🚀 Ethereum (ETH) Primed for 2016-Level Explosion as Wall Street Money Floods In

Institutional whales are circling Ethereum—and the charts scream 'buy.'

### The Setup: Déjà Vu for ETH Bulls

Patterns from ETH's 2016 moonshot are repeating. Dark pools lit up, Grayscale's trust premium flipped positive, and—shocker—BlackRock just filed paperwork for a 'Blockchain Infrastructure Fund.' Cue the 'digital gold 2.0' PowerPoint decks.

### The Trigger: ETF Nod or Burn Mechanism?

SEC approval of spot ETH ETFs could detonate the rally. But even without it, EIP-1559's fee burns keep supply tighter than a VC's pitch during a bear market.

### The Wildcard: Crypto’s Favorite Casino Chip

ETH remains the go-to collateral for degenerate DeFi plays. Just don’t ask institutions about that part during their ESG presentations.

### Bottom Line

When pension funds start chasing the same asset as Crypto Twitter shitposters, buckle up. History says this ends in either Lambos or tears—no in-between.

Major investors are positioning ahead of potential upside, reflecting long-term confidence in Ethereum’s fundamentals. With historical patterns aligning and demand accelerating, the stage may be set for Ethereum’s next major bull cycle.

Market Overview: ETH Holds Support Amid Short-Term Correction

After pulling back from a recent high near $4,000, ethereum has found solid footing around $3,590. Market analysts say this decline may be short-lived. Crypto analyst Ted noted that Ethereum continues to outperform Bitcoin, explaining that “buyers are aggressively stepping in at key support zones. Dips are being quickly bought up, signaling strong underlying demand.” This steady accumulation has reinforced the $3,369 level as a pivotal support area.

ETH bounced at $3,400 support, aiming to hold and push higher—deeper dips remain buying opportunities. Source: @TedPillows via X

Chart indicators such as Supertrend confirm this bullish setup, and if ETH holds above this level, analysts believe the next leg higher toward $4,100 is likely. This price point is seen as the last major resistance before Ethereum enters uncharted territory.

Technical Analysis: 2016 Pattern Reemerges

Veteran trader Merlijn has drawn attention to Ethereum’s chart structure, stating that its current setup is closely mirroring the 2016–2017 rally. He pointed out that Ethereum’s consolidation range between $2,000 and $4,000 is strikingly similar to its historical range between $8 and $20, which eventually led to a 2,000% rally. According to Merlijn, “the green arrows and red curves on both charts align precisely, marking correction and breakout zones.”

Ethereum is showing price action similar to 2016–2017, now supported by increased liquidity, adoption, and institutional involvement. Source: @MerlijnTrader via X

This technical alignment has sparked renewed Optimism among long-term holders and swing traders alike. The setup suggests that ETH could be gearing up for a similarly powerful move—this time with institutional strength behind it.

Institutional Accumulation: Wall Street Bets on Ethereum

Ethereum’s bullish momentum is increasingly driven by strong institutional demand. Treasury firms like SharpLink, led by Ethereum co-founder Joe Lubin, have amassed over 521,939 ETH valued at $1.9 billion, with plans to scale up to 1 million ETH. All holdings are staked, generating more than $3.3 million in validator rewards so far. Lubin described this surge as a “mainstream moment,” noting how traditional finance is integrating with decentralized finance, signaling growing regulatory clarity and institutional involvement.

Tom Lee prefers Ethereum over Bitcoin, saying, “Ethereum is having its 2017 moment and is the biggest trade for the next decade.” Source: @AltcoinDaily via X

Meanwhile, BitMine Immersion Technologies (BMNR), chaired by Fundstrat’s Tom Lee, controls the largest Ethereum treasury with 833,100 ETH. Lee called Ethereum “the biggest macro trade of the next decade,” emphasizing its role as the blockchain platform Wall Street needs for tokenizing its assets. He also highlighted Ethereum’s advantages over Bitcoin, saying, “If you’re comparing it to Bitcoin, we’re comparing the wrong analog,” and acknowledged that if forced to pick one asset, he WOULD choose Ethereum due to its smart contract capabilities and compliance.

