ADA Price Prediction 2025: $1.50 Target in Sight as Technical Breakout Meets ETF Hype

- Why Is ADA Surging in August 2025?

- Breaking Down ADA's Technical Breakout

- The ETF Factor: Grayscale's Game-Changing Move

- Price Targets: Where Could ADA Go From Here?

- Is Now the Time to Invest in ADA?

- ADA Price Prediction Q&A

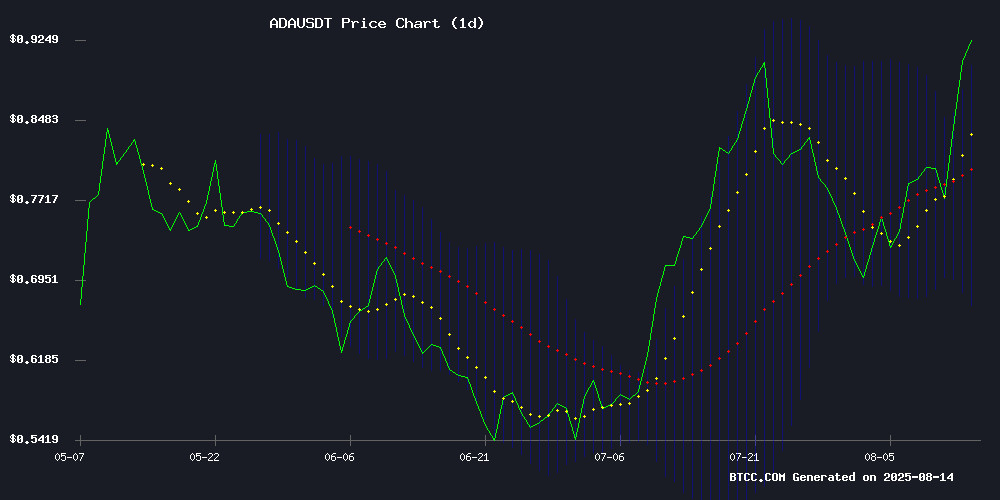

Cardano's ADA is making waves in the crypto market with a perfect storm of bullish technicals and growing ETF speculation. As of August 2025, the cryptocurrency has surged 20% in a week, breaking key resistance levels and sparking predictions of a rally toward $1.50. This analysis dives deep into the technical indicators, institutional developments, and market sentiment driving ADA's momentum.

Why Is ADA Surging in August 2025?

The current ADA rally isn't happening in isolation - it's the result of multiple converging factors. First, the technical picture turned decisively bullish when ADA broke above a descending trendline that had constrained its price movement since late 2024. Second, Grayscale's surprise filing for a Cardano ETF in Delaware has institutional investors taking notice. Third, the broader crypto market recovery has created favorable conditions for altcoins like ADA to shine.

Source: BTCC Trading Platform

Source: BTCC Trading Platform

Breaking Down ADA's Technical Breakout

Let's examine the technical indicators that have traders buzzing:

| Indicator | Value | Significance |

|---|---|---|

| Current Price | $0.9009 | 14.8% above 20-day MA |

| MACD Histogram | 0.001687 | Bullish momentum building |

| Bollinger Bands | Testing upper band ($0.8941) | Potential breakout signal |

What's particularly interesting is how ADA's current price action mirrors previous cycles, just at a slower pace. This suggests we might be in the early stages of a more significant rally. The cryptocurrency has already cleared multiple resistance levels between $0.85-$0.95, peaking at $0.9880 before some healthy consolidation.

The ETF Factor: Grayscale's Game-Changing Move

Grayscale's registration of the Grayscale cardano Trust in Delaware has sent shockwaves through the market. While this doesn't guarantee approval, it's a crucial first step that:

- Establishes the legal framework for a potential ADA ETF

- Signals growing institutional interest in Cardano

- Positions ADA as a potential candidate for mainstream investment products

The market reaction was immediate - ADA jumped 15% to $0.987 following the news, its highest level in five months. Futures traders on Hyperliquid are now more bullish on ADA than on XRP, Solana, ETH, and BTC according to TapTools data.

Price Targets: Where Could ADA Go From Here?

Analysts are eyeing several key levels based on technical patterns and Fibonacci retracements:

- Near-term: $1.00 (psychological resistance)

- Mid-term: $1.13 and $1.31 (Fibonacci extensions)

- Long-term: $1.50-$1.54 (2024 highs and measured move targets)

The 0.618 Fibonacci level at $0.92 could serve as a near-term consolidation zone before the next leg up. What's encouraging is that ADA has established strong support NEAR $0.80, with higher lows since mid-July indicating sustained buying pressure.

Is Now the Time to Invest in ADA?

The BTCC research team notes that ADA presents an interesting risk/reward proposition at current levels. On one hand, the technical breakout is validated by strong volume (2.21 billion ADA traded during the uptrend) and positive on-chain metrics (active addresses spiked to 42,309). On the other hand, ETF approvals remain uncertain and the crypto market is notoriously volatile.

For traders considering ADA, key levels to watch are:

- Upside: A daily close above $1.02 could confirm the bullish structure

- Downside: A break below $0.85 might signal weakening momentum

This article does not constitute investment advice. Always do your own research before making investment decisions.

ADA Price Prediction Q&A

What's driving ADA's price surge in August 2025?

ADA's rally combines technical breakout factors with fundamental catalysts. The cryptocurrency broke a long-term descending trendline while simultaneously benefiting from Grayscale's ETF filing and general crypto market recovery.

How likely is a Cardano ETF approval?

While Grayscale's Delaware registration is a positive step, ETF approval remains uncertain. The SEC WOULD need to be convinced about market surveillance, custody solutions, and investor protections specific to ADA.

What are the key price levels to watch?

Traders are monitoring $1.00 as psychological resistance, with potential targets at $1.13, $1.31, and $1.50-$1.54 if bullish momentum continues. Support levels to watch include $0.92 and $0.85.

How does ADA's current rally compare to past cycles?

The current price structure mirrors previous ADA bull cycles but at a slower pace, suggesting this could be the early stages of a more prolonged uptrend rather than a short-term spike.