Ethereum (ETH) Defies Volatility: Holding Strong Above $3,700 as $4,200 Target Looms Large

Ethereum isn't just surviving the crypto rollercoaster—it's thriving. While lesser assets flail, ETH clings to $3,700 like a Wall Street banker to their bonus. Here's why the $4,200 dream isn't dead yet.

The Steady Hand in a Chaotic Market

No dramatic plunges. No panic selling. Just a stubborn refusal to buckle under pressure. Ethereum's consolidation above $3,700 shows institutional-grade resilience—something Bitcoin maximalists might want to take notes on.

The $4,200 Horizon

Traders whisper about the magic number like it's the password to a VIP crypto club. With ETH's fundamentals stronger than a 'stable'coin's promises, that target isn't just hopium—it's becoming inevitable. Even the SEC can't regulate away this momentum.

Why This Isn't Just Another Pump

Real adoption. Real projects. Not just degenerate gamblers and over-leveraged hedge funds (though they're definitely along for the ride). Ethereum's proving that blockchain can be more than just a vehicle for speculation—even if that's still 90% of its current use case.

Will ETH hit $4,200? Probably. Will traditional finance finally admit they were wrong? Don't hold your breath.

While ETH briefly pulled back from its recent peak NEAR $3,860, analysts suggest the current consolidation is a healthy pause before the next potential rally.

With investor sentiment strengthening and technical indicators improving, many believe ethereum still has room to climb—possibly toward $4,200 in the short term.

Ethereum Price Today: Stabilizing After Channel Breakdown

After rallying throughout mid-July, Ethereum (ETH) saw its upward momentum interrupted earlier this week. The asset peaked near $3,860 but has since corrected to a support zone near $3,640, breaking below the ascending channel that had previously guided its climb. This breakdown signaled caution, but market observers note that ethereum price today has managed to hold firm above key support zones, which may be a sign of underlying strength.

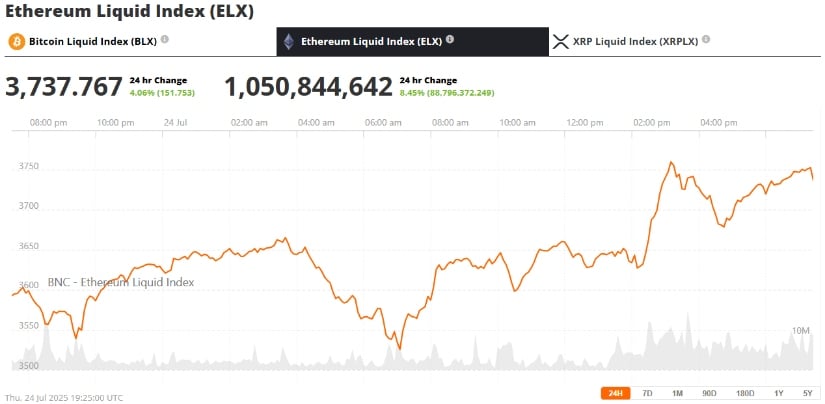

Ethereum (ETH) was trading at around $3,737, up 4.06% in the last 24 hours at press time. Source: Ethereum Liquid Index (ELX) via Brave New Coin

Technical analysis reveals that ETH recently faced rejection at the weekly 0.786 Fibonacci level, located near $3,525. That level now serves as resistance. The 1-hour Relative Strength Index (RSI) currently hovers around 50.40, suggesting that Ethereum is in a period of stabilization without clear direction, but not in overheated territory.

Market Sentiment: ETH Is Not Overheated, Say Analysts

Despite recent market jitters, analysts argue that Ethereum is far from overbought. crypto analyst “Crypto Dan” pointed out that ETH funding rates across major exchanges remain moderate compared to the overheated conditions seen in early 2024. According to him, the current price action reflects a “sluggish rally from an undervalued zone,” and any short-term correction is likely to be shallow and short-lived.

Ethereum may cool off short term, but in the bigger picture, it’s still heating up. Source: @cryptoquant_com via X

He emphasized that Ethereum’s current price movement isn’t just sustainable—it may also be laying the groundwork for a renewed uptrend. “Higher ETH prices are still ahead, and this rally may signal the beginning of an altcoin season,” Crypto Dan said in his recent post on X.

Ethereum RSI and Technical Chart Analysis

Technical indicators suggest a mixed but promising outlook. While the breakdown from the rising channel cooled immediate bullish momentum, Ethereum RSI today shows signs of balance. With RSI values retreating from extreme levels and resting near neutral, the stage could be set for a renewed push upward if buying pressure resumes.

Traders are watching a key resistance zone, and a strong breakout above it could spark the next leg up and confirm bullish momentum. Source: Ibrahim_Trade786 on Tradingview

Chart watchers are closely monitoring the $3,800–$4,000 resistance zone. A clean breakout above this band could act as a springboard toward the $4,200 target—an area many traders view as the next significant level to reclaim. ETH technical analysis shows that a close above $4,000 on strong volume may confirm a bullish continuation.

Altcoin Season on the Horizon?

Beyond Ethereum, broader signals suggest that an altcoin season may be taking shape. The Altseason Index recently climbed above 50, a milestone not seen in months. This index tracks whether altcoins are outperforming Bitcoin and often signals a shift in market leadership. Historically, an index reading above 75 confirms a full-fledged altseason, but the move past 50 is considered a transitional sign.

Additionally, the TOTAL2 chart—which excludes bitcoin and measures the combined market cap of altcoins—has broken out of an ascending channel. This mirrors past altcoin rallies and supports the idea that capital is rotating back into high-performing projects like Ethereum.

Ethereum Layer 2 and Staking Fundamentals Remain Strong

Underlying Ethereum’s price resilience is continued growth in its broader ecosystem. Ethereum Layer 2 growth, particularly on Arbitrum and zkSync, has led to lower gas fees and higher network efficiency. Moreover, Ethereum staking continues to attract validators, providing long-term support for the network.

Ethereum staking rewards remain competitive, while improvements from the upcoming Dencun upgrade are expected to enhance performance further. These fundamentals are helping to keep investor confidence intact—even amid short-term price dips.

Ethereum Price Prediction: $4,200 Still in Play

Looking ahead, the consensus among analysts leans bullish. Some traders, like Titan of Crypto, see Ethereum price reaching as high as $8,000 by the end of 2025 if momentum accelerates. While such long-term projections are ambitious, short-term targets around $4,200 are considered realistic—especially if ETH clears its current resistance bands.

ETH is approaching the key $4,000 resistance, with the upper target near $5,240 based on realized price. Source: Julio Moreno via X

Of course, failure to break above $3,800–$4,000 could result in more sideways action or a brief pullback. But given the improving technical posture and broader market sentiment, Ethereum’s price prediction for the coming weeks remains optimistic.

Looking Ahead: ETH Eyes Next Leg Higher

In summary, Ethereum news today shows a market in consolidation—but not weakness. The ETH price is holding steady above $3,700, supported by solid technical structure, healthy funding rates, and growing on-chain activity. If resistance levels break convincingly, the $4,200 target could be reached in the near term, potentially marking the start of a new bullish phase for Ethereum.

Investors should keep an eye on ETF developments, LAYER 2 growth, and broader altcoin market shifts as the second half of 2025 unfolds. For now, Ethereum’s price prediction remains firmly pointed upward.