3 Made-In-USA Crypto Gems Poised for a Breakout This Week

Wall Street's sweating while these homegrown coins heat up. Forget the Fed's waffling—here's what actually moves in August.

### The Patriots' Playbook: Homegrown Crypto Disruptors

Silicon Valley engineers and Texan miners are rewriting the rules. No VC middlemen, just pure decentralized hustle—exactly what Satoshi would've wanted (before the Lambo memes ruined everything).

### 1. The Infrastructure Powerhouse

One token's quietly building the backbone for next-gen DeFi. Institutional money's circling—they finally realized Wyoming's regulatory sandbox beats getting rug-pulled in the Caymans.

### 2. The Privacy Maverick

Developed in a Colorado bunker (metaphorically... probably). This chain makes Signal look like a postcard. Even the NSA's algo traders can't crack its zero-knowledge armor.

### 3. The Energy Game-Changer

Texas wind meets blockchain. A token that actually reduces grid strain during heatwaves—take that, ESG hedge fund hypocrites.

The Bottom Line:

While traditional finance plays musical chairs with rate cuts, these three prove American innovation still sets the crypto pace. Just don't expect your CFA to understand them.

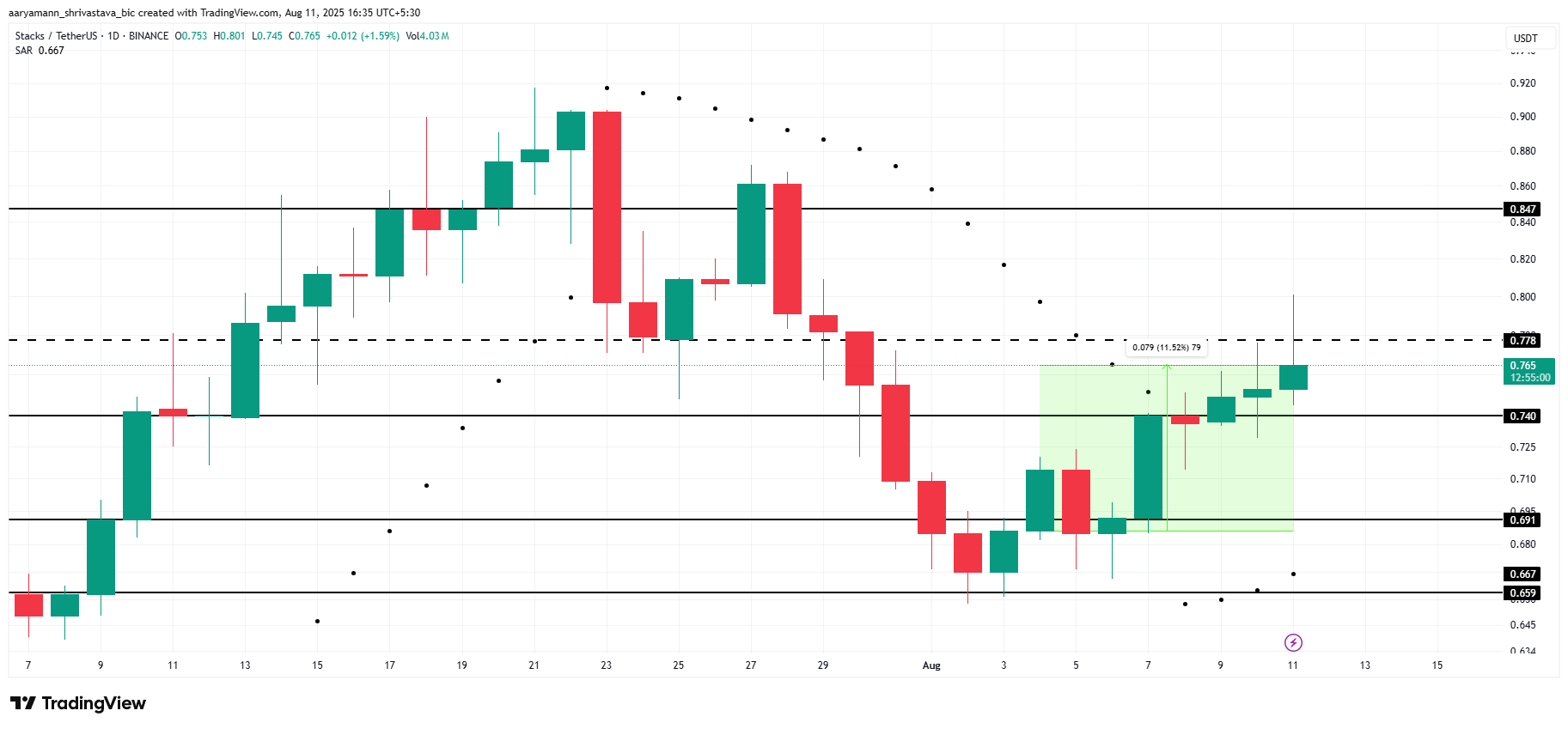

Stacks (STX)

STX price has risen 11.5% over the past week, signaling a shift from bearish to bullish. While the rally hasn’t been dramatic, the Parabolic SAR indicator is currently sitting beneath the candlesticks, showing an uptrend.

This shift indicates that the altcoin may be preparing for further upward movement.

The bullish momentum could help STX push past the $0.778 resistance level, potentially reaching the next resistance at $0.847. This WOULD mark a multi-week high and strengthen the case for further growth.

A successful breakout above this resistance could lead to increased buying pressure and continued upward movement.

