Solana Primed for $199 Comeback: Bullish Divergence & TD Sequential Signal Major Rebound

Solana's chart is flashing green as technical indicators line up for a potential surge. The crypto asset shows bullish divergence on key metrics while the TD Sequential—a favorite of traders timing reversals—paints a compelling recovery narrative.

Could this be the setup SOL needs to reclaim $199? The signs point to yes, but remember: in crypto, even 'sure things' have a habit of evaporating faster than a memecoin influencer's credibility.

Active traders are already positioning for the bounce. Will you ride the wave or watch from the sidelines? Either way, keep one hand on your wallet—this market cuts both ways.

Solana is starting to show some signs of potential reversal after a sharp cooldown this week. With price bouncing off a key support zone NEAR $176, participants are beginning to eye a potential short-term recovery.

Bullish Divergence on Solana Shows Early Signs of Reversal

Solana is flashing early signs of a potential reversal after tagging a key support zone near $176. This level has previously acted as a breakout level and is now offering support, as highlighted by crypto analyst Hardy. While the candles made fresh lows, the underlying momentum didn’t follow the indicator, hinting that sellers are losing steam. This type of divergence has historically acted as a strong reversal trigger, especially when it coincides with major horizontal support like this one.

Solana bounces off key support at $176 with bullish divergence signaling a potential short-term reversal. Source: Hardy via X

With SOL now pushing back above $180, early signs of a bounce are already in motion. If this momentum holds, the path toward reclaiming the $199 range opens up. The structure remains intact, and with momentum starting to shift, the bullish solana price prediction narrative is starting to return as well.

TD Sequential Flashes Buy Signal for Solana

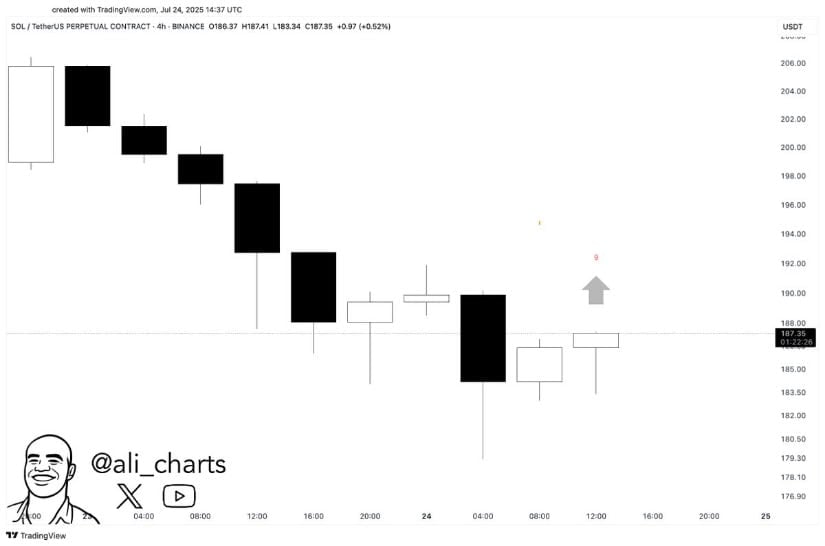

Adding fuel to the growing bullish narrative around Solana, analyst Ali Martinez has highlighted a fresh buy signal on the 4H chart via the TD Sequential indicator. After a sequence of sustained red candles, the count has now completed, suggesting exhaustion in the recent downtrend. This indicator often precedes short-term reversals when it aligns with broader support zones.

TD Sequential flashes a 4H buy signal for Solana, signaling potential trend exhaustion after the recent selloff. Source: Ali Martinez via X

Combined with the earlier spotted bullish divergence and key support retest around $176, this TD Sequential signal stacks up well from a confluence perspective. If buyers step in with follow-through, it wouldn’t be surprising to see SOL Solana price attempt a move back towards the $195 to $199 zone, where prior supply is currently positioned.

Institutional-Grade Staking Access Strengthens Solana’s Narrative

While Solana’s chart structure is beginning to flash signs of recovery, the fundamental side just added another catalyst. The newly launched $SSK ETF by REX-Osprey has integrated JitoSOL’s liquid staking, making it the first U.S.-based ETF to offer direct exposure to Solana’s on-chain staking rewards. This opens the door for traditional investors to earn native staking yield, all through a brokerage account.

REX-Osprey’s $SSK ETF becomes the first U.S. fund to offer direct exposure to solana staking via JitoSOL. Source: SolanaFloor via X

As SOL begins to reclaim momentum technically, this kind of real-world integration signals institutional validation that could help sustain bullish pressure. With over $100M already in AUM and growing demand for yield-bearing digital assets, Solana is positioning itself as a go-to asset.

Technical Outlook: Retest Completed, Eyes Shift to Upside

Following the earlier bullish divergence and TD Sequential signal, this latest chart from Kelvin suggests Solana may have just completed its retest phase. Structurally, the MOVE resembles a textbook double bottom, with a clear neckline retest just above $180. Price has reclaimed both the 50-day and 200-day moving averages, a development often viewed as a momentum shift.

Solana forms a textbook double bottom and eyes a golden cross, signaling potential momentum toward $240–$300. Source: Kelvin via X

What also stands out here is the bullish golden cross setup, where the shorter moving average, 50-day, is now lining up for a cross above the EMA-200. Once this technical reset completes, momentum WOULD favor a continuation towards $240 and $300.

Final Thoughts: Solana Technical Analysis

Solana is showing clear signs of strength after reclaiming key levels, and the bounce off the $177 to $175 support zone is starting to gain some momentum.

The structure remains clean, and momentum indicators are pointing toward a short-term recovery. As long as SOL holds above this critical support band, the path toward $184 and potentially $188 remains in play, with $190 acting as the next key test.

If buyers can flip $190 into support, bulls may reclaim full control, putting higher targets like $199 and beyond back on the table. With technicals aligning and fresh institutional momentum behind Solana now, the Solana outlook is starting to look stable once again.