Altcoin Season Hits a Wall – Are Ethereum, XRP, and Other Cryptos Losing Their Mojo?

Altcoins stumble as market momentum falters—what’s next for Ethereum, XRP, and the rest of the pack?

After months of explosive gains, the altcoin rally shows signs of fatigue. Traders are left wondering if this is a temporary dip or the start of a prolonged slump.

Ethereum’s scalability woes and XRP’s regulatory overhang aren’t helping. Meanwhile, the usual suspects on Crypto Twitter are already calling the bottom—just like they always do.

Will fresh institutional money save the day, or is this another case of ‘buy the rumor, sell the news’? Only time will tell—but for now, the party feels suspiciously quiet.

Bonus jab: If history repeats, expect another ‘altseason’ prediction right after the whales finish accumulating.

Traders are now looking around and wondering if the long-awaited altcoin season ended before it properly got going, or if this is just a dip because the next leg up.

The trigger: a surge in derivatives speculation that may have stretched markets to a breaking point. According to Glassnode, open interest on altcoin derivatives hit a record-smashing $45 billion this week, nearly doubling from $26 billion at the start of July. That’s a monumental leap in just three weeks. It’s also a sign that frothy exuberance was in overdrive.

Here’s what that kind of speculative fuel does: it inflates expectations, pumps up prices, and sets the stage for sudden, dramatic pullbacks when those expectations aren’t met. That’s precisely what we’re seeing.

The Casualties of the Day

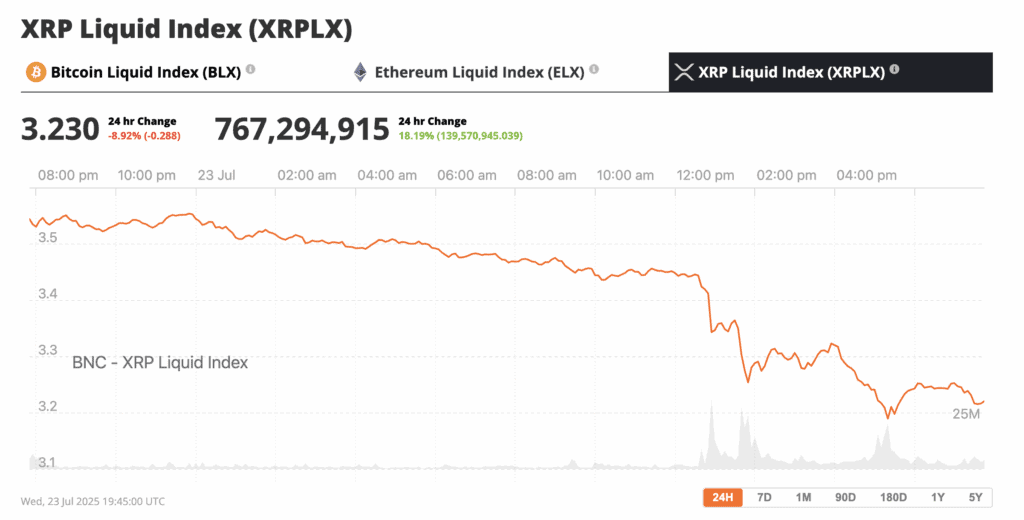

- XRP, which only last week broke a seven-year high and was the darling of the market, is now the biggest loser among the top 10 coins. It’s down nearly 10% in 24 hours, currently trading at $3.22. Sure, it’s still up 8% for the week, but that’s cold comfort for anyone who bought yesterday’s top.

- Dogecoin, the joke that became a memetic force of nature, dropped 9% to $0.241. Solana fell 7% to $188.

- Ethereum managed a more modest dip, down 3% to $3,586, but it’s leading the liquidation leaderboard. Nearly $605 million in crypto long positions got nuked in the last 24 hours, and Ethereum accounts for over $129 million of that—$104 million of which were bullish longs that misjudged the top.

XRP dropped 8.92% on Wednesday as traders took profits, Source: XRP Liquid Index

Bitcoin, meanwhile, barely flinched, dropping just 1% to $117,510 before recovering to over $118,000. The market is now waiting to see what Bitcoin does next. As long as Bitcoin can continue to consolidate and then move up, eventually altcoins will follow. Rekt Capital put it well, writing on X that “The Altcoin market is reacting as if Bitcoin has broken down from its Range but it hasn’t. In fact, it’s retesting the Lower High and Range Low as support. The retest is in progress. Bitcoin will retrace deep enough to convince you that the Bull Market is over and then it will resume its uptrend.”

The bitcoin retest is in progress, Source: X