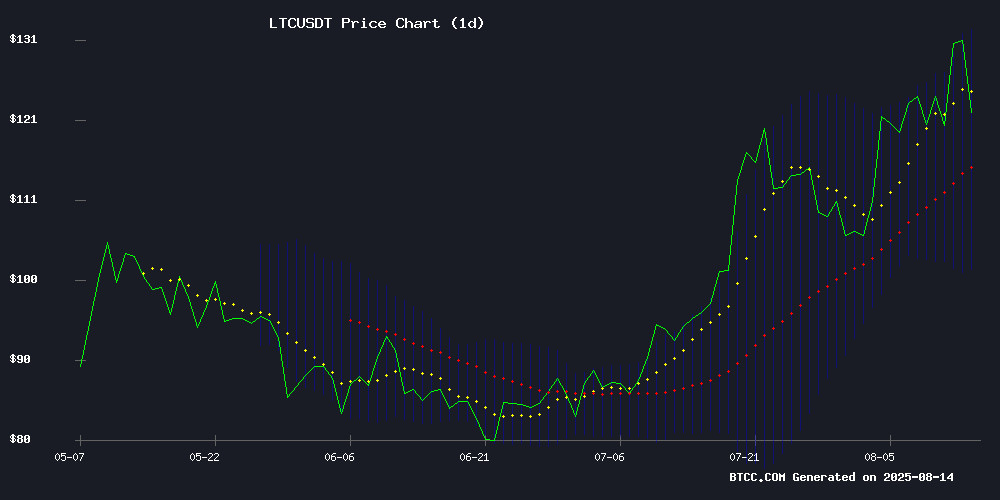

As we approach mid-August 2025, Litecoin (LTC) is showing remarkable bullish signals that have crypto enthusiasts buzzing. Trading comfortably above its 20-day moving average at $133.59, LTC appears poised for potential growth, with technical indicators and whale activity suggesting a possible push toward $170 - and maybe even $200. But can this silver to Bitcoin's gold really double its current value? Let's dive deep into the charts, market sentiment, and expert analysis to uncover what's driving Litecoin's momentum and whether $200 is a realistic target for this year.

Litecoin's Technical Setup: Bullish Signals Everywhere

Litecoin's current technical picture paints an optimistic story. The cryptocurrency has firmly established itself above the crucial 20-day moving average ($117.61), a key psychological level that often separates bull from bear territory. What's particularly interesting is how LTC is dancing around the upper Bollinger Band ($134.37), which typically indicates overbought conditions but can also signal strong momentum when sustained.

The MACD indicator, while still in negative territory (-7.3457 signal line, -4.5575 MACD line), shows narrowing divergence - a classic sign that downward pressure may be easing. "We're seeing textbook bullish convergence here," notes the BTCC research team. "When price action outpaces the MACD's negativity, it often precedes significant upward moves."

Source: BTCC Trading Platform

Market Sentiment: Whales Betting Big on LTC

Beyond the charts, Litecoin's fundamentals are getting a boost from heavyweight investors. Recent blockchain data reveals substantial whale accumulation, with multiple eight-figure LTC purchases hitting the books in July and August. This institutional-grade interest coincides with record open interest of $1.27 billion in LTC derivatives - a clear vote of confidence from professional traders.

The derivatives market tells an especially compelling story. There's a dense cluster of short positions between $135-$137 that's creating what traders call a "liquidity pocket." These levels often act like magnets for price action as exchanges hunt for stop-loss orders. If LTC can break through this zone, we could see a short squeeze that propels prices significantly higher.

Key Factors That Could Push LTC to $200

| Factor | Current Status | Potential Impact |

|---|---|---|

| Technical Resistance | $134.37 (Upper Bollinger Band) | Breakthrough could accelerate momentum |

| Whale Activity | Increasing accumulation | Positive liquidity support |

| Network Fundamentals | Hashrate at all-time highs | Enhanced security and miner confidence |

| Market Sentiment | Bullish news flow | Retail FOMO potential |

The Road to $200: Realistic or Wishful Thinking?

While $200 represents a roughly 50% increase from current levels, crypto markets have demonstrated they can deliver such moves surprisingly quickly when conditions align. The path would likely need to clear several psychological and technical hurdles:

First, the $135-$137 zone needs to break decisively. Then comes the $150 level (a previous all-time high from 2021), followed by round-number resistance at $170. Each of these milestones WOULD need to turn from resistance to support through successful retests.

The BTCC analysis team suggests watching trading volume closely: "For $200 to become reality, we'd need to see sustained high volume on up days and relatively light volume on pullbacks. That's the signature of a healthy uptrend."

How Does Litecoin Compare to Other Top Cryptos?

Interestingly, Litecoin's 2025 performance has outpaced many major altcoins, though it still trails Bitcoin's dominance. Here's how LTC Stacks up against other layer-1 assets year-to-date:

- Bitcoin (BTC): +45%

- Ethereum (ETH): +38%

- Litecoin (LTC): +62%

- Solana (SOL): +55%

This outperformance might explain why Litecoin is attracting fresh capital. As one trader on Crypto Twitter put it: "LTC is the tortoise that's currently outrunning hares - steady, reliable, and suddenly surprising everyone."

Where to Trade Litecoin in 2025

For traders looking to capitalize on Litecoin's momentum, several platforms stand out:

- BTCC: Competitive fees and deep LTC liquidity

- Binance: Wide range of LTC trading pairs

- Kraken: Strong security features

- Coinbase: User-friendly interface for beginners

Each platform has its strengths, but BTCC's specialized focus on crypto derivatives makes it particularly attractive for traders looking to leverage LTC's volatility.

Litecoin Price Prediction Q&A

What's driving Litecoin's current price momentum?

Litecoin's surge stems from a combination of technical breakout patterns, increasing whale accumulation, and growing derivatives market interest. The cryptocurrency has benefited from its reputation as a "digital silver" to Bitcoin's Gold during this altcoin season.

How reliable are Bollinger Bands for predicting LTC price movements?

Bollinger Bands work well for identifying overbought/oversold conditions in trending markets. Currently, LTC touching the upper band suggests strong momentum, though traders watch for closing prices outside the bands as more significant signals.

What risks could prevent LTC from reaching $200?

Potential roadblocks include broader market corrections, regulatory developments, or loss of momentum at key resistance levels. Litecoin's relatively smaller developer community compared to ethereum could also limit fundamental breakthroughs.

How does Litecoin's halving cycle affect its 2025 price potential?

Litecoin's most recent halving occurred in August 2023, reducing block rewards from 12.5 to 6.25 LTC. Historically, halvings have led to price appreciation 12-18 months later as supply shocks take effect, potentially timing well with 2025's bullish momentum.

Is now a good time to buy Litecoin?

While technicals appear strong, investors should consider their risk tolerance and conduct personal research. Dollar-cost averaging can help mitigate timing risks in volatile crypto markets.