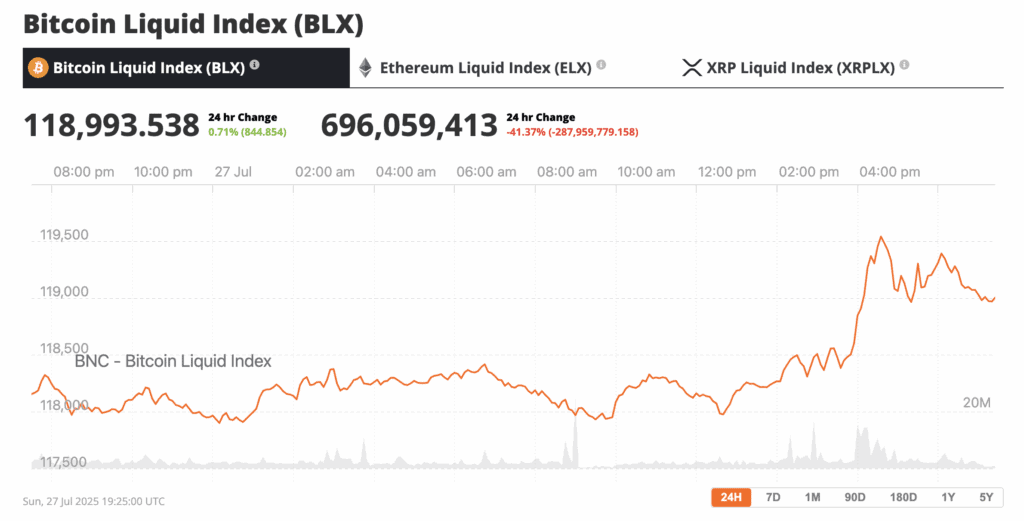

Bitcoin Surges Toward Weekly Close: $119K Liquidity Zone Fuels Bullish Momentum

Bitcoin bulls are back in control as price action defies gravity ahead of the weekly candle close. A massive liquidity pool at $119,000 acts like a financial black hole—pulling BTC upward while traders scramble for position.

The liquidity grab play

Institutional sharks and retail minnows alike are chasing this clear price target, creating textbook bullish pressure. Order book data shows stacked bids building beneath current levels—classic accumulation behavior before another leg up.Market mechanics at work

That $119K marker isn't just psychological—it's where exchanges hold thick clusters of short positions just begging to get liquidated. When BTC smells weak hands, it feasts. (Cue Wall Street veterans complaining about 'manipulation' while quietly front-running the move.)What's next?

Either we get a violent squeeze past six figures, or a brutal rejection that shakes out overleveraged longs. There's no in-between with crypto—which is exactly why degenerates keep coming back for more.

According to data from BNC, BTC/USD clawed its way back after bottoming out near $114,500, shaking off one of the largest Bitcoin sales in recent memory. Galaxy Digital sold a total of 80,000 Bitcoins from a Satoshi-era investor. Despite the huge size, the market was able to absorb it.

A massive sell-off of Bitcoins barely moved the price, source: X

The rebound was fueled, in part, by macro optimism: news broke that the U.S. and China had postponed tit-for-tat tariffs, calming global market nerves and boosting risk-on appetite.

Now hovering above its 10-day simple moving average, bitcoin is once again flirting with a breakout. But the next few candles could determine everything.

“$BTC needs to break above $119.5K for a big move. If that doesn’t happen, this consolidation will continue,” said investor and entrepreneur Ted Pillows on X, summarizing the sentiment of a market holding its breath.

Rekt Capital wrote on X that “Bitcoin will find ways to shake investors out of their positions during Price Discovery Uptrends. Sometimes this can be by virtue of uninterrupted uptrends, with investors hoping for a dip. Sometimes this can be by virtue of investors thinking a dip will turn into a correction.”

Bitcoin has reclaimed the Daily Range, solidifying a new Higher Low in the process, Source: X

Welcome Back, Volatility

The return of volatility is no coincidence. Analysts point to swelling trade volumes as a sign that the big players are back at the table, positioning ahead of what could be a pivotal week. Liquidation zones around the $119K mark are drawing attention, and Bitcoin has a habit of gravitating toward high-leverage pain points.

The Four-Year Cycle is “Dead,” Says Bitwise CIO

Zooming out, there’s a growing chorus of voices challenging the conventional Bitcoin market script. Traditionally, Bitcoin’s price has moved in four-year halving cycles, with massive rallies following each block reward reduction. But Bitwise CIO Matt Hougan says that playbook is outdated.

“I bet 2026 is an up year,” Hougan declared in a recent video post. “I broadly think we’re in for a good few years.”

His rationale? The halving’s impact is diminishing, each one is “half as important,” he says. And more critically, macro forces are aligning in Bitcoin’s favor. Interest rate pressure from political leaders, like Donald TRUMP urging the Fed to cut, could make risk assets like Bitcoin shine as traditional investments like bonds and savings accounts lose their yield appeal.

Don’t forget Matt and the team at Bitwise have a Bitcoin price prediction of $200,000 in 2025. If you’re asking yourself if now is the right time to buy Bitcoin and crypto assets, if Bitwise is correct, then the answer must be yes.

Bitwise has called for a Bitcoin price of $200,000 this year

While some are still waiting for a 2025 post-halving peak, others, like Hougan, are setting their sights on 2026 and beyond. If he’s right, we might be witnessing the early stages of a new macro-driven era for Bitcoin, one that’s less about mining math and more about monetary policy, liquidity flows, and geopolitical risk.