SEI’s Triangle Squeeze: Ecosystem Explodes While Price Lags Behind

SEI's technical pattern tightens as fundamental growth screams divergence.

While price action coils within a textbook triangle formation, the network's activity metrics tell a radically different story. User adoption rates, transaction volumes, and developer activity all scream expansion—creating one of the most glaring divergences in the crypto space right now.

The ecosystem's growth isn't just incremental; it's outpacing the token's price action by a significant margin. This isn't mere speculation—the on-chain data paints a clear picture of organic expansion versus price inertia.

Technical analysts watch the triangle's apex approach while fundamental analysts point to adoption metrics that would make most Layer 1 projects blush. The tension between these narratives creates a powder keg scenario—one that could resolve with explosive momentum.

Meanwhile, traditional finance analysts continue to dismiss the entire sector as speculative gambling—missing the actual speculation happening in their own quarterly earnings reports. Sometimes the market's efficiency is just efficiently wrong.

CryptoLord highlights SEI’s symmetrical triangle formation, a structure often signaling explosive moves after extended compression. With price consolidating NEAR $0.28–$0.29 and pressing against a descending resistance line, the market is preparing for volatility expansion.

A breakout above this key trendline could unlock bullish targets at $0.70 and $1.20, while failure to hold support risks a deeper pullback.

Adding to the technical outlook, Ryuzaki SEI notes that SEI’s fundamentals have strengthened significantly since it last reached $1.40. Total value locked has surged from $20 million to $600 million, backed by ecosystem growth through upcoming launches like Yei Finance and Folks Finance.

This widening gap between price and infrastructure strength positions Sei as one of the most closely watched tokens, with traders awaiting confirmation of the next major move.

Symmetrical Triangle Formation on SEI Chart

SEI is currently consolidating within a symmetrical triangle, with price action compressing against a long-term descending trendline. Analysts suggest this technical structure indicates a potential buildup before a decisive market move. Historical patterns show that such formations often precede increased volatility, making the present consolidation zone crucial for traders.

Price has recently fluctuated between $0.282 and $0.292, with $0.29 acting as short-term resistance. A breakout above this level could encourage further momentum, while failure to hold the $0.282 support may expose the asset to additional downside tests. The setup reflects a period of buyer and seller balance, awaiting confirmation of the next directional trend.

Ecosystem Expansion Beyond the Previous Peak

According to analyst Ryuzaki SEI, the fundamentals of the SEI network are considerably stronger compared to when the token last traded above $1.40. At that point, the protocol’s total value locked stood at $20 million. Today, SEI’s TVL has expanded to $600 million, signaling robust growth in liquidity across its ecosystem. Despite this, the token’s price remains below levels seen during earlier stages of development.

Source:x

This divergence between on-chain metrics and market value suggests that SEI’s infrastructure has expanded faster than its price. With more protocols building on the network, the token’s utility base has widened, yet market valuation continues to consolidate near lower levels. The gap between ecosystem growth and current pricing remains a focal point for traders monitoring SEI’s long-term potential.

Upcoming Protocol Launches

Ryuzaki also noted that only one token generation event has been completed through DragonSwap DEX. Additional launches are scheduled, including Yei Finance and Folks Finance, which are expected to introduce more liquidity and user activity into the network. These projects FORM part of SEI’s broader development pipeline aimed at enhancing adoption.

Each new protocol entering the ecosystem increases the opportunities for transaction volume and on-chain activity. As more decentralized applications join, the infrastructure expansion may support higher levels of sustained engagement across the network. Analysts are observing whether these upcoming integrations will contribute to closing the gap between SEI’s fundamentals and its trading price.

Current Market Performance and Trading Activity

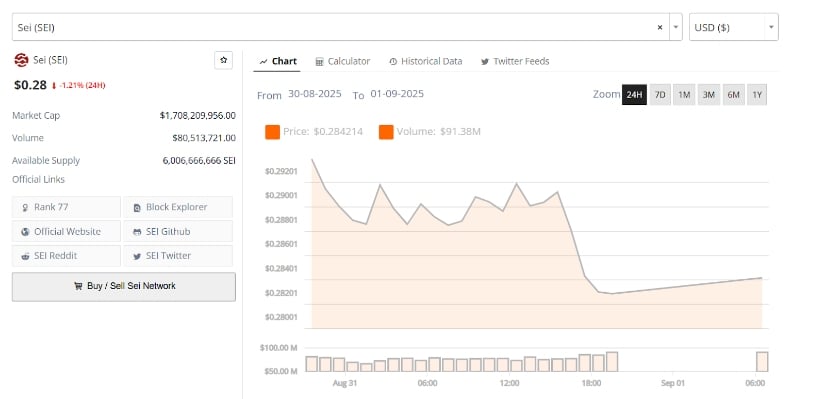

In the latest 24-hour session, SEI recorded a modest decline of 1.21%, settling near $0.28. The token experienced a local peak of $0.292 on August 30 before entering a downward MOVE through August 31. By early September 1, the price had stabilized above $0.282, suggesting short-term consolidation after the selloff.

SEIUSD 24-Hr Chart | Source: Brave NewCoin

Trading volume over the same period reached $80.5 million, with the largest spikes occurring during moments of price weakness. This pattern reflects active market participation, particularly on the sell side, though late-session stabilization indicated renewed accumulation near lower levels. SEI currently maintains a market capitalization of $1.7 billion with 6 billion tokens in circulation, securing its position among the top 100 cryptocurrencies.