Stablecoin Adoption Surpasses SOL: A Sign of Crypto’s Growing Maturity?

- Why Are Stablecoins Outpacing Altcoins Like SOL?

- Stablecoins: The Backbone of Web3’s Practical Economy?

- Regulation: The Double-Edged Sword

- FAQs: Stablecoins vs. SOL Adoption

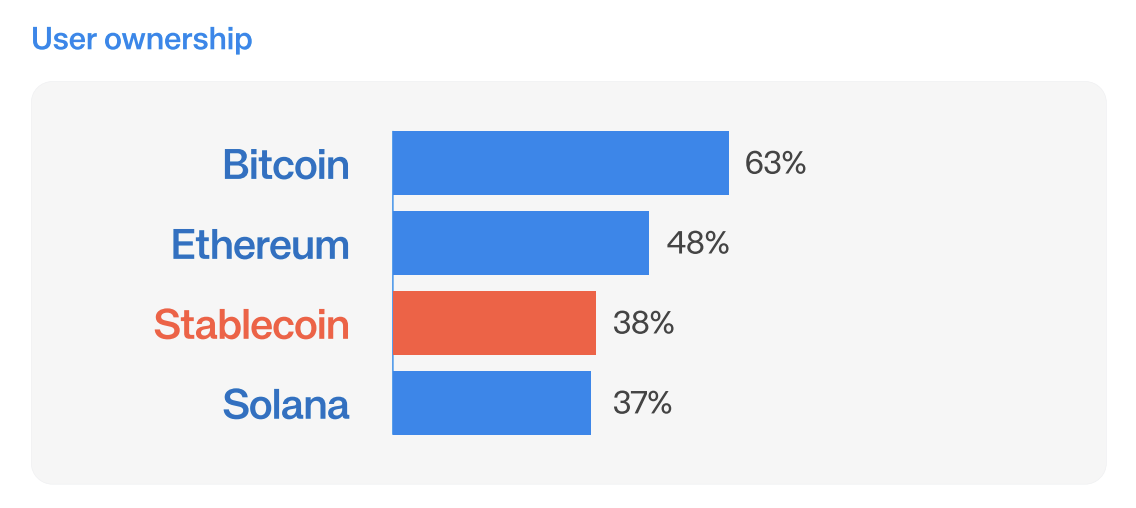

The crypto landscape is shifting as stablecoins overtake Solana (SOL) in wallet adoption, signaling a move toward practicality. With 38% of wallets holding stablecoins versus 37% for SOL, the trend reflects a broader maturation of the sector. Regulatory tailwinds, like the U.S. Genius Act, are fueling growth, though skeptics like JPMorgan caution against over-optimism. ethereum remains the stablecoin hub, but scalability issues leave room for competitors. Here’s why this shift matters.

Why Are Stablecoins Outpacing Altcoins Like SOL?

For years, crypto was synonymous with volatility and speculation. But the latest data reveals a pivot: stablecoins now dominate 38% of all crypto wallets, edging out Solana’s SOL at 37%. This isn’t just a statistical blip—it’s evidence of a maturing market. Investors are prioritizing stability over moonshot gains, using stablecoins for real-world applications like cross-border payments and DeFi. As Simon Taylor of Sardine puts it, "Stablecoins have become the dollar-based payment network for the Global South."

Stablecoins: The Backbone of Web3’s Practical Economy?

Unlike volatile altcoins, stablecoins thrive regardless of market cycles. They’re bridging gaps in e-commerce, remittances, and corporate treasury management. The Genius Act has turbocharged adoption, with banks and tech giants like chainlink heralding a "stablecoin issuance boom." But not everyone’s convinced. JPMorgan projects a $500 billion market by 2028—far below the $2 trillion some predict. Still, 49% of global institutions already use stablecoins for payments, per a 295-firm survey.

Regulation: The Double-Edged Sword

The Genius Act is a game-changer, legitimizing stablecoins in G20 economies. Yet Ethereum’s high gas fees and scalability woes persist, creating opportunities for chains like solana and BNB Chain. "Ethereum remains the leader, but its limitations are glaring," notes a BTCC analyst. Meanwhile, Tron’s USDT dominance shows how niche chains can carve out roles in this evolving ecosystem.

FAQs: Stablecoins vs. SOL Adoption

What’s driving stablecoin adoption?

Regulatory clarity (e.g., Genius Act), institutional interest, and real-world use cases like cross-border payments.

Is SOL losing relevance?

Not necessarily—Solana’s speed makes it a contender for stablecoin activity, but Ethereum still leads in volume.

Are stablecoins risk-free?

No. While less volatile, they face regulatory scrutiny and collateral risks (e.g., USDT’s reserves debate).