Dogwifhat (WIF) Primed for $2.20 Surge: Bullish Retest Fuels Breakout Hopes

Dogwifhat (WIF) isn’t just barking up the wrong tree—it’s scaling it. A textbook bullish retest and ascending channel formation hint at a potential breakout toward $2.20, leaving traders wondering if this meme coin’s got legs or just another case of 'buy the rumor, sell the news.'

The Setup:

WIF’s price action carved a clean ascending channel, bouncing off support like a crypto kangaroo on espresso. The $2.20 level now looms as the next psychological battleground.

The Catch:

Meme coins move faster than a hedge fund closing its shorts, but sustained volume’s the real MVP here. No pumps, no glory—just ask the bagholders of 2023’s flavor-of-the-week shitcoins.

Bottom Line:

Either WIF’s about to moon on pure meme magic, or it’s another reminder that in crypto, 'technical analysis' sometimes means 'drawing lines until you’re right.' Place your bets.

Dogwifhat (WIF) is showing early signs of preparing for another breakout, according to a technical setup shared by analyst Kamran Asghar.

Although WIF has recently corrected to around $1.08, the broader structure remains intact, with technical indicators pointing toward a possible breakout toward $2.20. Price movement over recent weeks has aligned with textbook consolidation phases typically seen before trend resumption.

Dogwifhat Accumulation and Flag Formation Define Bullish Structure

WIF’s price chart reflects a long-term accumulation phase that lasted from February to May 2025, forming a wide horizontal range. This period was characterized by low volatility and repeated rejections at the upper boundary of the range, a sign often associated with smart money accumulation.

A breakout from this zone occurred in early May, initiating a new uptrend that has defined the coin’s recent market trend.

Source: X

Following the initial breakout, WIF established a descending flag throughout June—a pattern known for bullish continuation.

This controlled retracement held above previous resistance levels, showing resilience despite intermittent sell pressure. In early July, the breakout from this flag validated the strength of the trend, followed by another flag-like consolidation inside a rising channel.

A successful retest of support NEAR $2.10–$2.15 further reinforces the bullish thesis, even though WIF currently trades at $1.08. As long as the price structure maintains higher lows and remains inside the rising channel, the trend outlook remains favorable.

Short-Term Volatility Reflects Profit-Taking and Rebalancing

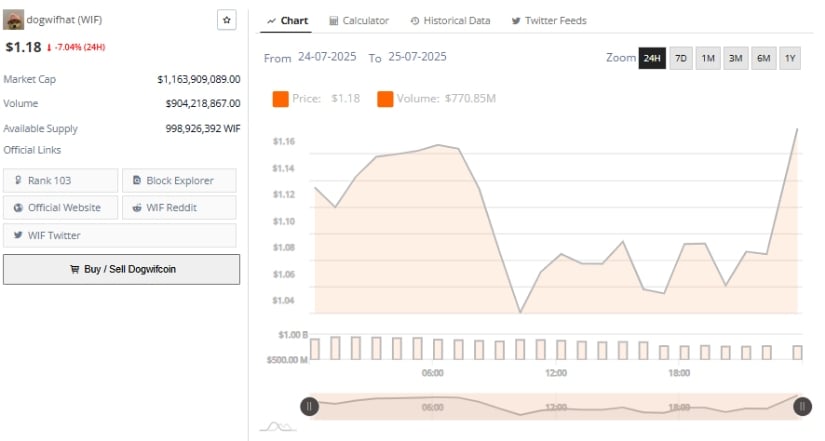

The 24-hour performance chart of dogwifhat shows a volatile session marked by sharp swings. Early gains took WIF to $1.15, followed by a fast drop to just below $1.04, illustrating a highly reactive market.

This V-shaped pattern points to profit-taking pressure likely triggered by prior gains and short-term speculative trading. While the price recovered throughout the afternoon and returned near $1.12, resistance around earlier highs held firm, showing reluctance among buyers to push beyond key intraday levels.

Source: BraveNewCoin

Daily trading volume was high at $904.2 million, suggesting continued interest despite the correction. However, much of this volume was concentrated during the price drop, aligning with strong liquidation and short-term exits.

WIF’s current market capitalization of $1.16 billion, based on a circulating supply of nearly 999 million tokens, places it firmly within mid-cap altcoin territory. To reestablish momentum, WIF needs to reclaim the $1.15–$1.18 zone with strong confirmation from volume and price action. If that fails, support at $1.00 could be retested before any continuation.

Indicators Signal Cautious Optimism as Price Holds Key Support

As of July 24, 2025, WIF is trading at $1.083, reflecting a daily loss of 6.96%. Despite the pullback, the token continues to maintain its broader uptrend structure from mid-June, supported by higher lows and breakout candles.

The recent rejection from $1.393 confirms a local top but does not yet indicate a trend reversal. Maintaining support above $1.00 remains critical in preserving the medium-term bullish outlook.

Source: TradingView

Momentum indicators offer a mixed but still constructive picture. The MACD line, at 0.079, is still above the signal line at 0.069, but the narrowing gap suggests that momentum is weakening. The Chaikin Money FLOW (CMF) is positive at 0.07, pointing to continued but reduced capital inflow.

Traders will be watching these indicators closely—if CMF turns negative and MACD crosses bearish, a broader consolidation between $0.95 and $1.15 may follow. If, however, WIF reclaims key levels with volume, the projected breakout toward $2.00–$2.20 could still be in play.