Who Just Gobbled Up $1.15B in Ethereum? Mystery Whale Makes Historic Crypto Splash

A shadowy institutional player just dropped a nine-figure bet on Ethereum—while the rest of Wall Street was busy shorting memecoins.

The buyout that broke DeFi scanners

Blockchain sleuths spotted a single entity acquiring over $1.15B worth of ETH across seven days, triggering algorithmic trading bots and liquidating over-leveraged shorts. The purchases coincided with Ethereum's Layer 2 networks hitting record activity—though naturally, gas fees spiked 300% right after.

Institutional FOMO meets crypto opacity

While pension funds still debate 'blockchain exposure' in committee meetings, some hedge fund clearly decided to front-run the inevitable ETF approvals. The move echoes MicroStrategy's Bitcoin hoarding—just without the CEO's cringe tweets.

One thing's certain: when traditional finance finally 'discovers' crypto, they do it by writing checks that could fund a small nation's revolution. Too bad they still can't pronounce 'Gnosis Safe' correctly.

The massive buying helped push Ethereum’s price above $4,000 for the first time since late 2021.

The Billion-Dollar Buying Spree Continues

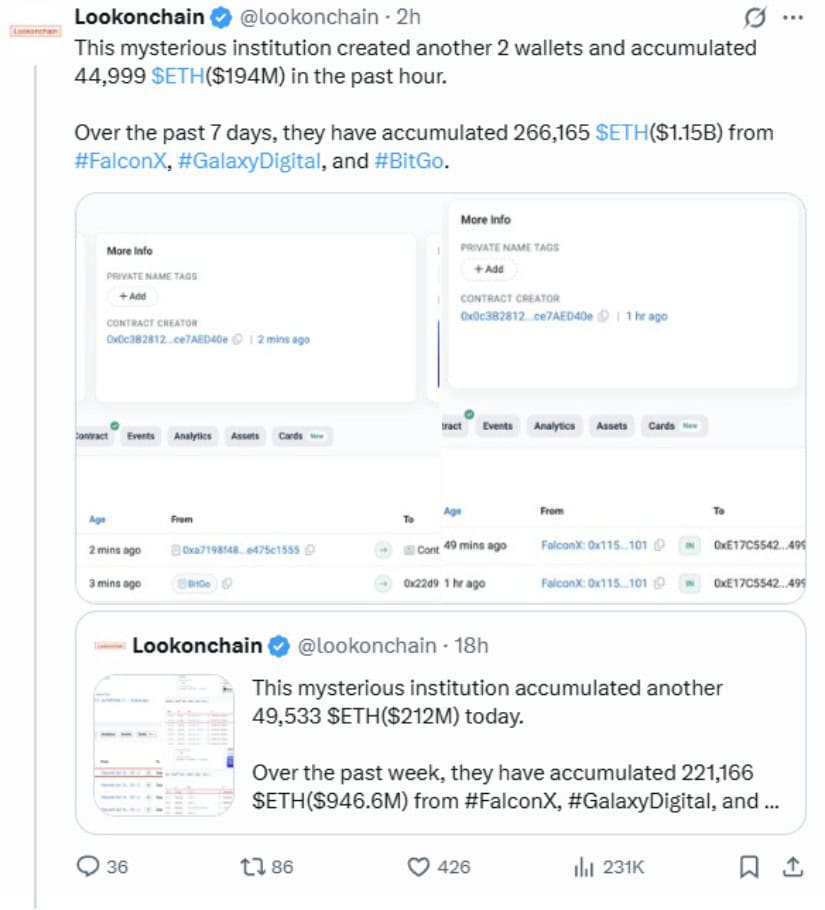

The mysterious institution has now accumulated 266,165 ETH tokens worth approximately $1.15 billion over the past seven days, according to the latest update from blockchain analytics platform Lookonchain. In just the past hour, this buyer created two additional wallets and purchased another 44,999 ETH worth $194 million.

The entity has been relentlessly buying throughout the week. Just 18 hours earlier, it had accumulated 221,166 ETH worth $946.6 million. The additional 45,000 ETH purchase shows the institution continues its aggressive accumulation strategy even as Ethereum’s price climbs higher.

