🚀 Bitcoin (BTC) Price Prediction: Citi Forecasts $199K Surge by December 2025—Time to Buy?

Wall Street’s latest crypto fever dream? Citi just slapped a $199K price target on Bitcoin—and the clock’s ticking.

### The Bull Case: Institutional FOMO Meets Halving Hype

Forget ‘slow and steady.’ Citi’s analysts see BTC riding a perfect storm of ETF inflows, supply shock post-halving, and the classic ‘greater fool’ theory dressed up as ‘macro hedge.’ (Sure, Jan.)

### The Catch: Volatility Ain’t Going Anywhere

Even if the bank’s crystal ball is right—a big ‘if’—expect gut-churning 30% swings along the way. Traders might profit; weak hands will get shredded.

### Bottom Line: Hedge Funds Will Front-Run This Narrative

By the time retail catches on, the smart money’s already booking profits. Welcome to crypto, where forecasts are just marketing materials with Excel formulas.

With shifting market cycles and evolving investor behavior, BTC’s next MOVE could reshape long-held price models.

Market Overview: ETF Inflows, Price Breakouts Drive Momentum

Bitcoin price today continues to hold above $117,000, following a strong breakout earlier this month when BTC reached a new all-time high of $123,000. According to Citi, institutional activity—particularly from Bitcoin ETFs—has become a dominant force shaping price movements.

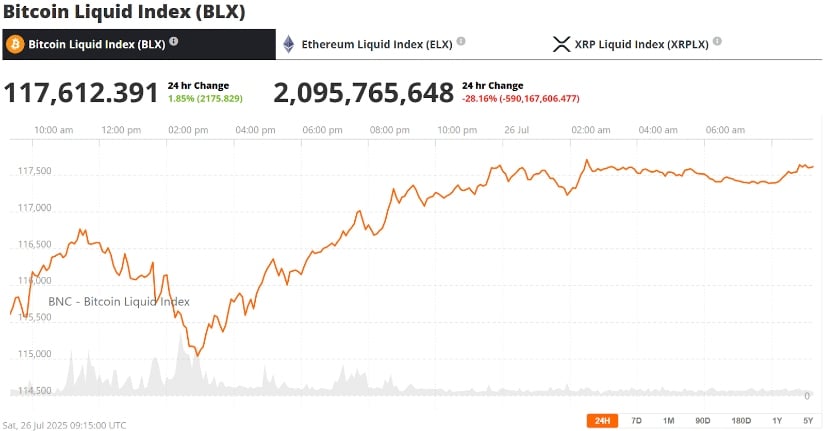

Bitcoin (BTC) was trading at around $117,612, up 1.85% in the last 24 hours at press time. Source: bitcoin Liquid Index (BLX) via Brave New Coin

Since their approval, U.S.-based Bitcoin ETFs have accumulated over $54.66 billion in BTC, led by asset managers like BlackRock and Fidelity. This institutional demand now accounts for over 40% of recent price fluctuations, as per Citi’s report.

Citi analysts estimate that an additional $15 billion in ETF inflows could push Bitcoin’s valuation up by roughly $63,000, driving the price toward $199,000 in the most optimistic scenario. That WOULD mark another major leg in Bitcoin’s ongoing rally, which began when prices hovered near $45,000 during the ETF launch month.

Breaking the Cycle? ETF Era May Outshine 4-Year Model

Traditionally, Bitcoin halving events and four-year cycles dictated market tops and bottoms. However, that model is now being questioned. Experts like Matt Hougan, CIO of Bitwise, believe that long-term institutional growth is overriding older patterns.

If historical trends hold, the current Bitcoin cycle could extend until October 20, 2025, following the typical 1,070-day pattern from bear market bottom to peak. Source: Bitcoin Archive via X

“ETF adoption has just begun,” Hougan stated, suggesting that Wall Street’s entry could last 5–10 years, with pensions, endowments, and banks like JP Morgan and Standard Chartered steadily deploying capital into crypto. This shift, he argues, may weaken the relevance of halving-based cycles.

Similarly, CryptoQuant CEO Ki Young Ju noted that past trends, such as whales selling to retail, no longer apply. “Old whales are selling to new long-term holders, not retail,” he said—highlighting that Bitcoin whale alerts now reflect a transfer to stronger hands, not speculative traders.

Expert Insights: From $135K Base Case to $199K High

Citi’s model offers three scenarios for Bitcoin’s year-end target:

- Bear Case: $64,000

- Base Case: $135,000

- Bull Case: $199,000

The base-case scenario combines several variables: $63,000 in added value from ETF demand, $75,000 driven by user adoption growth, and a $3,200 discount due to macroeconomic risks like underperformance in equities and gold.

Citi projects Bitcoin could reach $135K by year-end, with potential scenarios ranging from a bullish $199K to a bearish $64K. Source: @Cointel_GRC via X

Notably, Citi expects user adoption to rise by 20%, reinforcing Bitcoin’s network effect. With more people using BTC for transactions, savings, or investment, the network becomes more resilient—even in the face of volatile markets.

While Citi remains conservative compared to some analysts forecasting $250K to $500K Bitcoin by year-end, their acknowledgment of accelerating ETF flows signals that the Bitcoin ETF news cycle may continue to fuel upside momentum.

Looking Ahead: Bitcoin’s Long-Term Outlook Enters New Era

With Bitcoin now 975 days into its current market cycle, some analysts still anticipate a peak by mid-October 2025, consistent with historical trends. However, growing consensus suggests the Bitcoin price prediction landscape is evolving.

ETF inflows, stronger hands holding supply, and regulatory clarity are now shaping BTC’s trajectory more than traditional market cycles. Whether Bitcoin reaches $135,000 or surges to $199,000, the next few months will reveal how DEEP this institutional shift really runs.

For now, investors are watching ETF volumes, on-chain trends, and macro signals to determine BTC’s next move. As long-term forces reshape the market, Bitcoin’s rise may be less about repeating history—and more about rewriting it.