Grok’s Bold Forecast: $BTC, $SOL & $XRP Face Pivotal Week—While $HYPER Threatens to Eclipse Them All

Crypto markets brace for turbulence as Grok's latest analysis drops—and the underdog might just wreck the narrative.

Bitcoin's make-or-break moment

$BTC wobbles near a critical support level while traders hold their breath. Another 5% dip could trigger a cascade of liquidations—or set the stage for a violent squeeze upward. The charts whisper 'volatility ahead.'

Solana's silent comeback

$SOL quietly defies the altcoin slump, with network activity spiking 18% week-over-week. Developers keep shipping despite the macro gloom—because when has SOL ever played by traditional rules?

XRP's regulatory limbo

Ripple's legal circus enters its 1,457th act (approximate). $XRP price action mirrors the courtroom drama—wild swings on rumor, stagnation on reality. Institutional money remains parked on the sidelines, watching the SEC throw paperwork like confetti.

The $HYPER wildcard

Some obscure hyper-deflationary token you've never heard of just pumped 700% on a single CEX listing. Retail FOMO meets vaporware economics—because nothing screams 'sustainable growth' like anonymous devs and a Telegram group full of rocket emojis.

Closing thought: The market's memory lasts exactly 1.3 news cycles. Place your bets accordingly.

Grok, the LLM brainchild of xAI, has issued fresh crypto predictions for the week, and the majors are heating up.

Bitcoin is flirting with its all-time high. solana is almost leapfrogging $BNB in market cap. And XRP is inching toward levels never seen before.

ETF inflows, Trump’s pro-crypto stance, and a NEAR $4T total market cap are setting the stage for a summer rally. The question is: where’s the real upside?

Grok outlines the paths for $BTC, $SOL, and $XRP, but if you’re looking for the kind of altcoin that could actually explode this cycle, one low-flying project might have the edge: Bitcoin Hyper ($HYPER).

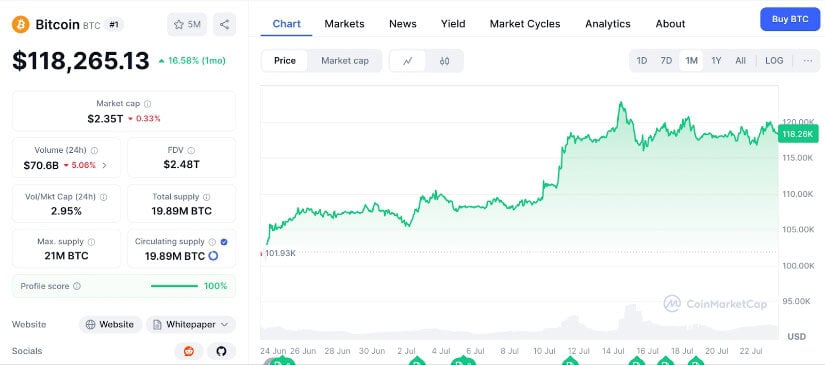

Bitcoin ($BTC) – Eyeing $130K If ETF Flows Persist

Bitcoin ($BTC) is holding steady at $118K, up 0.80% on the week and just 4% below its all-time high of just over $123K. Technicals are leaning bullish: RSI sits at a neutral 50 on the 4-hour and around 60 on the 1D, the 20-day EMA is rising, and support holds strong around $114K.

Grok’s bullish scenario sees a breakout above $123K, opening the door to $125K–$130K if ETF inflows and macro tailwinds continue.

On the flip side, a dip below $117K could trigger a correction toward $110K, especially if short-term profit-taking kicks in.

Sentiment remains bullish, with high open interest and strong social traction, but the chart suggests we could see some sideways action before the next leg up.

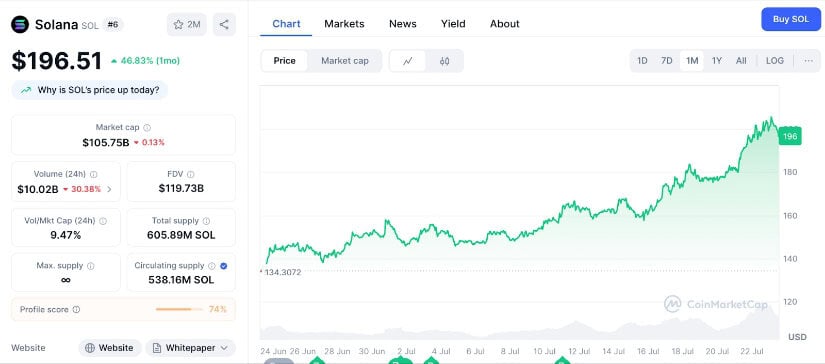

Solana ($SOL) – Can It Hold $195?

Solana ($SOL) is trading around $196, up 18.47% this week after bouncing from sub-$180 levels. It is close to flipping $BNB in market cap once again to become the fifth-largest crypto, adding fuel to the bullish fire.

Grok’s outlook is clear: Hold $195, and $SOL could rally toward $230–$250. But lose that level, and we might see a slide back to $165 near the 50-day EMA.

Driving momentum are soaring DeFi inflows, MetaMask integration, and ETF buzz. But the chart’s flashing a possible head-and-shoulders pattern, and staking deposits are cooling.