Ethereum vs Bitcoin: The Growing Gap in 2025

With Ethereum offering broader functionality—such as smart contracts, token issuance, and growing DeFi integration—experts argue that it’s beginning to separate itself from Bitcoin in meaningful ways.

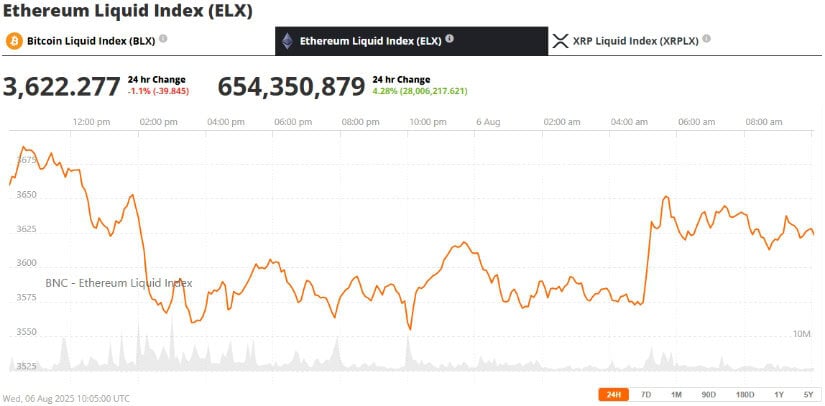

Ethereum (ETH) has been trading at around $3,622, down 1.1 % in the last 24 hours at press time. Source: Ethereum Liquid Index (ELX) via Brave New Coin

“Ethereum is having its 2017 moment,” Lee said during a recent podcast, suggesting that institutional recognition of Ethereum’s use cases is hitting an inflection point. He also compared Ethereum and bitcoin to Tesla and Palantir stocks, implying that both have different utilities and appeal to different investor types.

Layer 2 Ecosystem: Strengthening Ethereum’s Foundation

The rise of Layer 2 solutions like Arbitrum, Optimism, and zksync is accelerating Ethereum’s scalability without compromising its decentralization. Transaction volumes on these networks continue to grow, with Total Value Locked (TVL) in L2 ecosystems hitting new highs.

This trend is reducing mainnet congestion and gas fees, while increasing the overall utility of Ethereum. Since all LAYER 2 activity ultimately settles on Ethereum, this growth cycle directly strengthens the demand for ETH.

Key Resistance Ahead: What’s Holding ETH Back?

Despite Ethereum’s bullish structure and growing adoption, resistance at $4,100 remains a significant hurdle. crypto strategist Michaël van de Poppe recently shared that Ethereum’s rally had stalled after failing to clear the $4,100 barrier, leading to a 15% correction. He explained that this level is “the crucial threshold Ethereum must break to revisit or surpass previous highs.”

Ethereum fell short of reaching the $4,100 resistance zone, causing a 15% correction; breaking this level is key for new all-time highs. Source: @CryptoMichNL via X

Still, he remains optimistic, stating that the $3,200 to $3,400 zone has a 70% probability of holding as a bounce zone. If that support holds firm, Ethereum could quickly regain momentum and aim for new all-time highs. Below that, the $2,800–$3,000 level acts as a deeper safety net, though with lower probability of being tested.

Final Thoughts: Ethereum Eyes Breakout as Institutional Backing Surges

Ethereum is currently trading within a critical range, but signs point to a brewing breakout. Institutional treasuries, on-chain metrics, and technical analysis all indicate a setup reminiscent of 2016—only this time with significantly more capital and infrastructure behind it.

Tom Lee’s conclusion echoes the sentiment of many seasoned investors: “Ethereum is legally compliant, highly secure, and the infrastructure that Wall Street will tokenize on.” If ETH can decisively break above $4,100, it could be the beginning of a new bullish chapter—one that validates Ethereum’s place not just as the leading smart contract platform, but as the backbone of global digital finance.