Ethereum (ETH) Price Prediction: $10B Reserve Breach Fuels $6K Rally Speculation

Ethereum's war chest just crossed a psychological milestone—$10 billion in reserves now sits on-chain. Cue the price prediction algorithms scrambling.

Breaking the reserve barrier

When ETH's treasury vaults overflow, traders start doing the mental math. That $6K price target? Suddenly doesn't seem so crazy when institutional wallets are filling faster than a DeFi exploit drain.

The cynical take

Wall Street's still trying to short ETH with 2018 playbooks—meanwhile, the blockchain's actual users are building financial infrastructure that bypasses brokers entirely. Your move, legacy finance.

The ongoing tug-of-war between bullish fundamentals and cautious investor sentiment has put ethereum at a critical juncture.

Market Overview: ETH Price Gains Amid Whale Activity and Institutional Accumulation

Ethereum price today touched a high of $3,730 before pulling back to $3,639, according to the Ethereum Liquid Index (ELX) by Brave New Coin. The price jump was driven by a nearly 6% rally on Monday, largely credited to a significant Ether purchase by BitMine Immersion Technologies. The firm now holds over 833,000 ETH, worth more than $3 billion, making it the fourth-largest crypto treasury in the world.

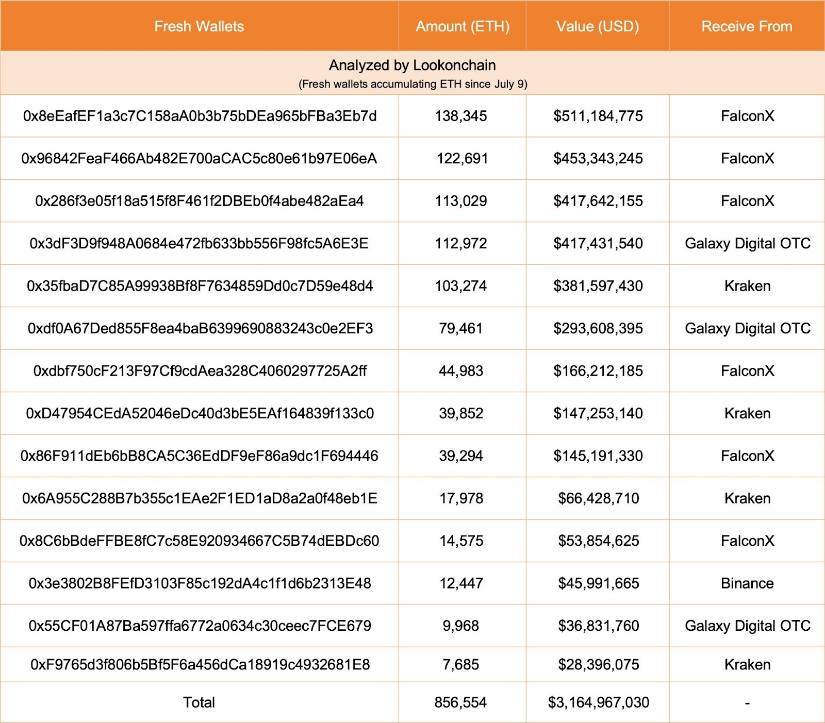

Whales and institutions scoop up over $3B in Ethereum since July 9—accumulation frenzy intensifies! Source: Lookonchain via X

This surge in accumulation isn’t isolated. According to Lookonchain, 14 new whale wallets snapped up 856,000 ETH in just two days, valued at approximately $3.16 billion. This uptick in large-holder activity aligns with Santiment data showing a rise in Ethereum wallets holding over 10,000 ETH—an indicator of long-term confidence.

Strategic Ethereum Reserve Soars to $10.8B: Institutions Double Down

One of the most compelling indicators of Ethereum’s growing strength comes from the Strategic Ethereum Reserve (SER), which has ballooned from under $3 billion to over $10.8 billion in just six weeks. Now holding approximately 2.45% of Ethereum’s total supply, the SER’s rapid growth highlights rising institutional interest in the asset.

