Philippines SEC Clamps Down on Crypto Giants: Exchanges Under Fire in 2025 Regulatory Blitz

The Philippines' Securities and Exchange Commission just dropped the hammer—major crypto exchanges are in the crosshairs of a sweeping regulatory crackdown.

No more gray areas. The SEC's move signals a brutal shift from 'wait-and-see' to full enforcement mode, targeting platforms operating without licenses. Traders brace for impact as liquidity could vanish overnight.

Meanwhile, traditional finance snickers from the sidelines—because nothing says 'healthy market' like governments playing whack-a-mole with decentralized tech.

The regulator issued a public advisory on August 1, 2025, targeting platforms including OKX, Bybit, KuCoin, and Kraken for violating new rules that took effect July 5. These exchanges continue serving Filipino users despite lacking required authorization under the country’s crypto Asset Service Provider (CASP) framework.

The enforcement follows a clear pattern established when Philippines authorities successfully blocked Binance in 2024. That action removed the world’s largest crypto exchange from the Philippine market after giving users 90 days to exit the platform.

New Rules Reshape Crypto Landscape

The crackdown stems from two new regulations issued in May 2025. SEC Memorandum Circular No. 4 and No. 5 created the first comprehensive framework for crypto businesses in the Philippines.

Under these rules, all crypto service providers must register as domestic corporations with 100 million pesos (about $1.8 million) in minimum capital. Companies must also maintain physical offices in the Philippines and submit detailed financial reports monthly.

The regulations require strict separation of customer funds from company assets. This protection aims to prevent losses when exchanges collapse, a problem that has affected crypto users worldwide.

Companies violating these rules face fines ranging from 50,000 to 10 million pesos per violation. The SEC can also impose additional daily penalties of 10,000 pesos for ongoing violations.

Ten Major Platforms Under Fire

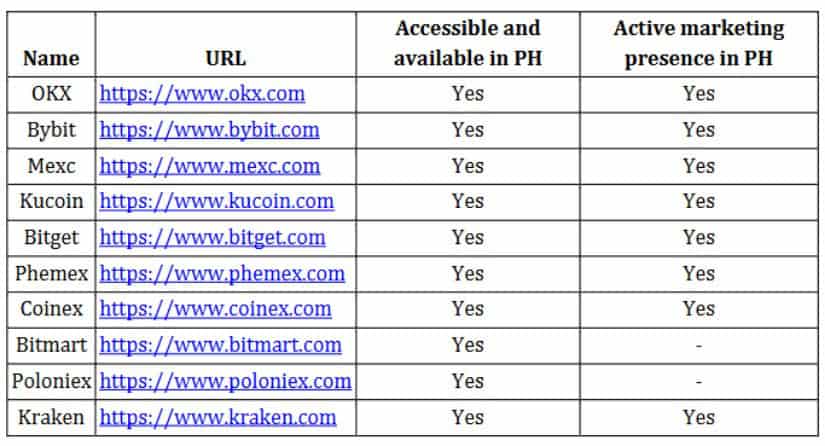

The SEC specifically named ten exchanges that remain accessible to Filipino users without proper licenses:

- OKX and Bybit, two of the world’s largest crypto platforms

- KuCoin and Kraken, popular international exchanges

- MEXC, Bitget, Phemex, CoinEx, BitMart, and Poloniex

Source: www.sec.gov.ph

Many of these platforms actively market to Filipino users through social media and local advertising campaigns. The SEC noted this direct targeting makes their violations more serious.

The regulator warned this list is not complete. Other unlicensed platforms operating in the Philippines may face similar action.

Enforcement Tools Mirror Binance Case

The SEC plans to use the same enforcement strategy that successfully removed Binance from the Philippine market. This includes working with Google, Apple, and Meta to block unauthorized crypto advertising targeting Filipino users.

The commission can also coordinate with the National Telecommunications Commission to block access to exchange websites and mobile apps. This “geo-blocking” prevents users from accessing platforms directly.

Criminal complaints and cease-and-desist orders provide additional enforcement options. The SEC emphasized it will pursue all available legal remedies against non-compliant platforms.

Regional Trend Toward Stricter Oversight

The Philippines action reflects growing regulatory pressure across Southeast Asia. Thailand recently announced plans to block OKX, Bybit, and other unlicensed exchanges by June 28, 2025.

Indonesia has imposed higher taxes on foreign crypto platforms while supporting domestic exchanges. The country previously blocked major international platforms including Binance, Bybit, and Coinbase for lacking proper licenses.

Vietnam plans to develop comprehensive crypto regulations by May 2025. These efforts aim to address money laundering risks while protecting local investors.

The coordinated approach suggests regional governments are prioritizing regulatory compliance over crypto innovation. This shift challenges the traditional model where international exchanges operated freely across borders.

Protecting Filipino Crypto Users

The Philippines has become a major crypto market, ranking 20th globally in crypto wealth. An estimated 12.79 million Filipinos are expected to use cryptocurrencies by 2026, generating 1.1 billion pesos in revenue.

This growth has attracted both legitimate businesses and fraudulent schemes. The SEC cited multiple risks facing users of unregistered exchanges:

- Total loss of funds if platforms collapse or freeze accounts

- Exposure to fraud and market manipulation

- Identity theft and privacy breaches

- Money laundering and terrorist financing connections

Users of licensed exchanges have legal protections if problems occur. Unregistered platforms offer no such recourse, leaving users vulnerable to complete losses.

The SEC particularly emphasized anti-money laundering concerns. Licensed exchanges must follow strict customer identification and transaction monitoring rules. Unlicensed platforms often lack these safeguards, creating vulnerabilities that international criminal organizations exploit.

Market Impact and Industry Response

The named exchanges have not publicly responded to the SEC advisory. This silence suggests uncertainty about compliance strategies and potential market exits.

Some platforms may choose to obtain Philippine licenses, though this requires significant investment and operational changes. Others might withdraw from the market rather than meet regulatory requirements.

The enforcement creates opportunities for compliant local exchanges and international platforms willing to meet Philippine standards. Licensed operators can capture market share as unlicensed competitors face restrictions.

Philippine authorities have not announced asset freezes or immediate account restrictions. However, the Binance precedent suggests such measures could follow if platforms continue operating without compliance.

What This Means Moving Forward

The Philippines SEC has drawn a clear line between compliant and non-compliant crypto businesses. The enforcement action signals the end of regulatory ambiguity that previously allowed international exchanges to operate freely.

This approach positions the Philippines as a leader in balanced crypto regulation. The country supports innovation while protecting users through licensing requirements and operational standards.

Success of this enforcement will likely influence similar actions across Southeast Asia and beyond. Other regulators are watching closely as the Philippines demonstrates how to effectively oversee global crypto platforms within national borders.