Crypto Traders Chase 100x Leverage—Copying On-Chain Whales for Futures Dominance

Retail traders are playing a dangerous game of follow-the-leader—mirroring whale wallets with extreme leverage on unregulated platforms. The 100x futures frenzy turns crypto into a high-stakes casino where most bets implode before hitting paydirt.

Copycat trading meets reckless leverage

Platforms now let users ape on-chain whale positions with a single click—no due diligence required. When Bitcoin whales move, leveraged minnows swarm like piranhas. The result? Liquidations cascade faster than you can say 'overcollateralized.'

The institutional smirk

Wall Street watches with amusement as retail traders chase 100x moonshots. Meanwhile, hedge funds quietly stack spot BTC—because someone needs to buy the dip when leverage junkies get rekt. Another day in crypto's perpetual cycle of greed and genius.

Copytrading Whales And Smart Money Traders Using On-Chain Data

Thanks to the transparency of blockchains and several cutting-edge on-chain data analysis tools, retail traders do not need to pay for ready-made copy trading features.

Smart trader 0xCB92 nailed the direction again and added to his $ETH short — now holding 60,000 $ETH($213.5M) with over $4.25M in unrealized profit.https://t.co/a13eoMtasF pic.twitter.com/w8YL3dBphI

— Lookonchain (@lookonchain) August 5, 2025

Lookonchain’s X account is a Gold mine in itself. It scours through thousands of trades and posts the most notable ones, providing reliable alpha to retailers.

Take, for instance, its recent post on whale 0xCB92, highlighting how it is a whale that can be trusted for copy trading, considering it has accurately predicted Ethereum’s short-term price trajectory every time.

0xCB92 is currently bearish on Ethereum. It has opened a 15x short position in ETH worth over $213 million and currently holds an unrealized profit of over $4.25 million.

Similarly, Lookonchain posts about some of the highest-risk, high-reward trades that whales place. On March 10th this year, a smart-money trader used 50x leverage to open a $53 million long position in ETH, profiting over $2.1 million in less than an hour.

Notably, this whale secured significant profits by executing a high-conviction trade ahead of Trump’s Bitcoin Strategic Reserve executive order. According to Lookonchain, the precise timing has led many to suspect the trader may be a political insider, making their moves especially worth watching during periods of political uncertainty.

Besides Lookonchain, Arkham Intelligence’s website and X account are also excellent sources of trading alpha for retailers looking to copy trade top whales.

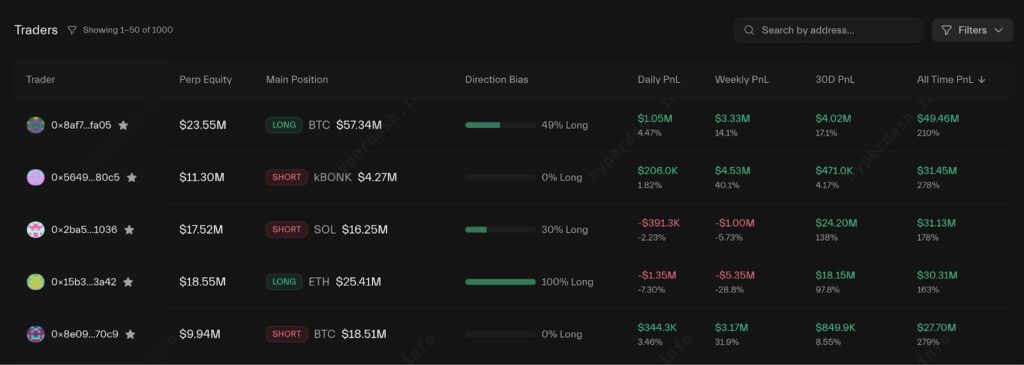

The viral new crypto exchange Hyperliquid has made its orderbook fully on-chain, which means it is possible to track its top traders through platforms like HypurrScan and HyperDash.

For instance, HyperDash’s top traders section ranks accounts with the highest all-time PnL and allows users to check their current trades. For a beginner the interface can appear complicated however.

How To Make 100x Leverage Crypto Trades On CoinFutures

CoinFutures has rapidly become one of the top choices for Crypto Leverage traders seeking high-conviction plays, especially those that are new to it.

With up to 1000x leverage crypto traders can potentially make outsized returns, and there’s alo no KYC requirement, instant funding options, and a simple “Up” or “Down” trade interface. It strips away the complexity that deters many retail investors from exploring perpetual futures crypto trades.

Unlike traditional exchanges that demand funding rates, have complex order books, or restrict traders to 10x leverage, CoinFutures lets even small-bankroll traders amplify positions with minimal complexity.

The platform also provides real-time bust price calculation, letting traders clearly see where a position WOULD be liquidated. Add to this built-in stop-loss and take-profit settings, and CoinFutures delivers the kind of risk management tools typically only available to institutional players, in a mobile-first, beginner-friendly format.

Here’s how to place a 100x leverage crypto trade on CoinFutures or even higher:

Start by sourcing alpha from platforms like Lookonchain, Arkham Intelligence, or HyperDash. These track on-chain whale activity, offering clues on when and where large players are entering trades.

CoinFutures is hosted inside the CoinPoker app, available on Android and Windows. Create an account using just an email and username; no documents or KYC needed.

Top up using crypto (BTC, ETH, USDT, SOL, etc.) or fiat options like Visa, Mastercard, Apple Pay, or PIX.

Pick your asset. Then select “Up” or “Down”, the direction you believe the price will move. Choose 100x leverage, meaning a $100 trade controls a $5,000 position. CoinFutures calculates the bust price (liquidation level) automatically, helping manage risk.

Before confirming, enter a Take-Profit level (where the trade will auto-close with gains) and a Stop-Loss level (to cap downside). This is crucial in fast-moving markets.

CoinFutures also tracks ROI in real-time, so users can adjust or exit positions based on performance.

Visit CoinFutures![]()