Overall sentiment is mixed. Ecosystem strength is undeniable, but the short-term technicals suggest $SOL may be due for a breather.

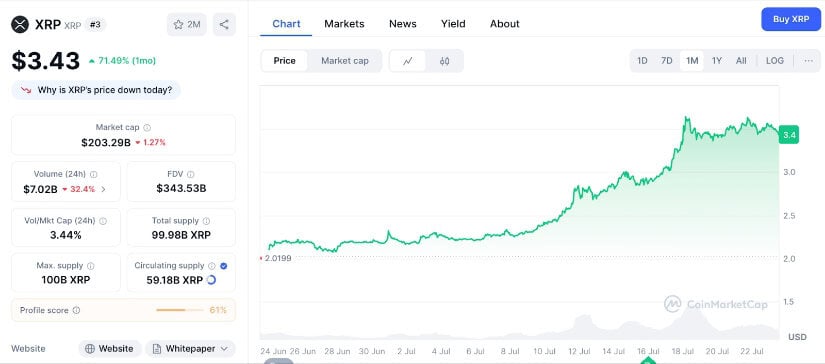

Ripple ($XRP) – One Last Leg to Rip Vertical?

Ripple ($XRP) is trading at $3.43, up 17% this week and hovering just under it’s recent all-time high of $3.58. Momentum is building fast, powered by a golden MVRV cross and increasing trading volume.

According to Grok, a clean break above $3.58 could open the door to $4 and beyond, with regulatory clarity acting as the key catalyst. But if resistance holds, expect a pullback toward $3.20 or even $2.64, the 50-day EMA.

Keep an eye on network activity, ETF speculation, and the ongoing SEC case – all critical variables for $XRP’s next move.

Sentiment remains bullish, but the sharp weekly gain raises the odds of short-term consolidation.

Altcoin That Could Explode This Cycle: Bitcoin Hyper ($HYPER)

Bitcoin has the narrative. ethereum and Solana have the tech. But what happens when Bitcoin finally gets a real execution layer?

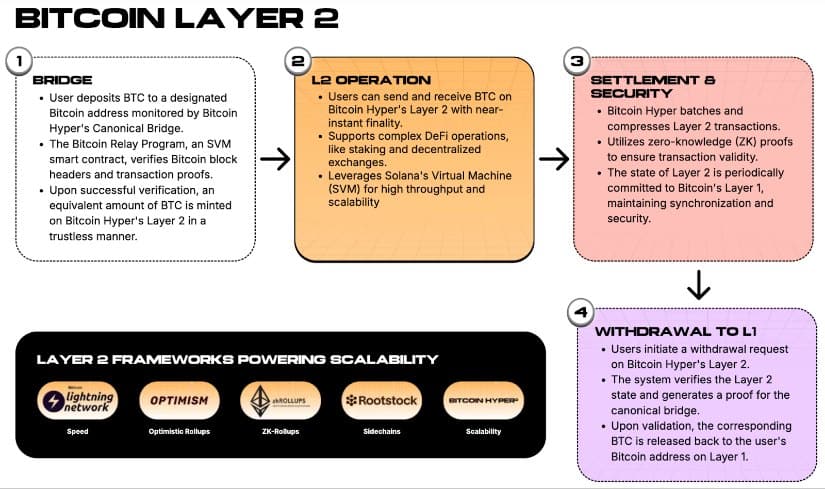

That’s where bitcoin Hyper ($HYPER) comes in: a true Layer 2 that integrates the Solana Virtual Machine (SVM) to bring smart contracts, sub-second speed, and composable dApps directly to the Bitcoin ecosystem.

This isn’t a sidechain or wrapper. It’s a high-performance blockchain secured by Bitcoin and turbocharged by Solana’s architecture. With the Canonical Bridge, $BTC can move in and out of the Hyper LAYER 2 trustlessly, opening the floodgates for DeFi, memes, payments, and more.

At the center is $HYPER, the network’s native token. It fuels everything: gas, staking, governance, token launches, and ecosystem access.

So far, over $4.3M has been raised. Staking APY sits at 220%, and the current price is just $0.012375 – still in early-stage territory. You can buy with $ETH, $USDT, $USDC, $BNB, or even a card.

If this altseason rewards early narratives with real use cases, Bitcoin Hyper ($HYPER) might be the first Bitcoin Layer 2 to go vertical.

Learn how to buy Bitcoin Hyper in our guide.

Final Thoughts – Layer 2s Might Win the Cycle

Grok’s forecast hints at strength in the majors, but altseason rarely rewards the obvious plays. Early entries tend to win, especially when there’s real tech behind them.

Bitcoin Hyper isn’t tagging along behind $BTC – it’s redefining what Bitcoin can actually do. While $SOL and $XRP chase ETF headlines, $HYPER is building the infrastructure they still don’t have.

This cycle might not be about price charts and politics. It might be about execution. And that’s where Bitcoin Hyper could flip the script.

This is not financial advice. Please always do your own research (DYOR). Crypto is volatile, and nothing’s guaranteed.

This is a sponsored article. Opinions expressed are solely those of the sponsor and readers should conduct their own due diligence before taking any action based on information presented in this article.