🚀 Ethereum (ETH) Soars to 6-Month High: $50M Whale Buy Sparks Mega-Bullish Rally

Ethereum just punched through resistance like a hot knife through butter—hitting highs not seen since January. And guess who's leading the charge? A crypto whale with pockets deeper than your average hedge fund manager's excuses.

The Whale Effect: That $50 million buy-in wasn't just a splash—it was a tsunami of confidence. Suddenly, every trader with a Binance account is scrambling to front-run the next leg up.

Technicals Don't Lie: The breakout confirms what chain analysts whispered for weeks—ETH was coiled like a spring. Now the charts scream one thing: higher.

Wall Street's FOMO Moment: Watch institutional desks 'discover' crypto again now that there's a 6-month chart they can slap on a PowerPoint. Too bad they missed the bottom—again.

This isn't just a pump. It's a full-blown market structure shift. And that whale? Probably sipping mai tais while retail traders stress-click 'buy' at every minor pullback.

Institutional flows, elevated momentum readings, and tightening liquid supply are combining to keep focus on the $4,000–$4,200 resistance band that could define the next phase of the Ethereum price prediction narrative.

Ethereum Price Rally Driven by Whale Entry and ETF Momentum

Ethereum advanced past the $3,700 threshold this week and briefly tagged $3,750, marking a 180-day peak and capping an approximately 169% rebound from March lows NEAR $1,392. Momentum accelerated in July, when the asset delivered over 40% monthly gain amid record institutional inflows into spot ETH exchange-traded funds.

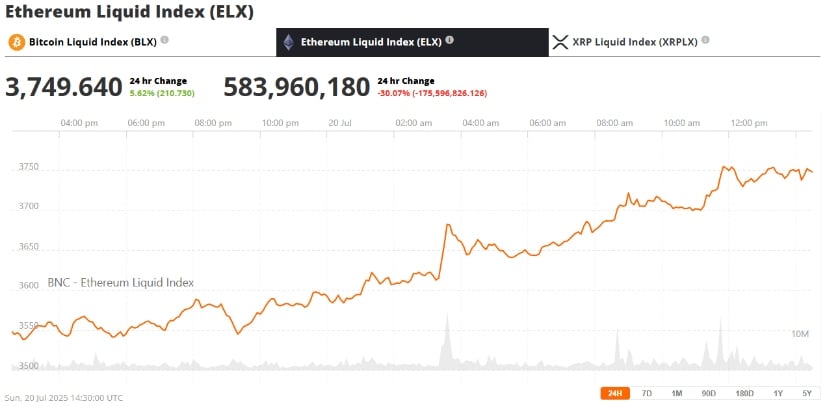

Ethereum (ETH) was trading at around $3,749, up 5.62% in the last 24 hours at press time. Source: ethereum Liquid Index (ELX) via Brave New Coin

A fresh $50 million purchase at an average of $3,715 per token by an unidentified whale or institutional account added fuel to the move, signaling strategic positioning at current levels and reinforcing confidence in Ethereum’s long-term growth case. Coverage describing the allocation noted that large entries of this scale often coincide with shifting market structure as professional capital seeks exposure to core crypto assets.

Whale address 0x5A8E made a $50 million purchase of 13,462 ETH at $3,715, signaling strong confidence in Ethereum’s upward trajectory. Source: EyesOnChain via X

ETF demand has become a central driver. U.S. spot ETH products registered a record single-day intake of roughly $727 million during the week ended July 18, part of a broader wave of institutional allocations that has seen corporate treasuries and asset managers rotate toward Ethereum exposure.

Ethereum Chart Analysis: RSI Near Overbought, But Momentum Remains Strong

Price action continues to track an ascending channel traced from March’s capitulation zone, with ETH now pressing the channel’s upper boundary in the $3,700–$3,800 region. The token trades above major exponential and simple moving averages, keeping trend signals firmly constructive.

Ethereum appears to be in a potential wave 3 impulse, with $4,500 emerging as the key target if price breaks $4,000 and holds above the level. Source: CryptoKnee on TradingView

Momentum readings are elevated. The most recent 4-hour look showed the Ethereum RSI today near 78, a level that flags overbought risk but also reflects strong buying pressure behind the breakout attempt. Historically, pullbacks from similar stretches in prior Ethereum rallies have tended to find support at progressively higher levels when longer-term inflows remained intact—a dynamic analysts are watching again as ETF demand stays robust.

Chart technicians continue to focus on overhead supply at $4,000–$4,200. Several analysts have described that band as a “strong high” zone whose clean break could mark the start of the cycle’s more “explosive” leg if volume confirms.

Layer 2 Growth and Ethereum’s Expanding Ecosystem

The latest advance comes alongside renewed activity across the Layer 2 stack, where scaling networks such as Arbitrum, Optimism, and zksync have benefited from higher on-chain engagement during Ethereum’s price recovery. Market commentary linking ETF inflows to wider DeFi and L2 enthusiasm notes that capital entering ETH exposure often ripples outward into ecosystem tokens, liquidity pools, and application usage when sentiment flips risk-on.

Short liquidations and repositioning in derivatives have amplified swings across the broader Ethereum ecosystem. Reporting around the $3,600 breakout highlighted a wave of forced buying in short positions and a pickup in speculative flows tied to DeFi and scaling plays, reinforcing the feedback loop between Ethereum’s Core asset and the applications it underpins.

