Chainlink Shatters Wedge Pattern – $41 Target in Sight as Bulls Take Control

Chainlink's price just ripped through a stubborn wedge formation—and now traders are eyeing a blistering run toward $41. Here's why the oracle token's technicals scream upside.

The breakout playbook: Wedge patterns don't stand a chance when LINK's volume surges like this. The last time we saw this much conviction, retail FOMO'd straight into a 60% monthly pump.

Institutional fingerprints: Whales are stacking LINK like it's 2021 again—probably because they finally realized smart contracts need more than just hopium to function. Who knew?

Reality check: Sure, $41 looks juicy, but let's see if the 'breakout' survives tomorrow's inevitable profit-taking from crypto tourists. As always in this market: trust the charts, but keep one hand on your wallet.

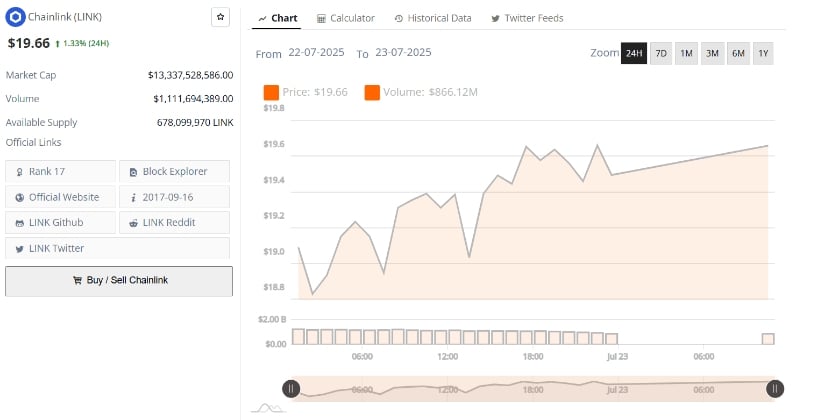

The token recently surged past a key descending wedge structure, a pattern that has historically preceded strong rallies in previous cycles. With chainlink price near $19.66 and holding steady gains, traders eye a break above $20 for further upside.

Analysts highlight the $13.5–$14.5 zone as a strong accumulation base, now transitioning into an expansion phase. As volume remains consistent and the daily RSI hovers above 73, Chainlink’s breakout structure suggests growing buyer conviction. The next key zones include $26 and potentially $41 if momentum holds.

Chainlink Price Breaks Out of Wedge Pattern, Eyes $41 in Continued Rally

Chainlink (LINK) is maintaining bullish momentum after confirming a breakout from a long-standing wedge pattern on the daily chart. Hence, the LINK price currently trades near $19.66, registering a 1.33% increase over the past 24 hours. Analysts are now assessing the breakout’s strength as LINK attempts to sustain this upward trend, with the $20 level emerging as the immediate resistance zone.

Source: BraveNewCoin

According to a chart analysis shared by @Crypt0minder, LINK’s recent breakout mimics historical cycles where descending wedge structures have led to strong upside moves. The latest breakout occurred after LINK held the $13.5–$14.5 accumulation support range, resulting in a sustained MOVE toward the $19 zone. The green arrow on the chart signals an anticipated continuation toward $41, matching a long-term resistance level formed during previous cycle peaks.

Source:X

Daily Indicators Reflect Strength in Current Rally

The daily Relative Strength Index (RSI) currently stands above 73, confirming strong momentum on the upside. It has also remained well above its 50-day simple moving average, a condition typically associated with bullish continuation patterns. The alignment between rising LINK price action and RSI strength supports the current uptrend structure.

Historical fractals in the chart show that similar breakouts from wedge formations in 2023 and 2024 led to rapid gains. These past structures featured multiple base formations and were followed by vertical rallies. The current price movement appears to follow this structure closely, positioning LINK for potential expansion if buyers retain control.

Short-Term Resistance Zones in Focus as Price Consolidates

On the 4-hour chart, analyst CW identified consolidation NEAR $19.33 following a steady rally from below $14. LINK Price is currently hovering below the $20 psychological barrier. Support levels between $13.70 and $17.50 remain intact, offering reentry points for swing traders in the event of a price retracement.

Source:X

The next resistance zone is placed near $26, aligning with a historical sell wall. This level previously triggered pullbacks and remains a focus for traders watching for a continuation move. For the short term, traders are watching whether Chainlink price can break above $19.80 to test the $20 level with strength and volume support.

Volume and Price Action Maintain Uptrend Conditions

Chainlink’s trading volume held steady at $866.12 million over the last 24 hours, reinforcing the recent move with consistent participation. Buyers have stepped in on each intraday dip, helping preserve the structure of higher lows. This trend has allowed the price to stabilize above previous resistance zones and build a potential base near $19.30.

The chainlink price action over the past 24 hours includes a brief dip to $18.75 before recovering strongly and touching highs near $19.65. The reaction to these dips suggests that demand remains active. If ChainLink price can surpass $19.80, momentum may continue toward a short-term retest of $20 and eventually move closer to the $26 level if current buying conditions persist.