The buyer now spreads its holdings across eight different wallets for security, with holdings ranging from $128 million to $181 million per wallet. What makes this buying unusual is where the ethereum comes from. Instead of buying from regular exchanges, the institution purchases from major trading desks and custodians including Galaxy Digital, FalconX, and BitGo. This suggests the buyer is likely a large financial institution or corporation rather than an individual investor.

Source: @lookonchain

Corporate Ethereum Rush Gains Steam

This mystery buyer is not alone. Companies around the world are adding Ethereum to their treasuries at record pace. In the past week alone, publicly traded companies bought more than 304,000 ETH worth over $1.3 billion.

BitMine Immersion Technologies leads this corporate buying trend. The company now holds 833,137 ETH valued at $2.9 billion, making it the world’s largest corporate Ethereum treasury. BitMine built this massive position from zero in just 35 days after launching its Ethereum strategy on June 30th.

SharpLink Gaming follows as another major corporate buyer, purchasing $303 million worth of Ethereum recently. The gaming company now holds over 521,000 ETH tokens worth nearly $2 billion.

These companies see Ethereum differently than Bitcoin. While Bitcoin serves as digital gold, Ethereum offers more utility through smart contracts, decentralized finance, and yield generation through staking.

Market Impact and Price Surge

The massive institutional buying helped drive Ethereum’s price up 21% in one week. ETH broke through the $4,100 resistance level that had blocked its progress for 18 months. The cryptocurrency now trades above $4,000, reaching levels not seen since December 2021.

This latest $194 million purchase in just one hour demonstrates the institution’s continued conviction in Ethereum even at higher prices. The rapid-fire buying suggests the entity sees significant value at current levels or expects further price appreciation.

Ethereum’s market value hit $523 billion, surpassing payment giant Mastercard’s $519 billion valuation. This milestone shows how cryptocurrency is gaining ground against traditional financial companies.

The number of large Ethereum holders is also growing. Wallets containing more than 10,000 ETH reached 868,886 on Saturday – the highest level in a year according to Glassnode data. This shows institutions and wealthy investors are accumulating the cryptocurrency.

Technical Outlook Points Higher

Analysts believe Ethereum could climb much higher from current levels. The recent breakout above $4,100 opens the door for a MOVE toward $7,000 or even higher by year-end.

Crypto analyst Nilesh Verma predicts ETH could hit $20,000 within six to eight months based on historical price patterns. Another analyst, Merlijn The Trader, suggests Ethereum might surpass even that target.

Tom Lee from Fundstrat calls Ethereum “arguably the biggest macro trade over the next 10-15 years as Wall Street adopts blockchain technology.” His firm chairs BitMine’s board and believes institutional adoption will drive long-term growth.

Exchange reserves for ETH have dropped to NEAR all-time lows of 18.89 million tokens. This tight supply, combined with growing demand, creates conditions for further price increases.

Risks and Warnings

Not everyone sees this trend as purely positive. Ethereum co-founder Vitalik Buterin supports companies buying ETH for their treasuries but warns against turning it into an “overleveraged game” that could hurt the asset.

The mystery behind the billion-dollar buyer also raises questions. While the size and sourcing suggest an institution, the entity’s identity remains unknown. This lack of transparency could concern some investors.

Cryptocurrency markets remain highly volatile. Even with strong institutional interest, Ethereum’s price could face significant swings based on market conditions, regulatory changes, or shifts in investor sentiment.

What This Means for Ethereum

Close to 30% of Ethereum’s supply is now locked in staking, with additional tokens wrapped in various protocols. Strategic reserves now hold over 3 million ETH, while exchange-traded funds control around 5.3 million ETH.

This institutional adoption, combined with technical breakouts and shrinking exchange supplies, positions Ethereum for potential significant gains. However, investors should remain cautious given the volatile nature of cryptocurrency markets and the rapid pace of these changes.

The identity of the mystery buyer may eventually become clear, but their impact on Ethereum’s price and institutional adoption is already reshaping the cryptocurrency landscape. With over $1.15 billion accumulated in just seven days and continued hourly purchases, this entity represents one of the most aggressive institutional accumulation campaigns in cryptocurrency history.