However, if STX fails to breach the $0.778 resistance, it may face downward pressure. A break below the $0.740 support level could signal a reversal, with STX dropping to $0.691.

Such a MOVE would invalidate the current bullish outlook, signaling a potential decline in price.

Aerodrome Finance (AERO)

AERO price has risen 51% over the past week, currently trading at $1.17. The altcoin is facing resistance at $1.21, a level it has yet to breach.

A successful breakout above this resistance could signal continued upward momentum, but the market remains cautious at this key level.

The exponential moving averages (EMAs) formed a Golden Cross towards the end of July, signaling bullish momentum. This technical pattern could drive AERO past the $1.21 resistance, aiming for $1.35.

However, if AERO fails to break through $1.21, the altcoin could decline. Failure to breach this resistance could lead the price back down to $1.00, erasing recent gains.

Such a move would invalidate the current bullish outlook, signaling a potential reversal in price direction.

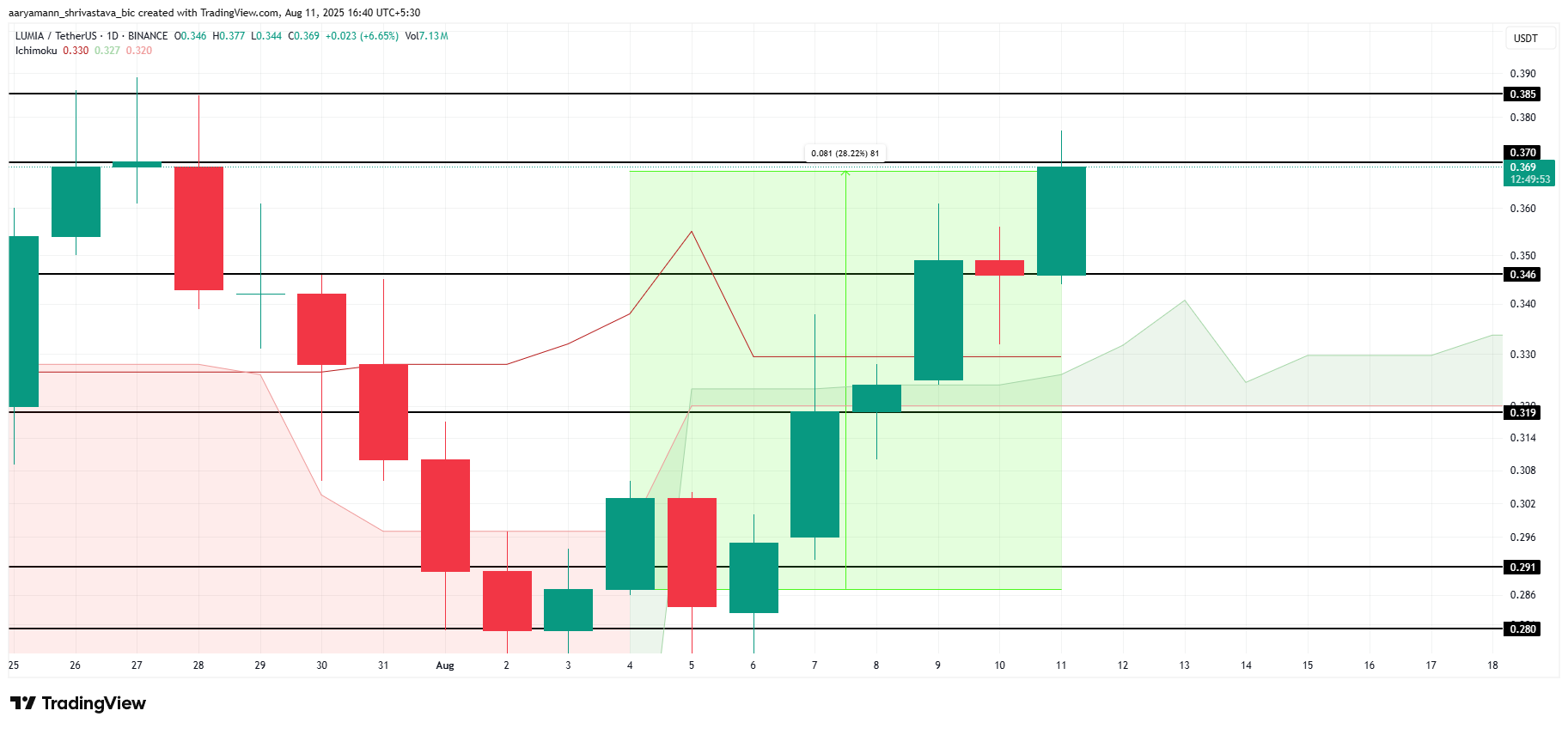

Lumia (LUMIA)

LUMIA has posted a 28% rise in the last seven days, moving from $0.288 to $0.369. The altcoin has emerged as one of the best-performing Made in USA coins, attracting investor attention.

This recent surge indicates strong market interest and potential for further growth in the short term.

Currently, LUMIA is facing resistance at the $0.370 level. The Ichimoku Cloud shows bullish momentum gaining strength, which could be pivotal for breaking through this barrier.

If LUMIA can surpass $0.370, it could target the next resistance at $0.385, continuing its upward trend and maintaining positive momentum.

However, if the US Consumer Price Index (CPI) report is disappointing, LUMIA’s price may face downward pressure. A failure to hold above $0.370 could lead to a drop to $0.346 or below, erasing recent gains. Such a shift would invalidate the bullish thesis, signaling a possible market correction.