Fundamental Catalysts: ETF Inflows and Institutional Adoption

Institutional allocations continue to reshape Ethereum’s investor base. Research commentary from Coinbase Institutional flagged “surging” corporate treasury accumulation of ETH in 2025, citing staking yield opportunities and tokenization themes as key motivations behind the shift. The same report highlighted a record day of ETF creations and rising derivatives basis trades that pair long spot ETH with short futures to harvest spreads—evidence of sophisticated strategies entering the market.

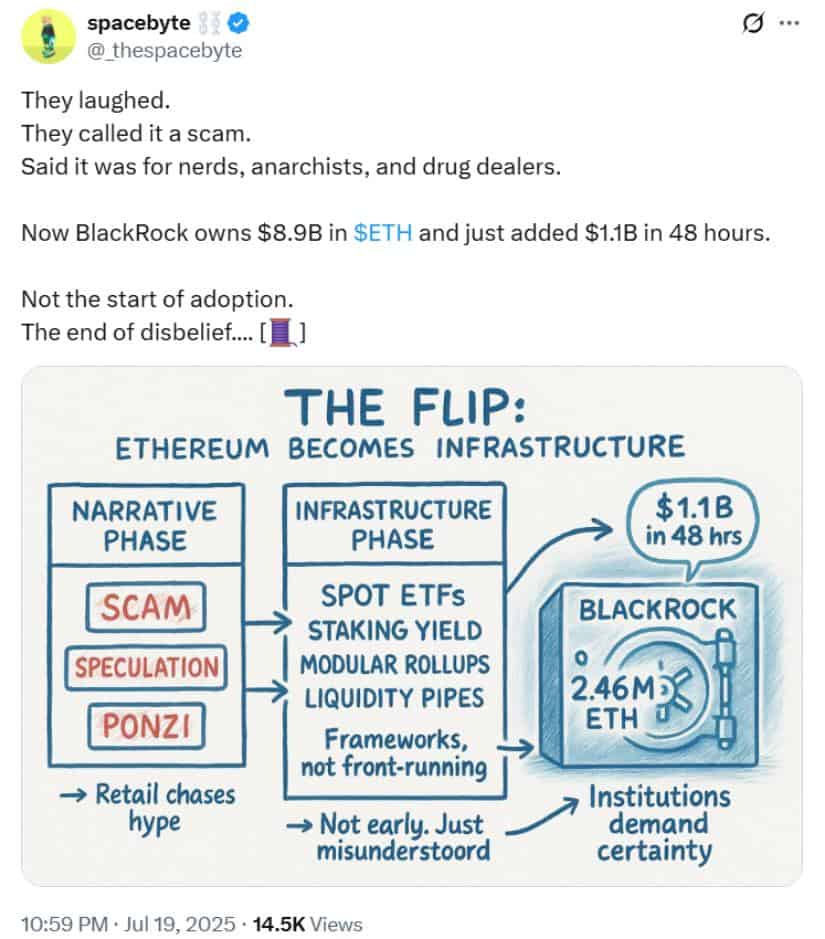

BlackRock’s $1.1 billion Ethereum accumulation in 48 hours, raising its holdings to $8.9 billion, marks a pivotal shift from skepticism to mainstream acceptance. Source: Spacebyte via X

Additional reporting shows cumulative ETH ETF inflows in July ranking among the strongest since product launches, with one survey placing the month’s tally above $890 million and pointing to BlackRock’s sizable holdings—estimated near 1.5% of circulating supply—as a factor tightening available float. Reduced exchange liquidity alongside large institutional custodianship can amplify upside once demand accelerates.

Regulatory Overhang and Market Sentiment

Rapid institutionalization is drawing fresh regulatory attention. Commentary surveying the landscape for Web3 firms and DAOs has noted that evolving compliance expectations remain a watchpoint as large financial players deepen Ethereum exposure through ETFs, custodial services, and treasury allocations. The potential for rule updates around staking treatment, tokenization frameworks, and disclosure standards sits in the background of the current rally.

Market participants monitoring these developments argue that clearer guardrails could ultimately broaden access to ETH-linked products, even if interim uncertainty injects periodic volatility. Institutional research desks continue to flag legislation moving through U.S. congressional channels that could define digital asset market structure and stablecoin oversight—factors viewed as material for next-stage Ethereum adoption.

Ethereum Price Prediction: Will Ethereum Break $4,100?

Near term, traders are watching whether bulls can secure a decisive close above $4,000 and absorb offers through the $4,200 zone. Technical mapping tied to the current ascending channel projects measured-move objectives near $4,100 on confirmation, with some cycle models suggesting upside extension should momentum carry and ETF flows persist.

Ethereum is rapidly approaching the $4,100 mark as ETF inflows now surpass those of Bitcoin, signaling strong short-term momentum. Source: Audacity618 on TradingView

Longer-horizon cycle comparisons remain constructive. Analyses contrasting Ethereum’s current percentage advance from its macro base with Bitcoin’s show ETH lagging the leader, implying room for relative catch-up if historical rotation patterns repeat and capital migrates from BTC consolidation phases into higher-beta alternatives.

Looking Ahead: ETH Eyes Breakout as Institutional Confidence Soars

Ethereum’s rise to a six-month peak is being underwritten by factors that extend beyond short-term speculation: heavy ETF subscriptions, targeted whale accumulation, expanding corporate treasury usage, and a deepening application stack across LAYER 2 networks. Collectively, these forces have tightened supply and strengthened the technical backdrop just as price presses a major resistance shelf.

A sustained move through $4,000–$4,200 would signal that buyers are willing to chase higher despite stretched momentum readings, potentially unlocking the “explosive” cycle leg technicians have flagged. Until that confirmation, elevated inflows and institutional interest remain the primary support pillars beneath the current ethereum price prediction outlook.