Ethereum’s strategic reserve surges past $10B, signaling a potential rally toward $6K–$8K by Q4. Source: @cas_abbe via X

Crypto analyst Cas Abbé underscored this trend, noting that Ethereum presents a “golden opportunity” for those who missed out on the Bitcoin rally. This accelerating accumulation signals increasing confidence in Ethereum’s long-term fundamentals, particularly as it pushes toward the $4,000 resistance level.

Ethereum ETF News: $465 Million Outflows in a Single Day

While whale and treasury buying continues, Ethereum ETF news paints a more mixed picture. On August 5, ETH ETFs saw $465 million in outflows, with BlackRock’s ETHA leading the exit at $375 million, followed by Fidelity’s FETH, which shed $55.1 million. bitcoin ETFs weren’t immune either, losing $333 million on the same day.

BlackRock dumps $375M in Ethereum—market braces for impact amid rising volatility. Source: @crypto_goos via X

Despite this, Ethereum’s price ROSE 4% in 24 hours, indicating market resilience. According to CryptoGoos, the outflows may reflect short-term profit-taking after Ethereum ETFs pulled in $5.4 billion during July. Analysts suggest the recent pullback could be temporary, especially if macroeconomic conditions improve.

Ethereum Network Metrics: Activity Hits 15-Month High

Beyond ETF flows, Ethereum network activity continues to strengthen. Daily transactions have climbed to 1.7 million—the highest in over a year—while new wallet creations and active addresses also spike.

The EIP-1559 upgrade is another contributing factor, consistently burning ETH and keeping net emissions nearly neutral. This combination of high utility and tightening supply creates a favorable setup for long-term bullish momentum.

Technical Analysis: Ethereum Faces Resistance at $3,800

Technically, Ethereum is currently consolidating between $3,400–$3,800. Analysts note that ETH bounced 9% from a recent low of $3,355, with strong support accumulating around the 50% Fibonacci retracement level at $3,422.

Ethereum battles key resistance at $3,800 as traders eye a breakout—but downside risks remain in play. Source: Orbiq on TradingView

However, ETH has a cap at approximately $3,800, in accordance with prolonged liquidation zones and the 20-day SMA at $3,652. A move above this level can target $3,941 and $4,094, but failure to hold above $3,354 can see the asset exposed to a pullback NEAR the 50-day SMA at $3,013.

Options market data is also reflecting cautious optimism. The 25% delta skew remains at a neutral 3%, suggesting that investors are still hedging downside risks, awaiting a clearer breakout signal.

Fundamental Catalysts: Will Ethereum Flip Bitcoin in 2025?

The bigger question for investors is whether Ethereum can flip Bitcoin in the next few months. While BTC continues to dominate headlines, Ethereum’s bursting treasuries, stable staking rewards, and strong LAYER 2 ecosystem suggest it could capture more institutional capital—especially if ETF outflows can be contained.

BitMine now holds the world’s largest corporate Ethereum treasury with 833,137 ETH worth $2.9B. Source: STACKMASTER via X

BitMine Chairman Tom Lee explained he was extremely optimistic about the long-term future of Ethereum, pointing to the firm’s aggressive growth in net asset value (NAV) per share as a key differentiator in the crypto treasury space. For Lee, Ethereum’s combination of liquidity and strategic value continues to be unrivaled by competitors, supporting BitMine’s bullish view on the asset in the face of increasing institutional interest.

Final Thoughts: Ethereum Prediction Hinges on Institutional Flows and Market Sentiment

Ethereum’s current consolidation reflects a market balancing strong on-chain fundamentals against cautious institutional flows. The surge in whale buying and the rapid rise of the Strategic Ethereum Reserve are bullish signals. However, persistent ETF outflows and macro uncertainty may delay Ethereum’s next leg up.

Ethereum (ETH) has been trading at around $3,639, up 2.36 % in the last 24 hours at press time. Source: Ethereum Liquid Index (ELX) via Brave New Coin

Still, if accumulation trends continue and resistance at $3,800 is decisively broken, Ethereum could be on track to test $6,000 by Q4 2025—as Cas Abbé and other analysts suggest.

Short-term traders should watch the $3,652–$3,800 resistance range closely, while long-term holders may view current levels as an accumulation opportunity amid strengthening fundamentals.