Bitcoin Price Prediction 2025: Will BTC Shatter $200K as Institutional Demand Explodes?

- BTC Technical Analysis: Bullish Signals Emerging

- Institutional Tailwinds: The Game Changer

- Holder Dynamics: The Supply Squeeze

- Macroeconomic Factors Supporting BTC

- The Path to $200,000: Plausible or Pipe Dream?

- Potential Risks to Consider

- Bitcoin Price Prediction FAQs

As Bitcoin flirts with $120,000 in August 2025, the crypto community is buzzing about whether we'll see a $200,000 BTC price before 2026. This analysis combines technical indicators, institutional developments, and macroeconomic factors to assess Bitcoin's potential trajectory. With corporate adoption accelerating, regulatory clarity improving, and long-term holders refusing to sell, the stage might be set for another historic rally.

BTC Technical Analysis: Bullish Signals Emerging

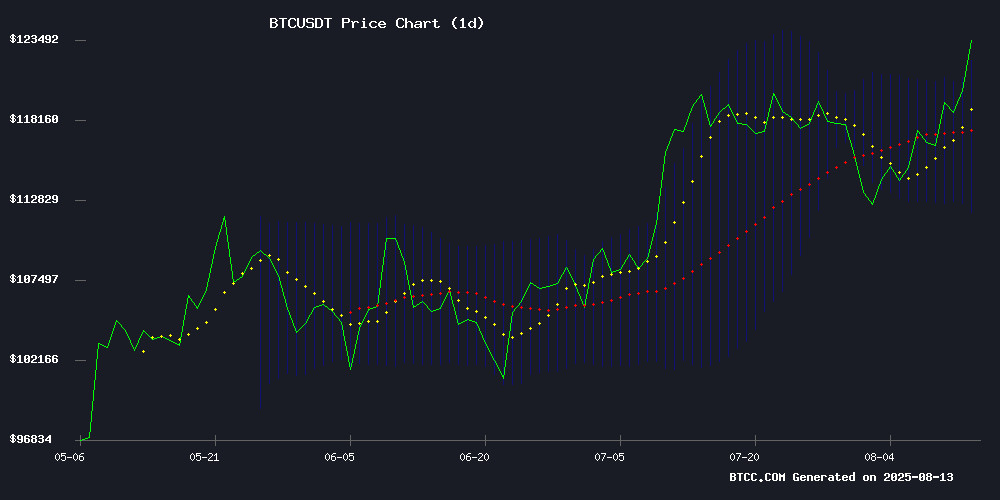

Bitcoin's current price action shows several encouraging technical indicators according to TradingView data. The cryptocurrency has maintained its position above the crucial 20-day moving average at $117,021.71, which typically serves as dynamic support during uptrends. The Bollinger Bands are showing a notable squeeze, often preceding periods of increased volatility - potentially to the upside.

Source: BTCC

The MACD histogram, while still negative at -359.31, shows decreasing bearish momentum. "We're seeing textbook consolidation before potential breakout conditions," notes a BTCC market analyst. "The upper Bollinger Band at $121,965.72 represents immediate resistance, but a decisive break above could accelerate momentum toward $130,000."

Institutional Tailwinds: The Game Changer

Several major institutional developments are creating fundamental support for Bitcoin's price:

- 401(k) Crypto Access: President Trump's executive order allowing cryptocurrency in retirement accounts could unlock trillions in potential investment.

- Global ETF Expansion: Kazakhstan's new spot Bitcoin ETF (BETF) follows similar products in the U.S. and Europe, broadening institutional access.

- Corporate Adoption: Companies like MicroStrategy continue adding BTC to their treasuries, while Japanese firm MetaPlanet recently allocated 10% of its reserves to Bitcoin.

Holder Dynamics: The Supply Squeeze

On-chain data from Glassnode reveals an interesting trend - long-term holders (LTHs) are showing remarkable discipline despite prices nearing all-time highs. Daily realized profits remain below $750 million in August, far from the $2 billion peaks seen earlier in 2025.

"When diamond hands hold, supply shocks follow," observes a crypto analyst. "The lack of aggressive profit-taking suggests strong conviction among long-term investors, which could amplify any upward price movement."

Macroeconomic Factors Supporting BTC

The broader financial landscape appears increasingly Bitcoin-friendly:

| Factor | Current Status | Impact on BTC |

|---|---|---|

| Inflation | July 2025 CPI at 2.8% | 94.4% probability of September Fed rate cut |

| Trade Policy | Record $29.6B tariff revenue | Historically drives capital to alternative assets |

| Institutional Flows | Accelerating | Increasing demand against limited supply |

The Path to $200,000: Plausible or Pipe Dream?

While $200,000 represents a 64% gain from current levels around $121,930, several factors suggest this target might be within reach:

- Technical Indicators: Price/20MA ratio of 1.05x could signal early uptrend if sustained above 1.1x

- Institutional Adoption: Growing corporate and retirement account allocations

- Supply Dynamics: Reduced selling pressure from long-term holders

- Macro Conditions: Potential Fed rate cuts and trade uncertainty

"The $156K-$168K year-end prediction implies 28-38% upside from current levels," explains a BTCC analyst. "If LAYER 2 adoption accelerates and macro conditions remain favorable, testing $200K becomes increasingly plausible within 12-18 months."

Potential Risks to Consider

While the outlook appears bullish, several risks could derail Bitcoin's ascent:

- Regulatory crackdowns in major markets

- Black swan macroeconomic events

- Technological vulnerabilities or security breaches

- Unexpected large-scale liquidations from institutional holders

This article does not constitute investment advice. Always conduct your own research before making investment decisions.

Bitcoin Price Prediction FAQs

What are the key technical levels to watch for Bitcoin?

The immediate resistance sits at $121,965 (upper Bollinger Band), with support at $117,021 (20-day MA). A break above resistance could target $130,000, while losing support might test $114,000.

How significant is President Trump's 401(k) crypto order?

This policy change potentially opens $43.4 trillion in retirement assets to cryptocurrency exposure, though actual allocations will likely start small and grow gradually.

Why aren't long-term Bitcoin holders selling at near-ATH prices?

Many LTHs have experienced multiple cycles and may be waiting for higher prices or have conviction in Bitcoin's long-term value proposition as institutional adoption grows.

What makes $200,000 a plausible target for Bitcoin?

The combination of technical indicators, institutional demand, supply constraints, and favorable macro conditions creates a scenario where $200K could be achieved, though not guaranteed.

How does MicroStrategy's performance relate to Bitcoin's price?

MicroStrategy's stock often trades at a premium to its bitcoin holdings due to structural advantages like leverage and institutional access, serving as a bellwether for institutional Bitcoin interest.